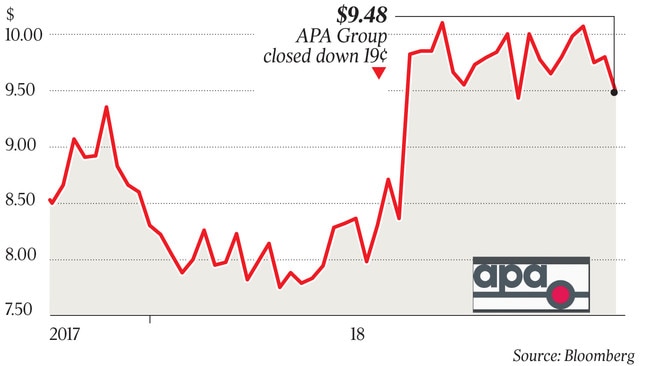

APA shrugs off hostility to deal with CK Infrastructure

APA Group is facing strong retail shareholder opposition to its agreed $13 billion takeover by Hong Kong’s CK Infrastructure.

Gas pipeliner APA Group is facing a strong retail shareholder backlash against its agreed $13 billion takeover by Hong Kong’s CK Infrastructure, with strong concern about the deal and the predator’s potential Chinese links aired at APA’s annual meeting yesterday.

But APA chairman Michael Fraser said he did not think the shareholder criticism at the Sydney meeting, where no one spoke in favour of the deal, was representative of broader public concern over the deal, which is awaiting a decision from Treasurer Josh Frydenberg.

Mr Fraser said the deal had institutional support and was likely to be approved by shareholders if Mr Frydenberg approved it.

At the meeting, one shareholder said the APA board’s acceptance of the $11 a share CK offer “could be equal to 30 pieces of silver”, given the “political impact” of the deal.

Another said: “You’ve built a strategic situation (in the form of pipeline networks on the east and west coasts) and you’re quite happy as board members to flog that off to the Chinese. This is going to put the country in another messy situation.”

More than one of the speeches drew applause across the room.

Other concerns voiced by the retail shareholders, who have done very well from consistent growth during managing director Mick McCormack’s 14-year tenure, included losing the reliability of the APA income stream, getting hit by capital gains tax and the disappearance of a local company.

Mr Fraser rejected a call for a show of hands among the 200 or so retail shareholders who attended the meeting.

“There hasn’t been one person who has stood up this morning who has spoken in favour of the CKI bid, so I think the board well and truly understands the mood of the meeting,” he said.

After the meeting, Mr Fraser said the sentiment was consistent with correspondence the board had received from retail shareholders. But he did not think the anti-deal sentiment was reflective of broader public concern.

“I think for a lot of the general public, this isn’t on their radar screen, is my assessment,” he said.

“You’ll get some media stories about it and you have people with a particular view writing arguments but my personal sense is, for most people, it’s not a mainstream issue.”

The FIRB decision carries an added political element with a federal election due in May or before and some MPs have spoken out against the deal.

Home Affairs Minister Peter Dutton, whose Critical Infrastructure Centre will advise the Foreign Investment Review Board on the deal, is reportedly against the deal on the grounds of potential Chinese influence. So are Liberal MP Jim Molan and senators Concetta Fierravanti-Wells and Andrew Hastie, as well as crossbench senators Pauline Hanson and Rex Patrick. Mr McCormack said the FIRB process was taking longer than expected.

“There’s an element in government that has been very vocal, on the right end of the spectrum,” he said. “My mother from the bush, in Proserpine, my mother-in-law up on the Downs, they’ve both had a whinge, (saying) ‘why are you selling this to the Chinese?’ — that’s how it gets stirred up.”

He added there had been reports about commercial interests stirring up opposition to the bid in order to be able to bid for APA if it fell over.

Mr Fraser said that based on conversations with big investors, he expected institutional shareholders to ensure the bid received the 75 per cent of voting shares needed to carry the deal across the line if Mr Frydenberg approved it.

About 30 per cent of APA’s register is retail but in most cases, retail shareholders do not vote in strong numbers.

APA narrowly avoided a first strike on its remuneration report, with 24.96 per cent of votes against it, fractionally short of the 25 per cent required.

Mr Fraser said the vote against the report was largely due to revelations that a 2013 renegotiation that boosted termination payments was understated in subsequent reports, including the most recent one.

A correction was issued last month that showed Mr McCormack could be entitled to a $10 million payout if the CK takeover is successful, representing a two-year non-compete period.

Mr Fraser said he had spoken to many institutional shareholders and the Australian Shareholders Association about the matter and thanked them for the 75 per cent vote for the report despite two proxy advisers recommending against it.

The chairman, a former AGL Energy chief, was scathing about Scott Morrison’s plans to try to force lower power prices by putting on a electricity price cap, threatening forced asset sales and underwriting new baseload generation.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout