That’s what comes with working for one of Australia’s richest couples, Andrew and Nicola Forrest, who earn over $2 billion a year in FMG dividends with an asset base of over $30 billion.

Suffice it to say the extensive rural holdings in Tattarang’s Harvest Road today are more the start than the finish of the venture, which runs from 1.3 million hectares of cattle country in the north to Koojan Downs Foodlot north of Perth to horticulture and aquaculture – Leeuwin Coast, featuring Akoya oysters.

There is set protocol for looking through the daily propositions, led by chief investment officer John Hartman and his team of seven, then reviewed by Hagger and the respective division heads, including Felicity Gooding at Minderoo and Paul Slaughter at Harvest Road.

The final decisions to proceed rest with the Forrests. When the project gets the green light one of their key company principles is stretch targets, which in Hagger’s words mean Andrew sets the target and “it’s our job to make it happen”.

The Akoya oysters are a case in point. It’s an industry that didn’t exist a couple of years ago but will soon be marketed across the country building to over 1.5 million dozen oysters a year.

The oysters were originally used by the Japanese for pearls but are now being targeted at high-end restaurants across the country.

Better still, the shellfish are self-sustaining and actually help the neighbouring environment, building seagrass communities and a harmonious ecosystem.

Another new industry is asparagopsis or red seaweed, which is being developed with the CSIRO in partnership with GrainCorp, Woolworths and AGP Investment.

Cows belching creates around 10.5 per cent of Australia‘s greenhouse gases, but supplementing diets with the seaweed radically reduces the methane output while also boosting weight gain and milk production.

The CSIRO is firming up plans with hopes the industry can grow from $100 million in 2025 to $1 billion in 2040.

The Koojan Downs feedlot north of Perth will be completed later this year, operating on systems overseen by US scientist Professor Temple Grandin, who has used her own autism to relate better with animals and help improve their lives under the no pain, no fear rules.

This process produces better meat from little things, like not seeing what happens to the cow ahead of them in the line.

The Tattarang principles include humility, courage, empowerment, enthusiasm, frugality, integrity, generating ideas and the all the-important stretch targets.

All going to plan in three years Harvest Road will be generating returns from two new industries in Akoya oysters and red seaweed, which didn’t exist in commercial quantities three years ago.

In the process it will also advance other Forrest projects like his campaign against single-use plastics.

In a report released last week he showed a relatively small number of companies backed by a handful of banks account for over half all single-use plastics.

Knowing just who is behind the production makes the campaign easier, he notes.

Forrest says 20 companies are the source of half of all single-use plastic thrown away globally, with ExxonMobil topping the list, followed by Dow and China’s Sinopec.

Sixty per cent of their funds come from 20 banks, led by Barclays and HSBC.

Hagger will feature in next week’s Global Food Forum.

Inside running

Insider trading cases are now becoming almost run of the mill with ASIC last week updating two cases, one a charge against Beacon Minerals executives and a guilty plea in the Healthe Care case.

The wheels of justice are slowly turning to the next stage of the plod’s case against Westpac in the Ausgrid fixed income case, where the plod alleged insider trading when the bank hedged a $12 billion financing for Ausgrid, which won the privatisation battle.

The bank is not due to file its defence in the case until early July but notably wasn’t overly aggressive in its public comment on the case when first aired earlier this month.

This suggests there is a chance it might seek a settlement just to clear the matter as it attempts to restore its battered reputation.

In its latest enforcement update ASIC noted five of the 10 criminal cases it had before the court were insider trading.

No mention was made of how many of the 211 investigations outstanding were insider trading. Practitioners contacted noted there was no apparent campaign from ASIC on the offence, which is a basic market integrity issue.

But there is no doubt what were once rare actions and difficult to prove are now almost bread and butter for the plod.

Better enforcement technology, more tips and the realisation that insider trading does hurt others have lifted the number of actions.

This is not to say the cases are any easier to prove, because it is a rare takeover which is not preceded by some well-informed trading.

To anyone wanting to bolster faith in the market, the ASIC actions are to be welcomed.

Among the brethren, the key statistic to watch when new ASIC boss Jo Longo and enforcement boss Sarah Court start next month will be the number of court-enforced enforceable undertakings.

In the last half there were just two undertakings amid 107 new investigations and 211 ongoing and prevailing wisdom says that is way too low.

ASIC, they argue, should hold more people to account for misbehaviour through enforceable undertakings and run fewer cases.

This runs counter to the ‘‘why not litigate’’ campaign which misled, because what is needed more is actual decisions and enforcement – not always time in court.

Short circuit

NSW Energy Minister Matt Kean has effectively raised his long finger to Angus Taylor by agreeing to a $3.2bn energy deal with Shell which includes the building of a new 100 megawatt two hour battery.

Taylor had only just concluded a talk at Energy Week telling the states ad hoc energy policy must end.

Yet they are both right.

Ad hoc energy policy doesn’t help anyone and what is needed is federal leadership with long-term markers so business knows what it is investing on .

Taylor has just spent $600 million to get Paul Broad at Snowy Hydro to build a new gas peaker power plant at Kurri Kurri.

On Tuesday Kean unveiled a 10 year energy supply deal with Shell, which includes the installation of a new 100 megawatt battery in the Riverina next to an Edify solar farm.

A two-hour battery can solve many of the supply issues for the state, like the recent slow downs by the Tomago Aluminium smelter, which last 30 minutes or so.

The Kurri Kurri gas plant has been criticised as overkill because AEMO said the state only needed another 150 to 250 megawatts to cover Liddell’s 2023 closure, and Energy Australia had already committed to another 350 megawatts.

So the question is what does Taylor mean by “ad hoc”.

Most think it means that states not running off and setting policy on their own, because that policy should be co-ordinated.

But co-ordination was noticeably absent in the string of plans for the replacement of energy from Liddell, which closes in 2023.

The Shell contract is a loss for Origin, which previously had part of the NSW contract.

When Kean negotiated the deal with Shell’s Greg Joiner, he wondered what the energy giant might do for NSW. The answer was delivered with the next battery next to the Edify solar plant.

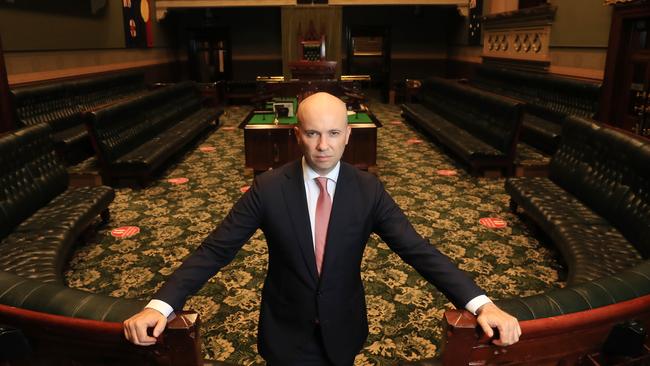

Andrew Hagger wakes each morning to a dozen or more emails offering business deals to his company Tattarang and the Minderoo Foundation.