Anglo plans aggressive metallurgical coal mine expansion in Australia

The new head of Anglo American’s metallurgical coal arm plans to aggressively increase the miner’s Australian operations.

The new head of Anglo American’s metallurgical coal arm has spelt out plans to aggressively increase the miner’s Australian operations, marking a complete reversal in strategy for the division.

Tyler Mitchelson, who took over the Brisbane-based role as CEO of the metallurgical coal division earlier this year, told The Australian he had a mandate to once again start targeting growth in a business that has re-emerged as one of the mining giant’s cash cows.

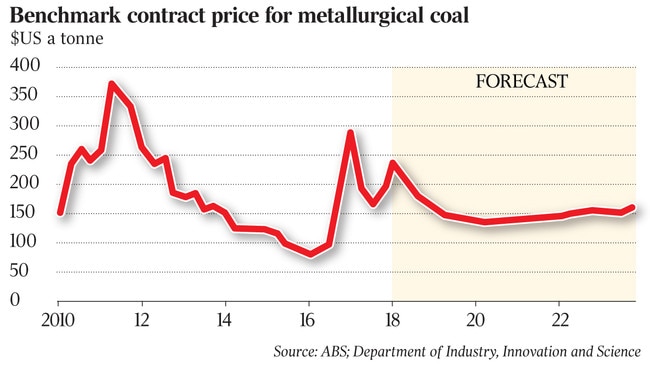

It’s a far cry from just two years ago, when Anglo — in the grip of an overextended balance sheet and weak commodity prices — sold off a suite of its metallurgical coal mines and was weighing up offers that would have seen it exit the Australian coal industry entirely.

The rebound in commodities came just in time, allowing Anglo to walk away from the sales process, and, with the metallurgical coal business now generating more cash for the miner than any other commodity, Anglo’s Australian-born CEO Mark Cutifani has charged Mr Mitchelson with growing its remaining Australian coalmines.

“Our focus is really on how we leverage what we have right now,” Mr Mitchelson said.

“It’s a huge untapped resource and potential that we think we can make a tonne of money off over the next little while.”

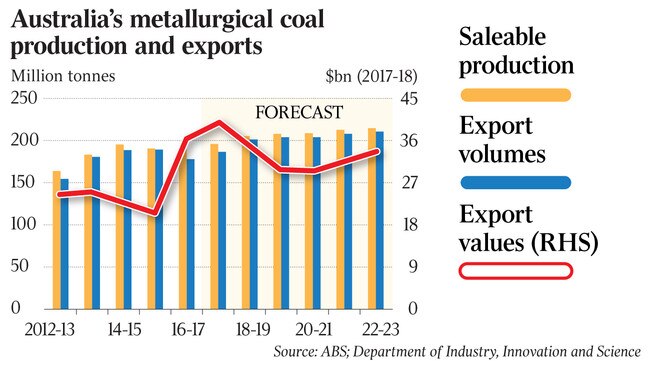

Anglo’s whittled-down metallurgical coal business generated just under $US2 billion ($2.68bn) in underlying earnings last year, thanks to a sharp recovery in coal prices. That was more than double the earnings out of its larger Australian coal base a year earlier, and was four times what Anglo’s entire global coal business could muster in 2014 and 2015.

Mr Mitchelson is aiming to make the most of that momentum, and expects his division to get bigger and more profitable in the years ahead. “We’ve got internal growth assets here, we’ve got productivity, we’ve got innovation,” he said.

“There’s going to be a real push to continue to grow this business and continue to grow the margins.”

Mr Mitchelson and his team are advancing growth plans in each of its remaining operations.

A plan to add another 25 per cent production capacity to its Grosvenor and Moranbah mines is at the front of the queue, while it is also looking at extending the life of its Capcoal operation by bringing its Aquila longwall out of care and maintenance.

It can expend capacity at its Dawson mine by bringing on the 9-12 deposit, which Michelson described as another “high margin, high value” coking coal mine, and longer-term the company plans to revisit the proposed development of Moranbah South off Grosvenor, which was shelved when Anglo ran into its troubles.

Mr Mitchelson said the current outlook for the division was in stark contrast to 2015 and 2016, which he said had been “a pretty tough time” for the business. “Our balance sheet was under a lot of stress and we had to take some pretty drastic action. Part of that was trying to generate cash internally within the business, but we had no real choice but to start looking at asset sales,” he said.

“In the end we did restructure our portfolio — Drayton, Callide and Foxleigh are no longer in the portfolio — but what we were able to do was maintain what are really the core high-margin, high-value hard coking coal assets that we can really do something with.”

It could have been a very different outcome had any of the suitors served up better offers for the remaining assets, but at the end of the sales process the combination of softer than expected offers and the signs of recovery in metallurgical coal markets convinced Anglo to stick with the remaining mines.

“In the end the value wasn’t there and the opportunity was there to actually keep the assets in the business,” he said.

“I know from looking at current performance, and … the potential of the business, this is going to be a very significant part of Anglo American for many, many years.”