Andrew Forrest reaps $1bn in Fortescue Metals dividends

Andrew Forrest will break through the $1bn mark in dividend income from his Fortescue shareholding this year.

Billionaire Andrew Forrest will break through the $1 billion mark in dividend income this year after his Fortescue Metals Group declared a fully franked dividend of 24c a share.

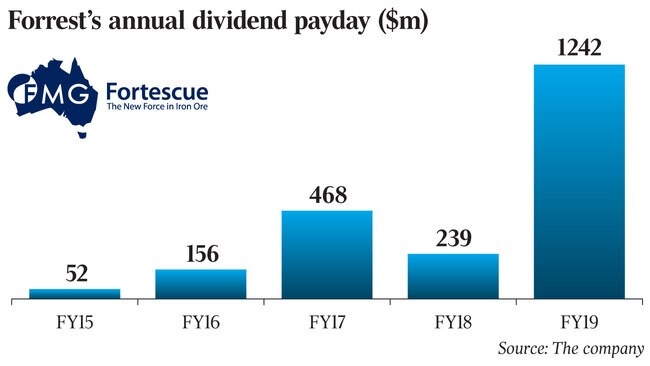

Mr Forrest, Fortescue’s chairman and major shareholder, will receive about $261 million from the final dividend, which is payable on October 2, to total $1.24 billion for the entire year.

The figure is about $1bn more that the $239m he received in total dividends across the 2018 financial year, during which Fortescue paid its shareholders an interim 11c-a-share dividend in February last year and then a 12c-a-share final dividend in October.

The latest dividend, well above analyst expectations, takes Fortescue to the top end of its dividend payout policy of 50-80 per cent of net profits.

Chief executive Elizabeth Gaines said Fortescue’s record $US3.2bn ($4.7bn) after-tax profit was an “outstanding” result, driven by the company’s own efforts as well as the iron ore price surge resulting from Vale’s Brazilian tailings dam disaster.

Ms Gaines said the average price Fortescue had received for its products had jumped $US21 a tonne over the year, compared to an average gain in the benchmark price for 62 per cent iron ore of about $US10 a tonne.

“Yes, the iron ore price has contributed, there’s no doubt about that. But it has been our strategy, and the execution of our strategy, to introduce a 60 per cent product — West Pilbara fines,” Ms Gaines said.

“We had three products in the 2018 financial year and six products in financial year 2019. We’ve responded to market conditions, we haven’t just sat there and taken what the market has given in terms of the iron ore price.”

Fortescue’s record net profit came on the back of underlying earnings before interest, tax, depreciation and amortisation of $US6bn and revenue of $US10bn.

The uplift in earnings and profit came despite weather interruptions causing lower shipments for the year, and a slight drift upwards in Fortescue’s average production costs, to $US13.11 a tonne last financial year, from $US12.36 a tonne the previous year.

Despite the recent dip in the iron ore price, Ms Gaines said Fortescue expected its strong start to the year to continue as it shipped a greater portion of higher-grade iron ore. It shipped nine million tonnes of its newest product last financial year, and expects that to rise to 17-20 million tonnes this year.

Fortescue has flagged total exports worth 170 million-175 million tonnes of iron ore this year, at an average price of $US13.25-$US13.75 a tonne.

The result comes as global supply is normalising, sparking a steep fall in iron ore prices this month. Global economic headwinds from the Sino-US trade war have also raised fears that demand will slow.

Ms Gaines said yesterday that the company expected to maintain its strong dividend performance, despite the need to spend $US1.2bn on the development of two new mines, at Eliwana and Iron Bridge, and a total of $US2.4bn on capital and sustaining development across its mines.

Fortescue finished the year holding $US1.9bn in cash, with net debt of only $US2.1bn.

But the stellar set of financial results did not save Fortescue from yesterday’s market mauling, with the company closing down 40c, or 5.3 per cent, at $7.17.

The market wipe-out stripped another $436m from the value of Mr Forrest’s shareholding, with his billion Fortescue shares now worth about $7.8bn.

Mr Forrest was in eighth place on The List — Australia’s Richest 250 with a fortune of $7.57bn when it was published by The Australian in March, and about $8.25bn ahead of yesterday’s trading.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout