Analysts sceptical as miners bet on copper for electric vehicles

Australian miners are placing big bets on copper to cash in on the shift to battery-powered electric vehicles.

Australian miners are placing big bets on copper to cash in on the shift to battery-powered electric vehicles, but analysts have started to wonder whether estimates of global take-up of new cars are optimistic.

Electric vehicles have been thrust into the political debate after Labor leader Bill Shorten outlined a policy of having half of new car sales as electric vehicles by 2030, a target Prime Minister Scott Morrison said was “unrealistic”. But Rio Tinto yesterday announced it would spend another $US302 million ($421m) on the development of the giant Resolution copper project it owns with BHP in Arizona, putting the rise of electric vehicles at the centre of its reasoning.

Rio chief executive Jean-Sebastien Jacques has been pitching Rio’s green credentials hard in recent months. Facing strong opposition to the development of Resolution from traditional land owners and environmental groups in Arizona, Rio listed its future contribution to green energy as the key reason for developing the mine.

“The rise of electric vehicles, battery storage, new transmission technology and other green energy innovations are highly copper-intensive,” he said.

“We need to prepare now to meet this future demand. Resolution will be well-positioned to provide North American manufacturers the copper that is essential to their products.”

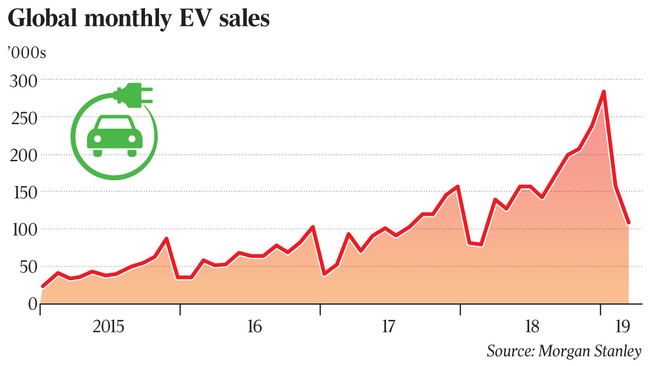

Electric vehicles need up to 80kg of copper, about four times that of a medium-sized petrol vehicle, and the growth of electric vehicle sales — from 600,000 in 2015, according to Morgan Stanley analysts, to 2 million in 2018 and more than 10 million units a year by 2025 — is seen as a key driver in copper consumption.

For years lithium project developers have argued the rapid adoption of battery storage will revolutionise the car industry, as well as electricity grids and household use of renewable energy, and the global mining majors have now adopted the rhetoric.

Rio Tinto has previously forecast an 8 million tonne shortfall in the copper market by 2030, based on current and planned new mines and expansions, making copper exploration the centrepiece of its future growth plans.

It has also accelerated development of its giant Jadar lithium deposit in Serbia, with pre-feasibility studies due out later this year and potential development of a mine at the project as early as next year.

Although BHP has not joined the rush into lithium, it is also eyeing the move to electric vehicles as a key catalyst for the growth of its copper business, and is re-positioning its Nickel West business — once the ailing and unwanted target of an unsuccessful sales process — as a key supplier of nickel sulphate to the battery market.

Smaller copper-focused players such as OZ Minerals are also telling shareholders copper’s future growth lies in the battery and electric vehicle market.

OZ Minerals chairman Rebecca McGrath said at the company’s annual meeting yesterday it had no intention of joining Wesfarmers, Rio Tinto and others in the rush to expand into battery metals, saying OZ believed its future remained in copper, which still gave it good exposure to the move to electric cars. “At this stage our strategy is global copper — copper core, as we like to refer to it. At this point (battery metals) are not part of our strategy. We’ve done a lot of research into the value of those materials, but we refresh our strategy regularly and we’ll keep a watching brief on those materials,” she said.

“But copper has a very key role and is probably, in terms of absolute quantities, in greater demand than some of those other commodities,” she said.

Morgan Stanley expects unit sales of electric vehicles to increase more than fivefold to 10.2 million units by 2025. But its most recent electric vehicle market penetration analysis, released last week, suggests electric vehicles will make up only 9.8 per cent of global vehicle sales by then.

It is the second half of the decade, when Rio hopes Resolution is producing, and other copper mines now being developed — such as Oz Mineral’s Carrapateena project — have undergone expansions to their full capacity, that Morgan Stanley analysts expect growth to accelerate.

They expect electric vehicles sales to nudge 25 million units by 2030, although still will still make up only 24 per cent of total global vehicle sales.

BHP is forecasting a similar number, according to a recent presentation by copper boss Danny Malchuck, which showed the company expects a 23 per cent compound annual growth rate in the sales of electric vehicles to 2030 under current assumptions about a softening commitment to meeting Paris emissions targets by some major global economies.

But that could rise to a 33 per cent growth rate — or annual sales of about 61 million electric vehicles by 2030 — if decarbonisation of the global economy keeps to the Paris timeline, according to BHP forecasts.

The Morgan Stanley projections suggest Bill Shorten and Labor’s bullish plan to have electric vehicle’s make up half of all local vehicle sales in Australia by 2030 would put Australia well ahead of global trends, however.

Morgan Stanley’s Global Electric Vehicle Market Monitor, released last week, projects global penetration of electric vehicles to hit 23.4 per cent by 2030, more than double Labor’s local target.

Even in Europe, seen as the leading market for electric vehicles, they are only likely to make up 31 per cent of sales by 2030, according to the report. In the US Morgan Stanley expects electric vehicles to reach only 14 per cent of the market by 2030.