Ampol to consider closing Lytton refinery

Ampol may shut its Brisbane refinery and instead import fuel, amid losses caused by the pandemic’s hit to demand.

Australia’s refining industry is teetering on the brink after Ampol launched a formal review of the future of its Lytton facility in Brisbane, flagging its potential closure in a signal the federal government’s industry assistance package may not be enough to keep local refineries operating.

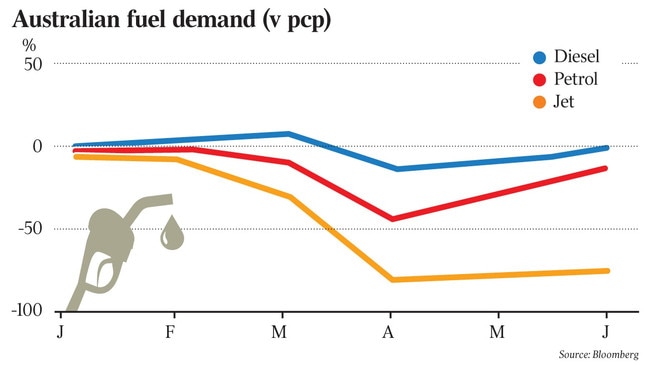

Ampol flagged the possible closure of Lytton in the face of mounting losses at the struggling manufacturing plant, saying the facility had lost $141m in the first nine months of the year as international oil prices crashed and refinery margins slumped, and consumers stayed off Australian roads in the face of coronavirus movement restrictions.

After a third-quarter loss of $82m, including the costs of a major maintenance shutdown, Ampol said Lytton’s total output for 2020 was expected to tumble more than 40 per cent to 3.4 billion litres of fuel.

The company had flagged an ongoing review of Lytton’s future at its financial results announcement in August, but announced the start of a formal six month process that will consider its potential closure and conversion to an import terminal.

Ampol’s decision will add to fears the nation’s refining sector could disappear entirely in the face of falling demand brought on by the coronavirus crisis and competition from far larger refineries in Singapore, South Korea, Japan and elsewhere in Asia.

Viva Energy is also reviewing the future of its Geelong refinery in Victoria, and energy giant ExxonMobil said in September its Altona was trading at a loss and facing “unprecedented pressure” from Victoria’s tough lockdown measures.

Three Australian refineries have shut since 2012 and the remaining plants now produce less than half of the country’s fuel needs, with most imported from overseas.

Ampol chief executive Matt Halliday told The Australian the plant’s closure was not necessarily a foregone conclusion, but it faced “extreme” pressure from falling international refinery margins, despite the offer of assistance from the federal government to the refining industry.

“We’re putting some more formality around the process that we’re undertaking, and being clear around the options we will consider — including the closure and conversion to an import model, as well as different modes of operation. Clearly the status quo doesn’t work and the outlook is very challenging,” he said.

“The pressures that we’re facing are extreme, and we’re also comfortable with our track record and experience to deliver an import terminal and secure supply to our customers. So we need to look at all of the options, and we’ll look at them objectively.”

Energy Minister Angus Taylor announced plans in September to invest in new domestic diesel storage facilities, create a minimum onshore fuel stockholding and introduce measures to support local refineries.

But Mr Halliday said the mounting losses at Lytton meant the company needed to “take control of its own destiny”.

“We certainly appreciate the recognition of the challenges that the refining sector is facing in Australia, and certainly the proposed support package seeks to address that. But we also need to be realistic about the extreme structural pressures that are facing Lytton,” he said.

“And that means it’s very clear we need to conduct the review we’re talking about, because we need to take control of our own destiny with a view to delivering returns to our shareholders.”

The key plank of the support for local refiners will be the introduction of a production payment that works by offering a minimum value of 1.15c per litre to refineries, based on their fuel security contribution to Australia. Refineries will only be eligible if they commit to stay in Australia.

The Energy Minister said on Thursday the federal government was “working closely” with Ampol and the rest of the industry as it fleshed out plans for its assistance package, which Mr Taylor said was important to ensure Australia’s future fuel security.

“Our budget backs local refineries and bolsters our domestic capabilities. Our plan will create 1000 new jobs and protect workers in the fuel sector and in fuel-dependent industries like our farmers, truckers, miners and tradies. It will also, importantly, protect Australian motorists from higher prices at the pump,” he said.

Mr Halliday confirmed that work on the production payment model had begun. Ampol shares rose 39c to $24.60 on Thursday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout