Alinta calls for federal government to take lending role in coal

Alinta wants the federal government to step in as a lender of last resort due to difficulties securing bank funding for Australia’s remaining coal plants.

Power giant Alinta has called for the federal government to step in as a lender of last resort due to difficulties securing bank funding for the nation’s remaining coal plants, amid escalating climate concerns.

Alinta, owner of the Loy Yang B coal plant in Victoria’s Latrobe Valley, said it faced major hurdles refinancing debt for the facility as banks put in place stricter environmental, social and governance rules which make it tougher for them to lend to coal generators.

“We recently refinanced Loy Yang B for a fair duration and I have to say that was an exceedingly difficult process and the number of parties that started saying that they were willing to participate in that underwriting diminished greatly from the start to the finish line,” Alinta managing director Jeff Dimery told the Credit Suisse Australian Energy Conference on Thursday.

“Even after you get through credit, at a corporate level they come down and say this is not a space we can participate in.”

The Alinta chief said the government may have to step in as a lender of last resort to ensure coal remains in the power system. The premature exit of Loy Yang B – which provides 20 per cent of Victoria’s electricity and is set to run until 2047 – could cause market ructions and price spikes if not managed carefully.

“One of the areas the government seriously needs to consider on this smooth transition to a low carbon economy is whether the government becomes a lender of last resort for the remaining life of those types of assets,” Mr Dimery said.

“Clearly under the new profile we find in the ESG world, there isn’t a whole lot of people who want to put money into those sorts of vehicles on a go-forward basis. I think that’s a dilemma. It’s something the government should now have in focus so that it can make sure there is not a disorderly exit from the market.” Energy billionaire Trevor St Baker this week slammed “virtue signalling” Australian banks for failing to lend money to coal producers.

Energy Security Board chair Kerry Schott said the clamour for an immediate end to coal was out of step with the needs of the power grid, noting a well structured transition plan was needed to help Australia manage the eventual exit of the fossil fuel.

“This in part is driven by there not being a laid out transition plan because if everyone knew we were on some sort of track it would keep things much more orderly – rather than people getting swayed by the mob which is don‘t do this because it sounds great,” Ms Schott told The Australian.

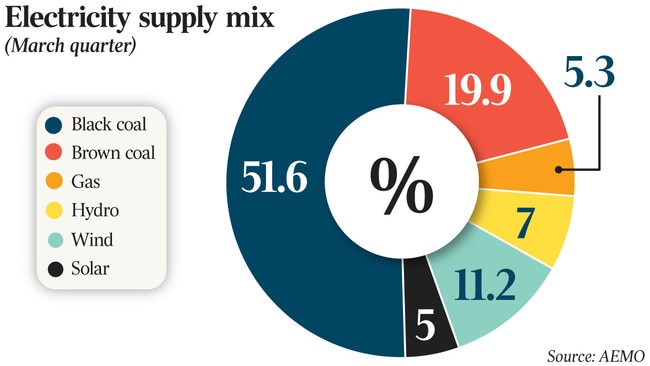

“But we cannot just go from having a situation where 63 per cent of our generation is coal to no coal next week. It’s just not possible, not desirable and certainly not affordable.”

Australia’s banks and financiers need to avoid short-sighted decisions, Energy Minister Angus Taylor’s office said.

“Australian financial institutions must recognise that energy affordability, security and reliability are important to their customers, shareholders and the wider economy. Short-sighted decisions made to appease a vocal minority of shareholders do not reduce global emissions, but rather undermine our energy security and economic recovery,” Mr Taylor’s spokesman said.

Coal plants are under pressure due to cheap solar and wind but are still expected to remain in Australia’s electricity system until at least 2040.

Trevor St Baker, who owns stakes in both a major NSW coal plant and Brisbane electric vehicle charging firm Tritium, highlighted problems on Wednesday for coal generators in securing insurance amid climate pressures.

Alinta, Australia‘s fourth largest electricity retailer and owned by Hong Kong’s Chow Tai Fook, said securing insurance has been challenging for Loy Yang B, even though it is the youngest of Victoria’s coal plants.

“It’s becoming a real problem insuring these types of assets. I personally believe it goes to this issue of how we exit these assets from the market. It’s a real challenge and a real dilemma and I believe it’s something that not only market participants need to look at. If you want to get a more controlled environment, then the central bodies at state level also need to be considering that challenge,” Mr Dimery said.

“We are finding it difficult to insure Loy Yang B, and the costs when we do, are rising dramatically. And I’m sure that is the same situation Trevor finds for his assets which would be consistent with all the other players in the market.”

Alinta closed a $440m loan in April for the 1100 megawatt Loy Yang B coal plant as part of refinancing a $715m loan taken out in 2017 when it bought the power station.

ANZ chief executive Shayne Elliott said in December he was proud the bank had not lent “a dollar” to any coal miners since his appointment in 2016, while the nation’s bank regulator has warned of the unprecedented impact of climate change on all parts of the financial system, putting lenders and insurers on notice they need to be on top of the risks to their businesses.

Low wholesale prices in the market had already made it difficult to invest in the market, according to Alinta, without government support.

“We got as low as low $30s per megawatt hour which quite frankly makes the industry uninvestable for new generation at those levels,” Mr Dimery said. “You wouldn’t be building new projects if you were purely relying on a market signal because I can assure you for us we can’t economically develop any sort of gas-fired peaking project in the market place without having some form of government support.”

EnergyAustralia brought forward the closure of its Yallourn coal plant in Victoria’s Latrobe Valley by four years to 2028 due to market pressures with the state government providing financial backing to ensure Yallourn stays in the system until then.