AGL warns of gas squeeze in Victoria

Australia’s largest power generator, AGL Energy, has warned Victoria faces gas shortages in the early 2020s.

Australia’s largest power generator, AGL Energy, has warned Victoria faces gas shortages in the early 2020s as supplies from Queensland dry up, with the problem to be made worse should Labor introduce a price trigger to limit export volumes and free up domestic supplies.

AGL, which is pushing ahead with plans to start importing liquefied natural gas to Victoria’s Crib Point by 2020-21, acknowledged the price of gas for Australian manufacturers had risen sharply but said imposing new restrictions on the export or import of gas may drive away investment in the sector.

“I can understand the desire to look at ensuring that those prices are capped, but the negative is are you discouraging investment as you try and halt the problem,” AGL’s head of wholesale markets Richard Wrightson told The Australian ahead of an energy conference speech in Darwin today.

“Obviously with this policy what will be key is where the price is set and will it discourage investment, and it will be a difficult and dangerous thing if it did.”

Energy companies are reeling from an unprecedented attack from all sides of politics with high gas and electricity prices driving the threat of interventionist policies from both the Liberal and Labor parties.

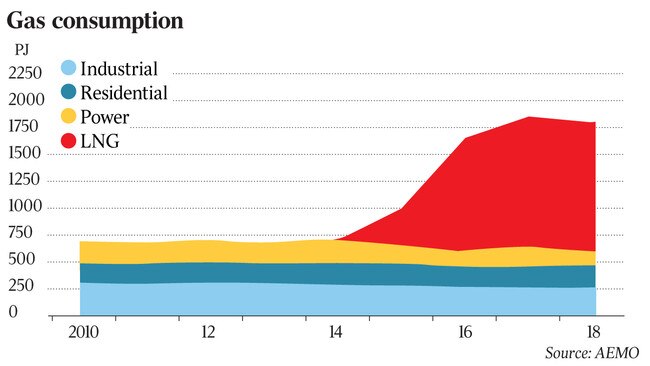

Federal Labor has pledged to introduce a domestic gas price trigger which would curb supplies of LNG exports, raising fears among producers about the risk of retrospective moves that could disrupt Australia’s second-biggest export earner.

The policy threat is seen as potentially casting doubt over AGL’s own import facility due to concerns the project would only be able to bring in gas supplies to Australia at higher international prices.

However, AGL said its own projections showed a shortfall of gas to Victoria in the medium term, which could partly be solved through initiatives like its import facility. It predicts that as coal-seam gas supplies from Queensland become more expensive over the coming years and as Bass Strait volumes decline from offshore Victoria, the supply situation will become more precarious with lower volumes to travel south in congested pipelines.

“As we move into the 2020s, we do think there’s going to be physical constraints on supplying gas to southern markets,” said Mr Wrightson.

“But also the cost of coal-seam gas climbs higher and higher as all the easy gas is taken first and you move into the more expensive gases further out in some of these fields. So the market dynamic still remains incredibly tight. There’s also a physical pipeline infrastructure which will be put under greater stress.”

He noted the Australian Energy Market Operator had taken “a more optimistic view” of the market due to the federal government’s Australian Domestic Gas Security Mechanism.

Macquarie said this week that AGL could be forced to delay an investment decision on its import facility due to the uncertainty around policy with a federal election next year.

However, Mr Wrightson said he was confident the project would keep to a target of being sanctioned in mid-2019 given the underlying case for its existence.

“The issue of Victoria physically relying on Queensland gets incredibly difficult as you move into the 2020s,” said Mr Wrightson. “By bringing an import facility into Victoria you’re basically shoring up security of supply for the state, which from a domestic point of view is critical.”

AGL, which engaged in a bitter brawl with the Turnbull administration over the planned 2022 retirement of its Liddell coal-fired plant, said gas was a critically important fuel to help manage the transition away from coal to a more integrated power grid while reducing prices.

“When we look at Crib Point it is with one eye to the gas market and one eye to the power market, because unless you can have deep, reliable liquid gas markets it makes it very, very hard to operationally manage gas-fired power stations to respond on the power side of things,” he said. “And it is definitely a component of pushing downward pressure on power prices.”

The push-back from AGL to a clampdown on the sector follows a combative speech by Santos boss Kevin Gallagher where he warned Australia’s political parties must avoid populist interventions in energy markets in the lead-up to a federal election, with international investors concerned over the risks posed by fresh export and price control curbs.

While Santos indicated it might consider Labor’s plan for new controls on uncontracted LNG exports should the policy receive community support, it emphasised politicians were treading a fine line as sovereign risk surges on reactionary rhetoric from Canberra.

Santos was concerned that “as we get closer to a federal election, the two major political parties will try to outdo each other with populist interventions that pay no regard to Australia’s reputation for stability,” Mr Gallagher said in a speech foreshadowed by The Australian.

Global energy companies could pull funds from Australia if interventions proceeded, Mr Gallagher warned.

“If governments continue to escalate their interventions to change the rules after investments have been made in export projects, they increase the prospect of investors assessing Australia as being just too risky a destination for their funds,” he said.