AGL, Origin sink as ACCC plans retail power price overhaul

Australia’s largest electricity companies are set to fight a watchdog proposal to overhaul retail power prices.

Australia’s largest electricity companies are set to fight a contentious proposal to overhaul retail power prices amid a new regulatory clampdown that slashed nearly $1.6 billion from the market valuations of the two biggest listed power players.

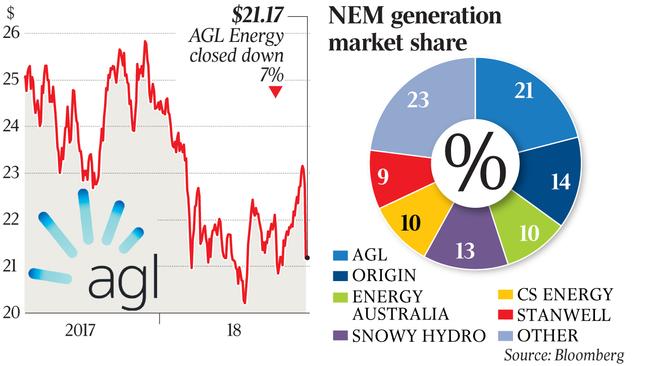

Shares in AGL Energy and Origin Energy sank yesterday after the Australian Competition & Consumer Commission unveiled the biggest shake-up to the national electricity market in two decades.

The competition watchdog’s set of 56 recommendations lashed the big three “gentailers” — locally listed AGL and Origin and the Hong Kong-controlled EnergyAustralia — over their dominance in both retail power markets and generation capacity in NSW, Victoria and South Australia.

Shareholders panicked at the potential handbrake being put in place on the energy majors’ growth, with AGL shares sinking as much as 7.9 per cent — marking one of its single biggest falls — before closing down 7 per cent at $21.17. Origin fell 3.6 per cent to $9.73 after earlier shedding 4.8 per cent, with about $1.6bn of value lopped from the two companies in a single trading session.

A proposal by the ACCC recommends scrapping so-called standing offers to customers and replacing them with lower-priced default offers that can be priced no higher than a level set by the Australian Energy Regulator.

The move aims to simplify the process for consumers confused by hundreds of retail offers.

However, the prospect of re-regulation in the electricity sector was a negative for AGL, according to Morgan Stanley, although neutral for its competitor Origin.

“We see the recommendation to create a default price set by the AER as a return to retail price regulation, which reduces the ability for retailers to price discriminate, but may also reduce competitive intensity, which advantages incumbent market scale and presence,” Morgan Stanley analyst Rob Koh said.

The ACCC’s overall set of proposed changes put at risk 17 per cent of AGL’s earnings and 9 per cent of Origin’s earnings, according to analysis by Macquarie.

“We suspect this analysis is really the worst case scenario, as there is also likely to be a lowering of costs to acquire and maintain customers,” the broker said. “We suspect if the recommendations are implemented, there is likely to be a concentration of retailers, thus the customer loss impact at AGL and Origin should decline.”

EnergyAustralia said handing control of a sensitive pricing practice to the AER would be challenging and may limit innovation.

“Re-regulating standing offers for electricity will be difficult for the AER to get right,” EnergyAustralia executive for energy Mark Collette said yesterday. “Set the price too low and it will reduce competition; too high and it will mean consumers pay more for energy than they should.”

It also warned any approach needed to be meaningful without limiting innovation. “We’re also concerned the AER’s compulsory guidelines may impact EnergyAustralia’s industry-leading hardship program — a one-size-fits-all approach, where the standard is reduced to the lowest common denominator, will leave vulnerable customers worse off,” it said.

However, the competition regulator dismissed their concerns and said the new system, if implemented, would still allow discounting to take place and competitive rivalry to flourish between different players in the industry.

“Our default offer would be set slightly above a middle level market offer and way below current standing offers but still high enough that you can have discounting,” ACCC chairman Rod Sims told media yesterday. “We’re not re-regulating the market — this is not that — this is just saying we cannot trust the retailers to set their own default prices to consumers.”

Queensland retailer ERM Power said the move was well overdue and reflected the lack of effective competition in the industry. “The big guys in the residential space are arguing that things should be left the same because why would they want to upset that stream of profits that they have in front of them,” ERM chief executive Jon Stretch told The Australian.

AGL said it recognised that challenges in the electricity market had affected customers.

“We are keen to review the recommendations and respond in a way that will benefit our customers,” an AGL spokesman said.

Origin chief executive Frank Calabria said there was clearly more that could be done to reduce complexity and improve transparency for customers.

“Origin supports efficient and well considered market reforms, including the comprehensive suite already under way, that can help us reduce power prices while avoiding unintended consequences that might erode customer benefits, halt innovation or distort the market,” a spokeswoman said.