AGL opts to hold on to coal plants

AGL Energy has rejected a sizeable shareholder vote calling for it to bring forward the planned closure of its coal plants.

AGL Energy has rejected a sizeable shareholder vote calling for it to bring forward the planned closure of its coal power plants, arguing it needs to balance the emissions goals of the Paris climate accord with the reality of ensuring the power grid stages an orderly transition away from the fossil fuel.

Activist group Market Forces lobbed a resolution that called for the company to quit coal by 2030, in line with the Paris Agreement to limit global warming to 1.5C above pre-industrial levels. While it attracted a 30 per cent vote by investors, AGL said it would not leap to any sudden changes.

The power giant plans to launch a study into how adhering to that Paris target may affect its power stations, but said in the meantime it was sticking to its greenhouse gas policy outlined in 2015.

“The Paris accord is an agreement between countries, not an agreement that binds companies,” AGL chairman Graeme Hunt said following its annual general meeting in Sydney on Thursday.

“We will close our coal-fired power stations at the end of their economic life and continue to invest in renewables. If we do those things our emissions will fall over time.”

AGL, the nation’s biggest carbon polluter, is scheduled to shut its Liddell coal station in early 2023, but its Bayswater unit will remain in operation until 2035 while Loy Yang A is due to run until 2048.

AGL said a transition away from coal must be done in an orderly manner.

“I do want to assure shareholders that the two key issues that are the subject of the resolutions, being climate change and emissions from our operations, are a key focus for the board. We understand that these matters are of concern to our shareholders and they are matters that the board takes very seriously,” Mr Hunt said.

“However, the board believes it’s important that any transition of the energy sector takes place in an orderly manner.”

Major Australian corporates and banks are facing growing pressure from institutional investors, activist funds and green groups to cut their direct emissions and also extend oversight of the extent to which their end customers may also be contributing to climate change.

Market Forces said the shareholder vote was a “historic demonstration of investor support for real climate action” and showed AGL needed to bring its business into line with the Paris accord.

“AGL’s vehement opposition of the resolution belies the company’s claimed support for the Paris Agreement,” Market Forces legal analyst Will van de Pol said.

“Its plan to manage transitional climate change risk amounts to relying on others to do far more than their fair share of the heavy lifting, while AGL continues with business as usual.”

AGL was bombarded by shareholders with dozens of questions over climate change, whether it should accelerate a move away from coal and its commitment to help Australia meet its Paris climate targets.

It told shareholders that staff wanting to join Friday’s global climate strike would be required to take a day of annual leave after the power player said it was inappropriate to follow ice-cream maker Ben & Jerry’s and give workers the day off.

Australia’s largest electricity generator said it was focused on keeping the lights on for consumers and noted it operated round-the-clock operations to ensure power supplies to households.

“We run a 24-hour business and in effect we need people to show up to keep the lights on,” chief executive Brett Redman told the AGM.

“We’ve said to our staff if they wish to attend the climate protests they’d need to take a day’s annual leave.”

The company was asked by a shareholder if it would change its position to match Ben & Jerry’s, which will close its Australian stores and pay staff to attend the march.

The power company dismissed the call given its critical role in the market.

“Selling ice-cream isn’t really an essential service,” Mr Hunt said. “Although my teenagers would very much disagree with me.”

Ben & Jerry’s has conceded it has a large carbon footprint “from cow to cone” but it was working hard to “tread as lightly on the planet as we can’’.

The ice-cream maker said it could not win the climate fight alone and urged adults to act as though their house was on fire.

“The truth is, if we shut down Ben & Jerry’s tomorrow, our planet would still be headed over a cliff,” it said.

“If we’re committed to taking steps as individuals, we must all feel compelled to join together collectively to hold our elected leaders accountable. Since adults have been slow to act, youth are now leading this movement, and that gives us hope.”

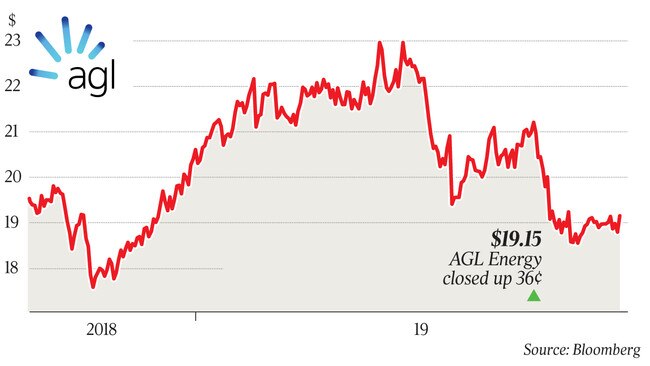

AGL has signalled a steep profit fall of up to 25 per cent in the 2020 financial year to a range between $780m and $860m, which it reiterated on Thursday, with the $820m midpoint some 10 per cent below consensus of $908m.

The Sydney-based power giant also said it remained on the hunt for opportunities in the broadband and data sector after pulling its $3bn takeover of Vocus following due diligence.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout