AGL Energy savaged after demerger given green light

AGL Energy suffered a savage share sell-off after unveiling its plan for a demerger.

AGL Energy suffered a savage share sell-off after unveiling its plan for a demerger, immediately hiking pressure on the electricity giant as it looks to remodel itself amid the challenges of low power prices and a faster than expected transition to renewables.

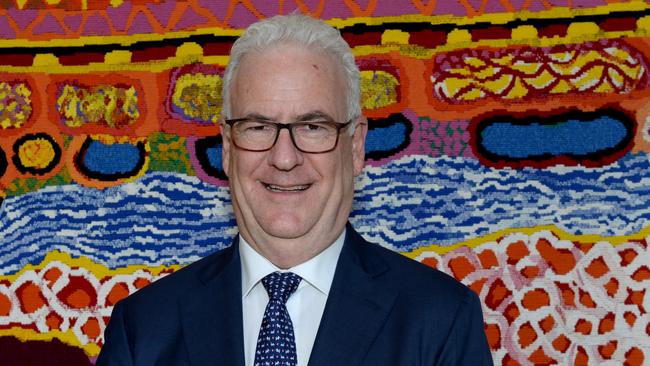

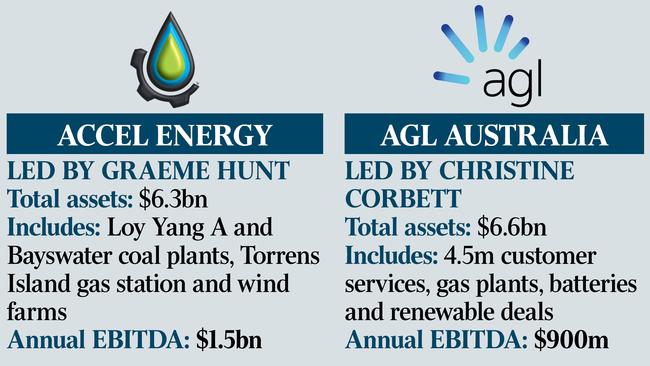

The nation’s biggest electricity retailer will proceed with a historic split with its main retail business to be demerged into a new company, AGL Australia under Christine Corbett while former chairman and interim boss Graeme Hunt will lead a new coal-focused generator Accel Energy.

The proposed separation got off to an troubled start after its shares plunged 10 per cent to $8.20 on Wednesday, marking the biggest one-day fall since 2007, with the stock having lost over half of its value since this time last year.

Mr Hunt blamed the share plunge on shareholder disappointment about changes to dividend payouts and a subdued profit outlook rather than doubts over the demerger. But it also reflected broader concern over how the separated companies with smaller balance sheets will fare in a volatile and fast-changing market.

The outlook for AGL was revised down to negative from stable by rating agency Moody’s on Wednesday night, noting that AGL’s new profile as Accel would undergo a “structural weakening” given the loss of business diversity and rising carbon risks connected to its coal plants and volatile power prices.

The utility is being battered by a storm of low wholesale electricity prices as cheap renewables continue to flood onto the market while moves by both state and federal governments to underwrite new generation has also contributed to a tough outlook.

AGL chairman Peter Botten conceded its board had been surprised by the pace of a rapid transition to renewables from coal and said he was disappointed by its share price performance in the last year.

“The winds have changed and have been substantially faster than many people anticipated,” Mr Botten said on Wednesday. ”From my perspective, those winds have been extremely fast and I didn‘t see quite the level of change and the acceleration of change in my thinking 12 months ago. And I believe that is representative of the AGL board.”

A halving of AGL‘s share price in the last year was described as disappointing for the board.

“Clearly the performance of AGL over the last 12 months given the nature of our business has been disappointing and directors are not walking away from that fact. Part of the process of where we are going and the new process is a genuine view that we will do whatever we can to turn the ships around and head them into these forces,” Mr Botten said.

“I am not in any way deflecting criticism of our performance. What I can say is we are very committed. People that are there and are staying are committed to turning the ship around and we believe the demerger is the way to do that.”

AGL Australia will provide electricity, gas, internet and mobile services to 30 per cent of Australian households and plans to target full carbon neutrality to chase a higher valuation as a green retailer with AGL’s non-executive director Patricia McKenzie named as chair.

Accel will retain a 15-20 per cent stake in AGL Australia following the demerger and Mr Hunt said there was no lockup on keeping the shareholding and it would treat the investment like any asset on its balance sheet, opening the door to a sale should it need to ease balance sheet pressures.

Shareholders will hold one share in Accel Energy, their old AGL Energy share, and one share in AGL Australia under the plan.

AGL Energy‘s stock code will switch to AXL while AGL Australia will hold the current AGL code post demerger.

A special dividend program was axed to free up $400m-$500m in cash for the companies‘ respective balance sheets. It expects 2021 full-year earnings guidance at the lower end of a $1.585bn-$1.845bn range and tips a tough 2022 performance due to low power prices.

“I would be inclined to focus more on those factors than perhaps the broader questions perhaps of support or otherwise for the demerger,” Mr Hunt said. ”No doubt we‘ll get a better sense of that when analysts write reports and we see where the market goes over the next few days.”

Alongside Mr Hunt at Accel will be Mr Botten who will take the same role at the generation-heavy business.

The demerger was slammed by Greenpeace Australia Pacific as “putting green lipstick on a pig” stating it was trying to hide its greenhouse gas emissions behind clever company reporting tricks.

The separation endured a rocky start after former boss and long-time AGL executive Brett Redman suddenly resigned from the company in April just four weeks after touting the merits of the plan.

The appointment of Mr Hunt as his interim replacement also unsettled some in the market.

Investors have been cautious over how $2.8bn of debt will be split between the businesses, the prospects of investment grade credit ratings and whether an equity raising might be needed depending on the structure of contracts between the two companies.

AGL conceded its coal-heavy Accel business may receive a lower credit rating due to environmental, social and governance concerns from investors than AGL‘s current BAA2 while the greener AGL Australia should rate higher.

Accel will establish bank loan debt facilities with an amortising loan of up to $800m and other facilities to fund short-term working capital and liquidity needs, soothing concerns it may struggle with lenders given climate concerns.

MST Marquee said it may have only got that level of funding by keeping its minority stake in AGL Australia.

“This is in effect a partial demerger only as both entities aren’t truly able to stand on their own two feet,” MST analyst Mark Samter said.

AGL Australia will have $2bn in bank facilities along with $910m in US private placement notes. The demerged business will own AGL’s 20 per cent equity in the clean energy operator PowAR and expects to source most of its supplies in a “capital light” manner via offtake deals with both PowAR and Accel.

AGL’s commitments including PowAR’s acquisition of Tilt Renewables and the Torrens Island battery means a special dividend program will be terminated but it intends to underwrite a dividend reinvestment plan for the financial year 2021 and financial 2022 interim period during demerger planning.

Terms and service deals for Mr Hunt and Ms Corbett are still being finalised while further board and management appointments for the two companies will be confirmed in due course.

Contracts will be put in place between the two firms to manage energy market price and supply risks over the short to medium term.

Australia’s largest electricity retailer plunged to a $2.28bn statutory loss for the first half in February after it was hit by a shock $2.7bn writedown driven by unprofitable wind farm deals.