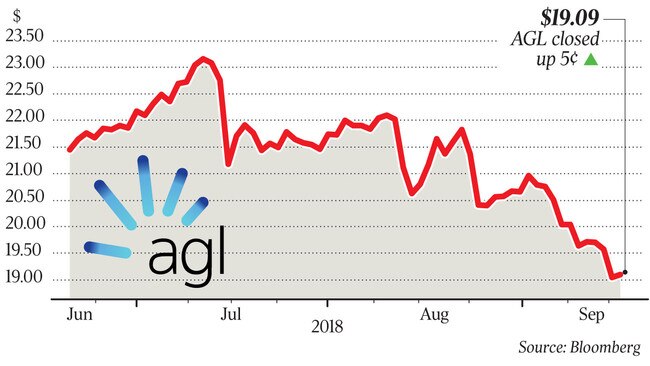

AGL Energy cranks up plan to import gas at Crib Point

AGL Energy has accelerated Victorian LNG import plans as it braces for an expected 2021 domestic supply crunch.

AGL Energy has accelerated Victorian LNG import plans as it braces for an expected 2021 domestic supply crunch, warning that the growing presence of wind and solar power could lead to more extreme shortages and price hikes if there is bad weather.

In documents submitted to the Victorian government this week, AGL said it was targeting first imports at the planned Crib Point liquefied natural gas import terminal, 65km southeast of Melbourne on the Mornington Peninsula, in the first half of 2020. This brings forward a previous 2020-21 target issued for the $250million project.

It shows AGL’s desire to import gas to cover customer needs has not weakened in the wake of last month’s sudden exit of chief executive Andy Vesey.

“Victoria, South Australia, NSW and Tasmania continue to have a threat to security of supply and exposure to a gas shortfall from 2021 if there is not a significant discovery of, or significant investment in, new sources of supply coming to market,” AGL said in an environmental effects statement filed with the Victorian Planning Department.

“The forecast gas supply shortfall raises the prospect of higher and more volatile prices for Australian customers, reflecting competition for scarcer domestic gas supplies.

“In addition, there is now the potential for an increased need for gas-powered generation due to weather related or contingency events that could still adversely impact this forecast and tighten the supply demand balance once again.”

AGL has also raised more questions over Australian Energy Market Operator forecasts that the east coast gas market would be oversupplied throughout next decade.

During the week, consultant Wood Mackenzie predicted east coast gas prices would surge by up to 70 per cent over the next decade.

Prices for gas could rise to between $14.30 and $15.90 a gigajoule by 2030 for Australian users, from a forecast $8.50 to $11 price next year without further exploration and lower costs of developing new supply sources, Wood Mackenzie said. Prices are forecast to rise to between $10.70 and $12.70 a gigajoule by 2025, reflecting a tightening Asian LNG market.

AGL is one of four proponents of LNG import terminals targeting east coast gas markets, where prices have risen and supply is tight. The tight markets are due to Queensland LNG exports, state government onshore development restrictions, declining Bass Strait production and the growing cost of developing new Australian gas supply.

Crib Point’s accelerated timetable brings it in line with that of the Andrew Forrest-backed Australian Industrial Energy import terminal slated for Port Kembla.

There was early market incredulity at the prospect of east coast LNG imports given Queensland recently started exporting, but it is now accepted the high cost of piping gas south appears to make it viable for at least one import terminal to be built.

AGL chief economist Tim Nelson has issued a paper saying LNG import terminals are a better way to address the shortfall than either government export restrictions, waiting for new supply to be developed amid relatively low international gas prices or piping gas from Western Australia.

“The most efficient and ‘no regrets’ economic solution at this point in time would be to allow market participants to develop gas import infrastructure,” Mr Nelson said. He said this would mean what is now a market floor — LNG export parity — would also be the market price cap.

“Most importantly, development of gas import infrastructure would not involve government intervention and could therefore limit perceptions of sovereign risk,” Mr Nelson said.

Last week, head of wholesale markets, Richard Wrightson told The Australian that Victoria faced gas supply shortages in the early 2020s and that the latest AEMO forecasts were “optimistic”.

In the environmental effects statement, AGL outlined its concerns with the forecast:

“AEMO’s report shows many of the supply sources AGL has relied upon to meet the needs of the market and its customers are in decline,” AGL said.

The import terminal will be able to produce up to 790 terajoules a day of gas at peak rates, which is more than Victoria’s total demand, or 527 terajoules per day at sustained rates.