AGL CEO Vesey’s exit won’t change plan to shut Liddell coal plant

AGL Energy says there is no change in its plans for the Liddell power station after deciding to part ways with CEO Andy Vesey.

AGL Energy says there will be no change in its plans for the Liddell Power Station after reaching agreement yesterday to part ways with Andy Vesey, whose four years as chief executive were marked by a bitter fight with Canberra over the future of the ageing coal-fired generator.

The resignation has sparked an international search for his replacement just two weeks after Mr Vesey delivered a record $1 billion profit and said he was “not going anywhere”.

AGL chairman Graeme Hunt, whose comments in the annual report two weeks ago that planning for succession was becoming more important sparked speculation about Mr Vesey’s tenure, said the process had been in place “for some time”.

Chief financial officer Brett Redman has been appointed acting chief executive while an international search gets under way. General manager of group commercial finance, Damien Nicks, has been appointed interim CFO.

The change in leadership is the latest in a series of dramatic developments in the energy industry this week.

On Monday, the federal government shelved its signature National Energy Guarantee policy in a decision that sparked the demise of its chief advocate, Prime Minister Malcolm Turnbull.

Energy Minister Josh Frydenberg has been voted deputy Liberal leader under new Prime Minister Scott Morrison, but the future of the policy remains uncertain thanks to the success of pro-coal conservatives in toppling a sitting prime minister over the issue. There is also uncertainty whether the Coalition government under Scott Morrison will seek to underwrite investment in a coal-fired power generator.

As reported in The Australian yesterday, the Australian Energy Market Operator has warned there is a heightened risk of blackouts in Victoria again this summer because of the increasing unreliability of ageing coal-fired generators. AEMO, which was involved in the design of the NEG, also said measures such as the reliability mechanism were needed to guide investment in new generation.

The industry remains under sustained political pressure with the big three electricity generators and retailers announcing record profits from high wholesale electricity prices just weeks after rolling out small cuts to household electricity bills.

Mr Hunt yesterday praised Mr Vesey and said there was no one factor that lead to his departure.

“Andy has done a great job for us,” Mr Hunt said. “Andy has done what we wanted him to do, which is to the turn the company around in an environment where there is rapid change.”

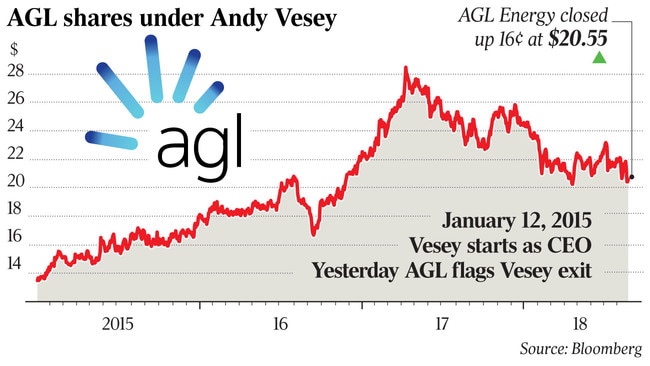

Mr Vesey oversaw a 50 per cent increase in the profits and share price of the company from February 2015 when he was appointed and set a path to make the company a cleaner, greener electricity generator and retailer.

AGL shares rose 16c to 20.55 on the news yesterday, but remain well below their $28.44 peak of April last year. Analysts at Macquarie Research Equities said the biggest threat to the company was a change of government, with Labor’s more aggressive pursuit of renewable energy and emissions reduction targets likely to cost the company up to $250 million in earnings. Victorian Labor government policies, such as subsidising the spread of rooftop solar and reverse auctions for commercial-scale renewable energy generation, will also undermine the viability of its coal-fired generation plants in that state.

AGL, still the country’s biggest polluter — thanks to its ownership of brown and black coal generators such as Loy Yang A in Victoria and the Liddell and Bayswater plants in NSW — announced plans to exit coal completely by 2050.

But Mr Vesey clashed repeatedly with the federal government over his refusal to sell or extend the life of Liddell beyond its planned 2022 closure. AGL was also attacked by Mr Turnbull and Mr Frydenberg over its 2015 sale of then surplus gas supplies to Santos, which began exporting them just as domestic shortages doubled and trebled domestic prices and put manufacturing industry and electricity prices in stress.

Mr Hunt said the departure did not signal a change of heart by AGL about closing Liddell and cited the AEMO report, which said the increasing unreliability of coal-fired generators was the main reason for its warnings of increased blackouts.

“Liddell is top of the pops, or bottom of the pops, when it comes to unreliability, ”he said.

Mr Vesey’s departure would pave the way for the future direction of the company and the skills needed to take it there, Mr Hunt said. The annual report said the company had stepped up its focus on developing internal candidates as Mr Vesey approached the fourth anniversary of his appointment in February 2015.

“Brett is a highly experienced executive who has distinguished himself as our CFO and has a deep knowledge and understanding of the business and the industry,” Mr Hunt said yesterday.

“Under his leadership, we have every confidence that it will be an orderly transition as we finalise the CEO search.

Mr Redman said he looked forward to continuing AGL’s strategy. “AGL’s priorities during the coming weeks will continue to be the safe and reliable operation of our assets, serving our customers to the best of our ability, and listening and responding to all our stakeholders,” he said.

Mr Vesey said: “It has been an honour to lead AGL — and a privilege to have had the opportunity to engage in the complex questions of the sustainable transformation of Australia’s energy sector over recent years.

“I am proud of what the AGL team has achieved during those years and I am now looking forward to observing AGL’s continued success.”

He will remain as an adviser to the company until December.

AGL shares rose 20c to $20.59, bouncing off a four-month low.