AEMO report says export coal prices pushed up the cost of domestic power

The Australian Energy Market Operator’s September report links coal demand in the northern hemisphere with the skyrocketing cost of electricity here.

Soaring prices for export coal pushed up domestic energy prices in the September quarter, the energy market operator says.

And the looming closure of the Liddell Power Station in New South Wales will lift wholesale costs ahead of next winter.

The Australian Energy Market Operator will release its September quarter dynamics report on Thursday, warning soaring global coal prices flowed into domestic power costs in the period.

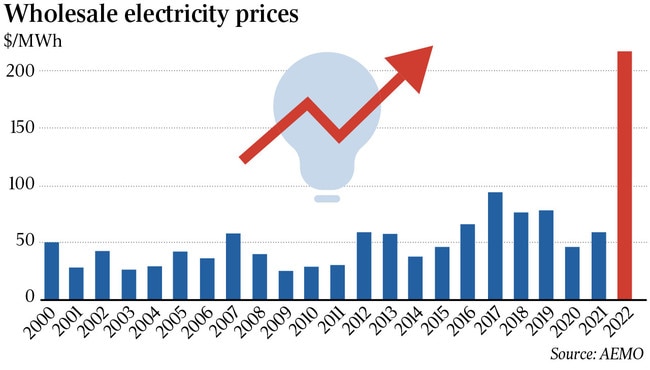

September quarter wholesale prices fell only slightly from record highs of the previous period, according to AEMO, with spot prices averaging $216 a megawatt hour – more than three times the price being paid at the same time in 2021, but still 18 per cent lower than the $264/MWh average in the three months to June 30.

While the winter energy crisis was caused by a combination of coal-fired plant failures and lower-than-expected renewable energy feeding into the grid, AEMO says international coal prices played a major role in pushing up September quarter wholesale costs.

“The ongoing war in Ukraine and higher demand ahead of the northern hemisphere winter has increased the market price for domestic gas and export-grade thermal coal,” the AEMO report says.

“Steep increases in traded price for thermal coal export combined with wet conditions across the east coast impacting local black coal supply saw many black coal generators repricing offer volumes to higher price bands.

“Compared (to last year), volumes offered by national energy market black coal (generators) below $100/MWh reduced by over 2000 megawatts on average.”

AEMO notes black-coal-fired generators in NSW and Queensland contributed 10,825MW of power into the grid in the quarter, the lowest September period contribution since the NEM was formed, as some were priced out of the market by cheaper renewable energy.

“Decreasing generation from both the NSW and Queensland fleets, despite fewer outages and higher operational demand in NSW, was primarily due to a shift in supply offers to higher price bands,” the report reads.

“Not normally a high priced or volatile quarter, this period saw 24 per cent of all spot prices exceeding $300/MWh. A great proportion of these prices were in the $300 to $500/MWh price band, and occurred most often in July, signifying a generally higher cost of energy rather than short-term scarcity-driven extreme prices.”

Heavy weather in the three months to September 30 closed railways, interrupting deliveries to coal-fired power stations, which also helped push up prices.

East coast gas prices recorded similar highs, averaging $26 a gigajoule over the quarter, a 142 per cent increase from the September quarter 2021 average of $10.74/GJ and only slightly below the $28.40/GJ in the June period.

Domestic gas prices peaked in early July, according to AEMO’s latest quarterly energy market report, with Sydney spot prices hitting a high of $59.49 a gigajoule at one point, more than five times their September quarter average of $11.16 in 2021.

AEMO’s latest quarterly report also notes that futures trading through the quarter reflected expectations that next winter is likely to see another spike in energy costs, mirroring commentary in Tuesday’s federal budget predicting a sharp rise in power prices over the next year.

“High mid-year spot prices have been reflected in the forward electricity contract market, with Australian Securities Exchange electricity futures for calendar year 2023 rising from an average of $168/MWh across mainland NEM regions at the end of June to $202/MWh at the end of this quarter,” the report reads.

Futures contracts reflected higher energy prices in winter than at peak summer loads, it says.

“This indicates a market view that winter 2023 energy costs will be higher than the summer period. This reflects the scheduled closure of the remaining Liddell units early in the second quarter of 2023, spot price outcomes in 2022 to date as well as concerns around ongoing high international energy commodity costs.”

Given forward wholesale contract prices for electricity remain elevated, Treasury expects retail prices to rise by a further 30 per cent in 2023–24.

“Higher electricity prices will have both a direct and indirect impact on inflation, increasing input costs across the consumer price index basket,” the budget papers say.

A delay in the pass-through of wholesale costs has shielded households from some immediate price pain, but retailers are expected to hike prices considerably when bills are reset next year. Alinta and Origin estimate retail prices could rise by up to 35 per cent given high wholesale futures prices into 2023.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout