ACCC probes Rio Tinto’s supplier rort

Rio Tinto is pushing 10,000 suppliers to discount their bills if they want to be paid on time, sparking an ACCC probe.

Rio Tinto is pushing its 10,000 Australian suppliers to discount their bills if they want to be paid on time, delivering hundreds of millions to the cashed-up mining giant but sparking an outcry from small businesses and an investigation from the competition watchdog.

Rio’s so-called “dynamic discounting” scheme targets small and medium-sized suppliers, according to company documents, offering to pay invoices before the due date in exchange for a discount of up to 2 per cent from its total — putting their margins under renewed pressure while delivering big savings to Rio’s Australian operations.

Small suppliers say Rio is “aggressively” pushing a payment platform provided by San Francisco-based financial services company Taulia to businesses that have little choice but to take the discount to protect their own cash flow. Rio introduced the platform after shifting the payment centre for all its global suppliers to India, creating a bottleneck for invoices and triggering a wave of complaints.

The move has angered suppliers, who are facing increasingly tighter margins, with some labelling the scheme nasty, cheeky and not fair.

One medium – sized business, which relies on Rio work to stay afloat, estimated it would cost more than $20,000 a month if it wanted all of its bills paid on time. Another supplier told The Weekend Australian they waited almost five months to receive payment — and it only came after multiple calls to Rio’s India office — before they received an email from Rio urging them to use the Taulia platform and take a financial hit if they wanted to be paid more quickly.

Australian Competition & Consumer Commission chairman Rod Sims has launched an investigation into Rio and its payments program, focusing on whether it equates to unfair contract terms or unconscionable conduct under Australian consumer law.

“Payment terms of say four or five months are outrageous and it doesn’t make them any better that you pay a discount to get your money earlier,” Mr Sims told The Weekend Australian.

“You just shouldn’t have a term of that length in the first place. This whole system looks like it’s a large player in a very dominant position taking advantage of that position to the disadvantage of small players. We are certainly going to investigate it.”

A Rio Tinto spokesman said the company paid all its “eligible small business suppliers within 30 days of receipt of invoice”, in line with Rio’s commitments to the voluntary Australian Supplier Payment Code.

“To assist our suppliers to manage their cash flow we introduced additional measures. In 2019 we introduced a portal so suppliers can view invoices and run remittance reports, tracking when their cash will be received. This is a free and voluntary service for any supplier,” the spokesman said.

“Via this portal, suppliers can voluntarily elect a financing option to accelerate payments and receive their cash faster than the agreed 30 days. This is at the full discretion of the supplier.”

If all of its Australian suppliers signed up to the new program, which cuts the amount owed on invoices by up to 2 per cent, this would equate to a windfall of up to $200m a year for Rio.

Timely payment is a critical issue for small businesses who cannot dictate terms to their own suppliers and staff, and are often required to pay their own bills on shorter terms than major companies — and must make those payments whether the big companies they work for pay on time or not.

The Australian Securities & Investment Commission’s latest figures on business failures show cash flow problems are responsible for about half of company collapses, with the figure on the rise over the last three years.

Many small suppliers say they must take the discount if they want to get cash through the door to pay their own bills.

Rio purchased $6.8bn on goods and services from more than 2500 suppliers in Western Australia, and another $3.2bn from another 2500 suppliers in Queensland, according to a company statement to a parliamentary inquiry in 2018.

During a presentation in May last year, Rio’s vendor relationships manager, Dirk Fourie, and short-term liquidity risk manager, New Zi Xuan, said the company’s dynamic discounting program specifically targeted its small and medium-sized suppliers. Under a headline stating ‘Why dynamic discounting?’ the pair wrote it was a “competitive financing option to suppliers, particularly smaller to medium-sized firms or those unable to access supply chain financing’.

Mr Fourie and Mr Zi Xuan said the economic benefits to Rio were an “alternative investment option for group surplus cash at low risk” and “reduces cost of unit purchase”.

But the US-based Taulia offers its clients much more. Taulia touts the benefits of machine learning and artificial intelligence to model the discounts a supplier may be prepared to accept. This includes an analysis of the supplier’s own borrowing costs to work out what discount they might be prepared to wear in order to access early cash.

Taulia boasts its dynamic discounting service delivers a risk-free, high return for its clients. “By investing your cash to capture discounts, you can earn risk-free returns that are much higher than traditional investments. Our customers achieve double-digit returns and there is no risk as you’re committed to pay at invoice maturity anyway,” the company states on its website.

Taulia added that a survey from all its clients found that 39 per cent of their suppliers were paid late, creating fertile ground to cut invoices in exchange for early payment.

“This underlines the considerable opportunity for early payment programs to provide suppliers with much-needed working capital support, while tackling the issue of late payments,” said Taulia’s vice-president of customer success, Bob Glotfelty.

Like other major mining companies, Rio began trying to cut supplier costs as the mining boom ended in the early part of the last decade, slashing its own workforce and pushing contractors to cut costs and waste at the same time.

Rio has cut the cost of producing a tonne of Pilbara iron ore from about $US24 a tonne in 2012 to $US13.30 in 2018, trying to stay ahead of the falling price to preserve its profit margin, with cuts to supplier payments helping drive cost reductions.

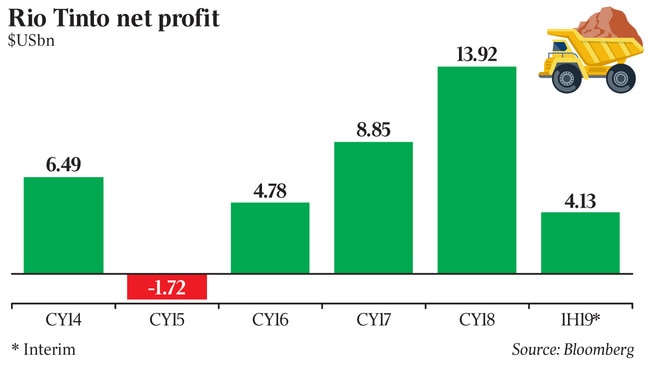

But last year’s surging iron ore price has exacerbated supplier anger about Rio’s squeeze. Despite operation problems at its Pilbara mines that drove up costs and reduced shipments, consensus analyst estimates indicate Rio will book underlying after-tax earnings of about $US9.7bn ($14.16bn) from its iron ore division at its February annual financial results.

The Rio revelations come only a week after the WA state government banned departments and trading enterprises from using a similar scheme, after complaints that the state government-owned Water Corporation was urging contractors to take a financial hit if they wanted bills paid within 28 days. WA Treasurer Ben Wyatt said on Wednesday that suppliers should expect to be paid in a timely manner if they had done the work.

“Governments should lead by example and if suppliers do the work, they should expect to be paid in a timely manner,” he said.

“The issues raised last week by Water Corporation suppliers were rightly deemed unacceptable by the Premier. As the Premier made clear last week, we don’t believe this is acceptable and have moved swiftly to ensure suppliers are paid within 30 days or sooner when possible.”

The federal government has also been progressively lowering its payment terms to Australian businesses that provide its services, most recently cutting to 5 day terms on small business invoices billed through its own electronic payment system.

Amid wider concerns about the fast growth of other forms of supply chain financial, federal small business ombudsman, Kate Carnell, is undertaking an inquiry investigating claims big companies have been pressuring suppliers to use external financiers to manipulate their working capital positions.

Do you know more? lynchj@theaustralian.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout