ACCC power plan may backfire

The competition regulator may struggle to cut wholesale power prices and cap the growth of energy majors.

The competition regulator may struggle to cut wholesale power prices and cap the growth of energy majors, with elements of its reform package set to entrench the market dominance of Australia’s largest electricity players.

Goldman Sachs warned yesterday that elevated gas and thermal coal prices and peak demand growth would put “upward pressure” on wholesale power prices, potentially denting a plan by the Australian Competition & Consumer Commission to reduce prices by 22 per cent on average by 2021.

Instead, the watchdog may have to rely on reducing bills through its recommended changes to network charges and the removal of costly solar scheme subsidies.

“The ACCC assumes prices in 2021 will fall below the marginal cost of coal generation, which we believe is unlikely, and see the fundamentals driving upside,” Goldman analyst Baden Moore said.

The broker is also sceptical on the ACCC’s plan to lower prices through a taxpayer-funded scheme that would invest in generation assets and boost supply. While it acknowledges the harsher regulatory overtones are negative for investor sentiment, it expects continued improvement in energy market returns and retains buy recommendations for both Origin Energy and AGL Energy.

Goldman’s response underlines the tough task faced by the government and ACCC chairman Rod Sims to boost competition in markets and reduce spiralling prices. The big three “gentailers” hold large retail market shares in many states and control more than 60 per cent of generation capacity in NSW, Victoria and South Australia.

Investors yesterday gave a mixed response to the biggest shake-up to the national electricity market in two decades.

While Origin shares fell a further 3 per cent to close at $9.43, extending Wednesday’s 3.6 per cent drop, that was partly seen as a lagging response to crude oil, which suffered its biggest plunge in more than two years earlier in the day.

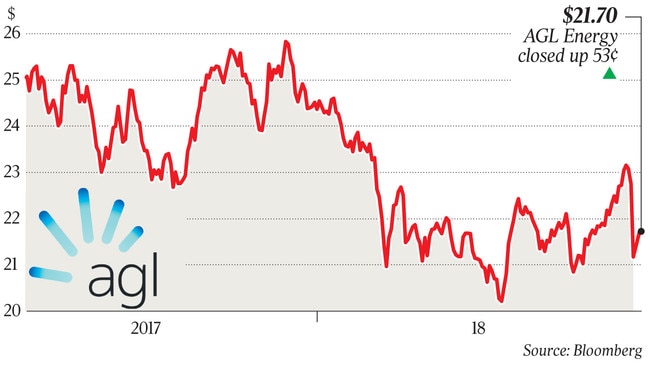

AGL, for its part, clawed back losses, with analysts arguing Wednesday’s $1.6 billion sell-off in the two listed power players was overdone.

After a 7 per cent battering on Wednesday, AGL recovered to close up 2.5 per cent at $21.70.

Network company Spark Infrastructure took a tumble, declining 3.1 per cent to $2.18, compounding a 3.4 per cent fall the day before.

Morgan Stanley concluded share price declines were overdone and said investors had been caught by surprise by the idea of re-regulation of the electricity market at a federal government level.

Despite the negative rhetoric of new oversight of the industry, the broker argued any changes may end up further entrenching the dominance of the big three — Origin, AGL and the foreign-controlled EnergyAustralia — rather than undermining their earnings.

“We retain the view that price re-regulation will only serve to reduce market competition and any decrease in unit retail margins will be offset by market-share gains by the incumbents,” JPMorgan analyst Mark Busuttil says in a note.

“We believe that AGL and Origin have overreacted to the release of the report.

“The recommendations, if implemented by the federal government, would have only a modest impact on the businesses.”