$50bn of gas projects in doubt as outlook dims

Australian energy producers face heightened volatility for the next $50bn pipeline of gas projects.

Australian energy producers face heightened volatility for the next $50bn pipeline of gas projects, with major oil price shocks and shareholder pressure over carbon exposure complicating investment decisions, resources consultancy Wood Mackenzie has warned.

Nearly $20bn has been spent on writedowns and charges on Australian and Papua New Guinea projects run by Woodside Petroleum, Shell, Origin Energy and Oil Search in July as some of the nation’s biggest gas producers adjust to an uncertain outlook.

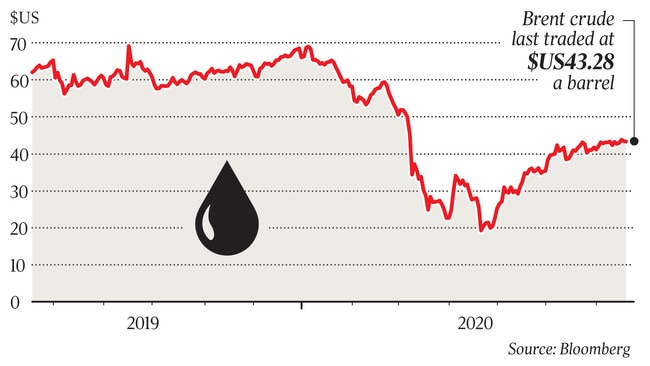

Crude prices have doubled from record lows in April to trade at $US43 a barrel, but even at those improved levels many projects remain marginal. Producers have responded by lowering their price assumptions, triggering giant writedowns of oil and gas assets, to reflect a collapsing demand outlook with COVID-19 continuing to roil the market.

“The triple whammy of the energy transition and two oil price shocks in the last five years has permanently changed how investors see the oil and gas industry,” WoodMac research director Angus Rodger said. “Concepts like portfolio resilience and sustainability are the new mantras. Weaker portfolios have been exposed and resilience simply means being able to thrive through the cycle, making money at the bottom as well as performing well when prices are higher.”

The next wave of major developments worth in excess of $50bn now faces fresh uncertainty too. Woodside this week delayed its $US11.4bn ($16.3bn) Scarborough to Pluto development until the second half of 2021 while a decision on the go-ahead for the long-delayed $US20.5bn Browse project now won’t be made until 2023. Santos has also deferred an investment decision on its $US4.7bn Barossa project because of the oil plunge and coronavirus ructions.

Woodside’s Burrup Hub concept — involving Scarborough gas being piped to an expanded Pluto plant and gas from Browse being processed through the existing NW Shelf plant which it operates — faces shareholder scepticism on whether it can exceed the company’s 12 per cent hurdle rate for new investment.

Instead, some investors would prefer Woodside move Scarborough gas through NW Shelf rather than expanding Pluto, easing balance sheet pressure and boosting Scarborough‘s break-even LNG price given lower NWS tolls.

Hitting new hurdle rates has emerged as a major issue for the industry, WoodMac noted.

“The next generation of Australian pre-final investment decision projects have some key advantages, as they can utilise existing infrastructure, but the hurdle rates are getting higher,” Mr Rodger said. “As companies lower longer-term price assumptions and embed carbon costs into the approval process, they are evaluating these projects on a stricter, more holistic basis. Ultimately, they are asking: do these projects add to the resilience of our portfolio, or weaken it?”

Australian gas producers are hardly alone. Global major BP, which in June took a writedown of as much as $US17.5bn, slashed its long-term energy price assumptions and even warned it may leave oil and gas in the ground amid a fast-moving transition away from fossil fuels.

BP has adopted a high carbon price of $US100 a tonne in 2030 and Woodside this week surprised some in the sector by doubling its own carbon assumption to $US80 a tonne in the expectation stricter regimes will be put in place over years to come, including in its home market of Australia. Investors are also demanding greater accountability from fossil fuel producers to prepare for climate change, with the previously fringe idea of oil and gas assets becoming stranded now regarded as a rising risk for energy operators.

“Although gas burns significantly cleaner than oil and especially coal, LNG is nonetheless coming under more scrutiny as the sustainability and climate change debate rapidly evolves. Companies like BP and Woodside are reacting to this by releasing and updating their own internal carbon prices, in part because of rising investor concern and corporate pressure,” Mr Rodger said.

The carbon issue may be global, but WoodMac said it was particularly pertinent to Australian producers.

“As the full carbon footprint of the LNG business — from creation to delivery of every cargo – comes under greater scrutiny, it raises big issues for more carbon-intensive producers. Australian projects are more exposed than many here, both because of some older, less efficient plants — think NWS — and also feedgas that has relatively high levels of CO2, such as Gorgon, Prelude and Ichthys,” Mr Rodger said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout