Super funds to halve: Macquarie

The number of Australian funds is predicted to halve, and the bulked-up survivors could drive corporate activity.

The number of Australian superannuation funds has been predicted to halve and the larger cashed-up “mega” funds are likely become the driving force of corporate activity as they take larger direct investments in Australian companies.

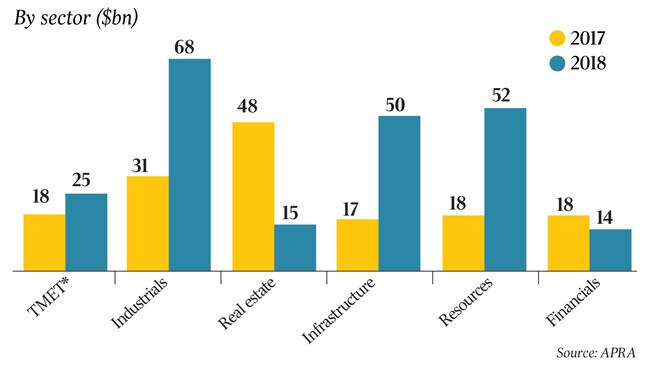

A new report by Macquarie, the top-ranked mergers and acquisition adviser, obtained by The Australian has showed that superannuation sector consolidation could be greater that initially predicted, following the Hayne royal commission. It said that in 2018 Australian superannuation funds managed $2.7 trillion and the value of the funds under management could shoot as high as $10.5 trillion by 2040.

Macquarie said the result of the sector’s consolidation would be fewer but more cashed-up funds that would start to make greater direct equity investments.

“Pension funds are managing record capital inflows, resulting in competitive pricing for core assets and a broadening of mandates to include private equity-like direct investment,” the report, given to the investment bank’s clients, said.

“Increasing weight of private capital is emboldening pensions and superannuation funds to leverage listed shareholdings to win private auctions.

“Consolidation will see the number of funds halve, creating ‘mega funds’ with increasingly significant war chests to deploy.”

AustralianSuper has been the highest-profile fund to take on direct investments after it teamed up with Transurban to buy 51 per cent of WestConnex for $9.3 billion. UniSuper holds a 13.4 per cent stake in Transurban, which operates the Sydney motorway.

AustraliaSuper is also part of a consortium with private equity group BGH that has offered $2.1bn to buy Navitas, the education services group. The two also tried to buy Healthscope but the private hospital outfit recommended a rival bid by Brookfield’s private equity division.

FirstState Super last year paid $2.86bn for the Victorian land titles office business.

“Private capital and sponsors will become increasingly aggressive on the buy side as the supply of capital increasingly outweighs the availability of attractive large-scale investment opportunities,” Macquarie said.

The Australian revealed last week that AustralianSuper and some of its rivals, including Statewide, are on the hunt for mergers following the royal commission findings and new legislation that clamps down on low-balance funds.

Statewide, the South Australian fund, confirmed it had held early talks with WA Super on the potential to merge.

A separate report from White & Case, an international law firm, to be published today shows that Australian M&A activity is expected to remain steady this year but more deals could be driven by superannuation funds becoming co-investors in bids.

White & Case partner Nirangjan Nagarajah said the superannuation funds were likely to start deploying more capital through direct equity investments.

“I think superannuation funds are changing the dynamics, but it’s a step change, not a complete revolution in the way deals are done,” he said.

“A company could have a large super fund on it registry and they might look at that differently. They might not just be a passive investor as they have been in the past.

“I don’t think that is going to play out in every situation but we have seen a couple of transactions where there has been activity.”

The White & Case report shows US investors were the most common source of foreign investment-led M&A with 83 deals worth $US9.76bn, ahead of Japan, which was involved in 21 deals worth $US6.2bn. Chinese activity was worth $US2.6bn.

The firm predicts that energy and mining will again be among the most active sectors for deals this year, especially in gold, following Newmont’s $10bn merger with Goldcorp.

It was also reported in Canada at the weekend that Barrick Gold could make a hostile $19bn bid for Newmont to scuttle the merger. As part of that deal, Newcrest could buy Newmont’s Australian gold assets.

There were $US21.3bn worth of deals announced in energy, mining and utilities last year.

White & Case partner John Tivey said the gold consolidation would be driven by companies keen to reduce their cost of production, especially as some producers merged to become larger players in the sector.

“I think part of the appetite for activity in gold at the moment is the increased perception of volatility that exists now,” he said.

“There’s the US and China trade tensions, so there’s renewed interest in gold as a safe harbour destination. There’s also a need for gold companies to be more efficient in their production.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout