Santos shares tumble following rejection of Harbour Energy’s $14.5bn bid

Santos shares are down almost 10pc after it rebuffed a $14.5bn bid and hit back at suitor’s ‘limited growth prospects’ jibe.

Santos shares have slid nearly 9 per cent after analysts expressed surprise at its board’s rejection of Harbour Energy’s $14.5 billion takeover bid and as the Adelaide oil and gas company hit back at the spurned suitor’s claims it had limited growth prospects.

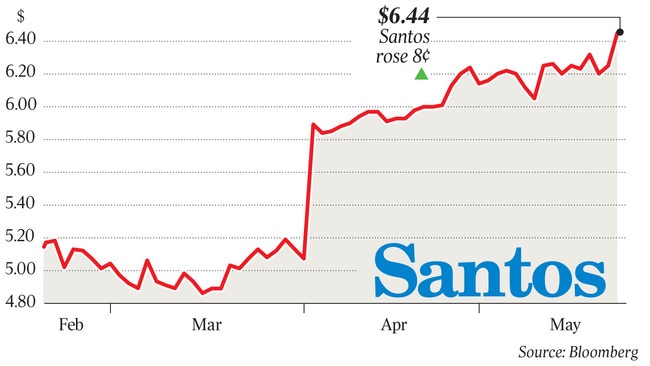

After resuming trade at 11am (AEST), the company’s stock (STO) dived almost 10 per cent during midday trade and was down 8.77 per cent to $5.875 at 3.11pm (AEST).

Santos last night said it had rejected the $US5.25 ($6.95) per share Harbour offer as too low, too complicated in its hedging demand, exposing shareholders to currency risk and as not treating all shareholders equally.

The Keith Spence-led board resolved to reject an offer that it had managed to get the bidder, run by former Shell executive Linda Cook, to increase five times since an initial approach last August. Harbour’s decision to declare the bid best and final means it cannot return with another offer for six months.

Santos shares slumped this morning on the news, but, thanks to the oil price and operating and balance sheet improvements, are nowhere near the $4.38 price the stock was at in November when Harbour’s interest was made public.

The fall came as analysts expressed surprise at the rejection, with Citigroup cutting Santos’s recommendation from neutral to a sell, and after Harbour issued a fiery response to the rebuff and called for a shareholder vote on the offer.

Most observers expected the board to turn the offer, which was conditional on 75 per cent shareholder approval, over to investors by recommending it.

Harbour also said its five-weeks of due diligence revealed some disappointments and that it thought Santos had limited growth options, is ready to re-engage if the Santos board changes its mind.

Sources close to Santos have today said part of the Harbour bid plan included the need for most of the Santos management team to market the transaction to raise debt capital before shareholders had voted on the deal.

“PNG LNG expansion, Barossa Backfill to Darwin LNG and the Narrabri Gas Project can all be funded out of free cash flow at around $US60 a barrel,” a Santos spokesman said today.

The Santos team has bristled at Harbour’s firey response to the rejection, in which it claimed due diligence was disappointing and that Santos had essentially agreed to complexities around hedging that it later used as a reason to reject the bid.

A source close to Santos said the deal would have been unfair to Santos’s 120,000 shareholders.

“Harbour came to the table with only about a third of the money it needed to buy Santos and they wanted Santos shareholders to help them stump up with the rest,” the source said.

“120,000-plus shareholders who have stuck with Santos through thick and thin, and are about to return to fully-franked dividends, would have been the ones required to take the risks of this transaction.”

He said Harbour had planned to have most members of the Santos management team marketing the transaction for three to four months in roadshows around the world, and in the US high yield bond market, to raise debt capital, all before shareholders had any say.

“By the time shareholders got any say, their choice would been between a weakened Santos with less upside, or accepting Harbour’s US dollar price, which, depending on oil price and foreign exchange movements, may or may not be an attractive offer,” he said.

“Not much of a choice.”

RBC Capital Markets analyst Ben Wilson said the rejection had come as a surprise.

“The rejection is a shock to us as we saw the bid price as very much full, discounting north of US$80 a barrel, and see few other interested parties,” Mr Wilson said.

“The primary objections noted by the Santos board relate to the quantum of the bid not adequately reflecting peer company moves and oil price appreciation and uncertainty around source of funding for the Harbour cash bid. The onus is now firmly on the board and executive to execute strategy, grow the company and hope that oil, gas and LNG prices do not retreat materially.”

Mr Wilson said it was unlikely that Harbour would return with a hostile bid, noting that the earlier agreement struck with major Santos shareholders ENN and Hony effectively precluded a hostile approach.

“We think Harbour’s Santos ambitions are dead,” he said.

Citi analyst James Byrne slashed his target price for Santos from $7 a share to just $5.30 in the wake of the rejection, and said the company would need to be more forthcoming on its potential growth opportunities.

“We think that the due diligence process by Harbour and its lenders will have forced Santos to heavily scrutinise its own portfolio. Accordingly, it’s possible to envisage that Santos is now in a position to better communicate to the market what growth is able to be unlocked and by when,” Mr Byrne said.

“Furthermore, and perhaps most importantly, Santos may in a position to provide the market with the associated detail on that growth which we think has been lacking since the company entered ‘survival mode’ in 2016.”

Andy Forster, from Santos top twenty shareholder Argo Investments, said he had viewed the Harbour offer as reasonable and was surprised that Santos decided to not put it to shareholders.

“We were of the view that we were probably going to have the chance to vote on it so we were a bit surprised the board didn’t recommend it.

“I’m not sure when we are going to see a $7 share price at Santos for some time, unless oil prices keep going up.

“They’ve done a great job operationally with cost out and productivity, but a lot of the things around growth, things like Narrabri I wouldn’t be ascribing much value to.

“We probably thought it was a pretty good price at the end of the day.”

But Paradice Investment fund manager Troy Angus, who holds Santos stock on his portfolio, said he had not been keen on the deal simply because the price was not high enough.

“We are very supportive of the board’s decision to reject the Harbour offer,” Mr Angus said

“It did not and does not offer full value for the asset and the company’s growth options.”

Harbour warned shareholders that Santos had limited growth opportunities and that recent

Last night, Harbour said it was disappointed that Santos had walked away from what it said was an offer with a $4bn premium and with how it had approached the final decision.

“There was insufficient engagement with Santos on valuation, no meaningful attempt by Santos to discuss a realistic price which could be supported by any reasonable set of technical and commercial assumptions, and an unwillingness by their board to explore means of closing the gap between the offer and their expectations,” a Harbour spokesman said.

Santos chief executive Kevin Gallagher noted “the Board worked as a team throughout the process to fully evaluate the Harbour proposal. All the independent directors, including myself, were unanimous in reaching the decision that the price offered by Harbour was simply not compelling enough when considered against the superior value our current plan will deliver for shareholders over time.”

It is understood that Santos chairman Keith Spence has been an opponent of Harbour since the US company arrived on the scene mid-last year and could not be convinced of the bid’s merit.

Mr Spence held discussions with Harbour chairman R. Blair Thomas over the weekend.

The bid, at $US5.21 ($6.95) a share, required Santos to hedge oil production in a rising price environment to lower costs for Harbour on a deal where Foreign Investment Review Board approval was uncertain.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout