CK Infrastructure’s $13bn bid for APA Group

Hong Kong’s billionaire Li family has made a $13bn cash bid for the nation’s dominant gas pipeline company, APA Group.

Hong Kong’s billionaire Li family has stepped up its push for Australian infrastructure assets, making a $13 billion cash bid for the nation’s dominant gas pipeline company, APA Group, in one of the biggest bids to date for an Australian company.

The Li family’s Hong Kong-listed CK Infrastructure and a group of related companies yesterday revealed they had made an $11-a-share cash proposal to APA that had seen them granted due diligence on the asset.

The price, reached after a short engagement with the APA board, is seen by the market as a good one. At $13bn, this has only been eclipsed by the recently completed $30bn takeover of Sir Frank Lowy’s Westfield shopping centre empire.

But even if a financial deal on APA can be reached, it will pose a dilemma for Scott Morrison and competition boss Rod Sims.

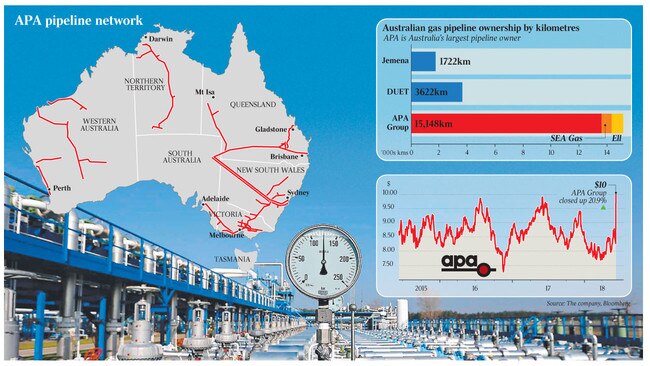

This is because it will make CKI, which in 2016 bought Duet Group, by far the dominant owner of the east coast’s critical gas pipeline system when energy has become a hot political issue given surging gas and power prices.

Yesterday, APA shares jumped $1.73, or 21 per cent, to a record $10, clearing a previous closing record of $9.83 set in June last year.

The regulatory concerns mean the price remains well short of the $11 offer price, which was pitched at a hefty 33 per cent premium to APA’s closing price on Tuesday.

If a binding deal can be reached, a takeover would be completed through a scheme of arrangement, requiring 75 per cent of shareholder votes, and the majority approval of CK Asset shareholders.

APA chief Mick McCormack stressed that at this stage all that was happening was that the books were being opened.

He said the companies engaged before the price was reached.

“There’s been some discussions over a short period of time around price and where we got to was that,” Mr McCormack told The Australian yesterday.

“The board considered it and $11 was sufficient to grant CKI and its friends due diligence. What that turns into, a binding bid, or no bid, or a transaction, that’s yet to be seen.”

Not all of APA’s larger shareholders are keen to engage.

APA’s bigger shareholders were generally supportive of the Michael Fraser-led board’s engagement with CKI, although excitement about the deal was not unanimous and the regulatory concerns shone through.

“It’s a pretty full price, it’s at a healthy premium, so it’s pretty attractive,” said Andy Forster, senior investment officer at Argo Investments, which holds about $100 million of APA stock.

“The market is somewhat sceptical as to whether it will get the necessary regulatory approval. With all the national security concerns around gas and domestic supply, these guys are going to end up owning a fair bit of Australia’s essential infrastructure.”

UniSuper, APA’s biggest shareholder with a 16 per cent stake, “fully supports” APA’s decision to allow CKI to conduct due diligence, chief investment officer John Pearce told Bloomberg.

CK (previously Cheung Kong) was run by Li Ka-shing until his retirement last month when he was succeeded by his son, Victor Li.

CKI bought Duet last year for $7bn but in 2016 a joint bid it made with China’s State Grid for Ausgrid was knocked back by the Foreign Investment Review Board.

The bidding group, which comprises CK Asset Holdings, CK Infrastructure Holdings and Power Asset Holdings, has made a number of overtures to regulators.

“The consortium has been engaged with federal regulatory agencies with regard to the proposal and supports increased regulatory oversight and transparency in the gas transmission sector,” CKI said.

APA said CKI had informed it that it had proposed a divestment package to the Australian Competition & Consumer Commission that included APA’s interests in West Australian assets including the Goldfields gas pipeline, Parmelia gas pipeline and Mondarra gas storage facility, with a separate management team.

As well as separating these assets from the broader CKI/APA group, it would create another player in the pipeline market.

Tom Millner, portfolio manager at top 20 APA shareholder BKI Investments, said he would prefer to see APA stay ASX-listed.

“These assets are really long-dated assets and we’re long-term shareholders, so we’d be happy to hold this company and continue to invest in it for many years,” Mr Millner said, noting APA’s distributions had been growing every year.

“It’s highlighted what they’re worth, but the disappointing thing for us is we have a really good Australian company here that may be taken off our exchange, so our investable universe gets smaller.”

Before the bid, brokers monitored by Bloomberg had target prices of $7.45-$10 on APA.

Credit Suisse, which was at $7.45, last night raised its target price to $11, based on expectations the bid would go ahead.

Its previous target had been based on a downbeat view of the effect of new pipeline arbitration rules on APA.

“While it is often said that some infrastructure owners take a longer-term view of value, we would argue that the new rules dramatically reduce the economic life of APA’s assets,” Credit Suisse analyst Peter Wilson said.

Mr Wilson said APA’s statements around divestments indicated ACCC concerns were “ironed out”. He said the establishment of the Turnbull government’s Critical Infrastructure Centre, set up last year to streamline approvals and provide early certainty, was a good sign.

“This, and CKI’s knowledge of FIRB, give us confidence that approval should be forthcoming,” Mr Wilson said.

Yesterday, the ACCC said it would soon start a 12-week public review of the proposal. “APA and the CKI consortium members both own a significant portfolio of gas pipeline and associated assets,” an ACCC spokeswoman said.

“We will investigate the impact the proposed acquisition will have on competition for gas transportation, and the impact on upstream and downstream gas markets. We will also be looking at the impact on competition for the construction of new pipelines in the future.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout