APA takeover: CK Infrastructure rejects claim it’s subject to Chinese influence

HK group rejects suggestions it’s under China’s influence as the FIRB reviews its $13bn bid for APA Group.

Hong Kong’s CK Infrastructure Holdings has strongly rejected suggestions it is under any influence from the Chinese government as the federal government reviews its $13 billion bid for pipeline company APA Group.

“I can emphatically rejected that suggestion,” CKI deputy managing director Andrew Hunter said in interview with Australian journalists this week. “The idea that we are in some way influenced by the Chinese government is fictitious, to say the least.”

“CKI is a publicly listed, global infrastructure company. We subject ourselves to the highest standards of corporate governance.

“We take direction from a board of directors and we are answerable to our shareholders, which are largely institutional investors from around the world.

“For anyone to suggest otherwise is sadly misinformed.”

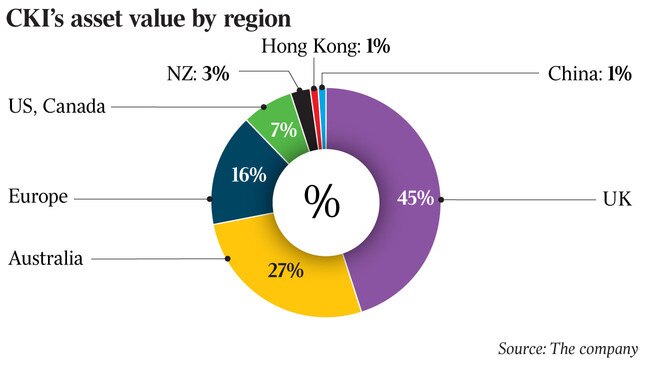

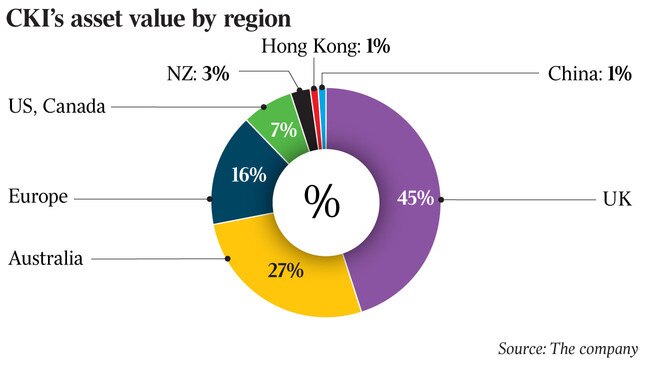

The company said it only had “very modest business assets” in China while it had 27 per cent of its assets in Australia and 45 per cent in Britain.

Mr Hunter said the listed company based in Hong Kong was “a very different thing” from a Chinese state-owned company or a Chinese private company like telco Huawei, which was recently blocked from participating in Australia’s 5G network on the grounds of potential influence from Beijing.

He said CKI had plans to invest another $1.5bn in expanding APA’s pipeline network in Australia and increasing its connectivity with the gas network, if the deal were approved.

The normally low-key company, which was founded by Hong Kong billionaire Li Ka-shing and is now run by his son Victor, has been operating in Australia for more than 20 years.

It decided to break its silence this week to explain its position as the Foreign Investment Review Board considers its application to buy APA in the wake of some speculation about its potential links with Beijing.

Mr Hunter said the company had decided to speak out this week as there had been “a lot of inaccuracies reported in the media”.

CKI was surprised when it was blocked from buying NSW electricity company Ausgrid in 2016 when the federal government decided at the last minute that the asset could not be bought by any foreign company because of an undisclosed security issue.

Mr Hunter said he had been closely involved in that bid. “It was disappointing,” he said. “I still have the scars to prove it.”

But he said CKI had had many more approvals in its bids for Australian companies which outweighed the one rejection, including its bid last year for pipeline company Duet.

“It was quite within the rights of the government and FIRB to decide what it decided (on Ausgrid), and we have moved on from that,” he said.

“But we don’t want to belabour the point because we have had far more clearances in Australia than we have had denial from regulators.”

Its bid for APA was approved by the Australian Competition & Consumer Commission and is now being reviewed by FIRB.

The company has been taken aback by the new atmosphere of anti-Chinese rhetoric and the potential for this to become an issue in its latest bid.

Speaking by phone from London, Mr Hunter rejected suggestions that Victor Li’s role as a member of the standing committee of the Chinese People’s Consultative Conference meant that CKI could be influenced by the Chinese government.

“I don’t think it is an issue at all,” he said.

He said it was “not unusual for business people to contribute their knowledge and experience in all sorts of matters in the countries in which they operate”.

“We have people in the UK and North America sitting on boards and making contributions to the community in which they operate.”

Mr Hunter said CKI had extensive interests in pipelines around the world and regarded its bid for APA as a “very important transaction”.

“We have spent a considerable amount of time and effort to get this transaction over the line. We are fully engaged and we hope to move it forward.”

Mr Hunter said CKI had not been in discussions with any federal politicians over its proposed bid but was handling it through FIRB processes.

He said he and CKI had had a “fair amount of dealing with FIRB over the years. It is a process we respect completely.”

He rejected suggestions that as a foreign company it could decide to “turn off the pipeline” at APA for some political reason as being “slighty naive”.

“Your government is more than well equipped to deal with the security of supply and have step-in rights as and when required.

“The idea that a corporate can just switch off the gas is really not well informed.”

Mr Hunter said CKI was hoping to complete the APA transaction by the end of the year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout