Mercer allegedly misrepresents sustainable credentials in greenwashing case: ASIC

The corporate regulator’s war continues, with Mercer Superannuation facing allegations its ‘sustainable’ fund held investments in polluting companies.

The corporate regulator has signalled more legal action to come after filing court claims against retirement giant Mercer, claiming it breached greenwashing rules after spruiking the “sustainable” credentials of its superannuation investment options.

In Federal Court filings lodged on Tuesday, the Australian Securities & Investments Commission took aim at Mercer, claiming it misrepresented the nature and characteristics of some of its superannuation investment options and may have misled consumers into thinking it was more green than it was.

Greenwashing is the portrayal of a product’s environmental or social credentials, which creates a false impression to investors.

ASIC claims Mercer told 3,300 fund members its seven Sustainable Plus investment options excluded investments in companies involved in extraction or sale of fossil fuels, production of alcohol and gambling.

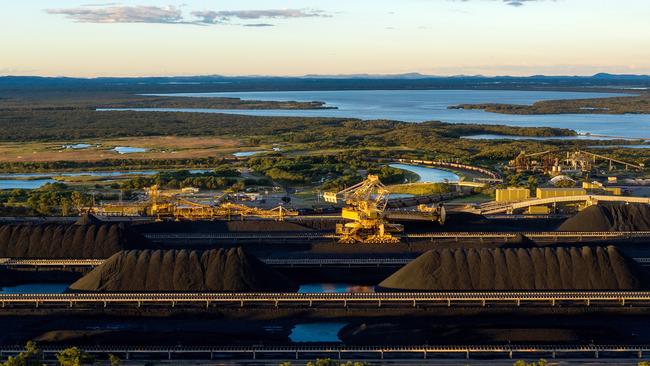

This included allegedly barring investments in AGL Energy, BHP, Glencore, Whitehaven as well as Budweiser Brewing Company, Heineken Holding, Treasury Wine Estates, Aristocrat Leisure, Caesar’s Entertainment, Crown Resorts and Tabcorp Holdings.

However, ASIC claims Mercer’s sustainable funds actually held some of their $170m in assets in some of these companies.

“These statements marketed the Sustainable Plus options as suitable for members who ‘are deeply committed to sustainability’,” ASIC alleges.

The filing comes as the first time ASIC has taken court action in relation to alleged greenwashing, and comes months after the regulator first put the sector on notice.

ASIC has hit several funds and investment managers with penalties over alleged greenwashing in recent months, including pinging Cruelty Free Super’s trustee Diversa and Vanguard Super.

ASIC deputy chair Sarah Court said there was “no end” to allege greenwashing cases referred to the regulator.

“We have other matters we are actively considering, there may well be further enforcement attention in the greenwashing area,” she said.

Ms Court said the case showed the regulator’s commitment to taking on “sustainability-related claims made by financial institutions”.

‘There is increased demand for sustainability-related financial products, and with that comes the growing risk of misleading marketing and greenwashing,” she said.

“If financial products make sustainable investment claims to investors and potential investors, they need to reflect the true position.”

ASIC is calling on the court to make declarations and issue penalty orders against Mercer, as well as barring the firm from making any future alleged misleading statements on its website and inform members of the contraventions found by the court.

“One of the statements we are making allegations in relation to remains on the website in substantially the same form we are concerned about,” Ms Court said.

Mercer’s Sustainable Plus superannuation scheme was available to members as part of a “select-your-own” model.

“If investments in certain industries like fossil fuels are said to be excluded, this promise must be upheld,” Ms Court said.

Mercer Super is part of the Marsh McLennan finance empire, a sprawling US-listed financial and professional services giant.

A Mercer spokeswoman said the firm had co-operated with ASIC “throughout its investigation” and would “carefully consider ASIC’s concerns with respect to this matter”.

BT Super announced it would merge with Mercer Super in early 2022, with the transfer expected to complete by April in a move which would create an 850,000 member scheme.

Mercer Super was identified in a Market Forces’ analysis in mid-2022 as one of eight sustainable superannuation options holding investments in fossil fuel exposures.

Market Forces superannuation funds campaigner Brett Morgan said ASIC’s filing would “send shockwaves through the superannuation industry and corporate Australia”.

“Greenwashing needs to be stamped out because it’s undermining real climate action and potentially misleading millions of super fund members,” he said.

“It’s tantamount to greenwashing that super funds with net-zero commitments are investing members’ retirement savings in companies with massive fossil fuel expansion plans like Santos and Woodside.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout