Members warned on early access to Qantas Super

Qantas Super has urged members drawing down their retirement savings early to top up their accounts once they’re back at work.

Qantas Super, a $8.5bn fund solely for employees of the under-pressure airline, has urged any of its members rushing to draw down their retirement savings under new early access rules to “top up” their savings once they’re back at work.

Qantas Super, which manages the retirement savings of 32,000 airline workers, is particularly vulnerable to financial stresses introduced by the government’s plan to allow laid off workers to access up to $10,000 of their savings before July, and a further $10,000 between July and late September.

The airline has stood down 20,000 workers during the coronavirus pandemic after interstate and international travel was several curtailed by attempts to limit the spread of COVID-19 — meaning almost two-thirds of Qantas Super’s members could be eligible to take up to $400m in total out of their accounts.

The move comes as the $224bn industry super funds are about to launch an advertising blitz, arguing that fund members risk crystallising losses through accessing their super accounts early while global markets have been sold off in recent weeks.

The Industry Super Australia campaign also argues industry super funds remain critical to provide investments in businesses and local infrastructure to help drive the economic recovery.

“It’s important for members to know that they’ll also be helping the economy bounce back, just like they did with the GFC, by investing in infrastructure and other things that create jobs and keep business strong,” said Bernie Dean, the chief executive of Industry Super Australia, the umbrella group that represents 15 industry super funds.

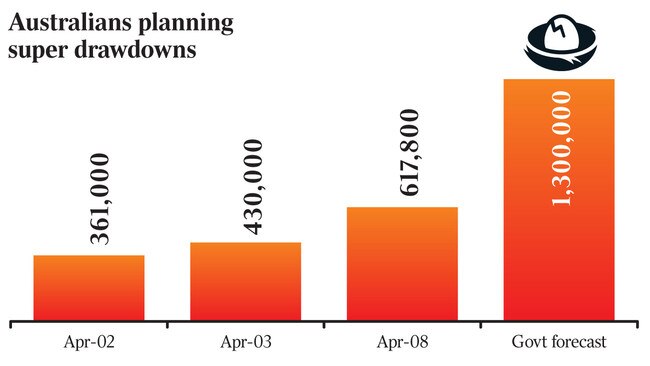

According to an industry memo circulated by the Australian Taxation Office on Thursday evening, 617,800 workers have put their names down to access their savings in the scheme, which starts later this month.

That figure, which was current to the end of Wednesday, is almost double the 361,000 registered super members that the ATO logged over the three days from Tuesday to Thursday last week, as revealed by The Australian on Monday.

The government is expecting about 1.3 million savers to ask for early access to their nest eggs, but this estimate could soon be eclipsed as the scheme has already been inundated with almost 50 per cent of its forecast applications. While the government reckons about $27bn will be drawn down under the scheme, the $3 trillion superannuation sector fears the total could be above $50bn, which would pressure some smaller, cash-starved funds to hold a fire sale of assets — further lowering the value of already depressed asset values — or liquidate out of long-term positions in infrastructure or property holdings.

Some smaller union-and-employer-backed industry funds, which cater specifically to members in the shuttered retail, hospitality, tourism and entertainment sectors, are facing a three-pronged cash flow strain as asset values tank, contributions stall as workers are laid off, and they face a flood of hardship withdrawals.

However, a number of smaller corporate funds also face a heavy load, with many retaining a membership from just a single organisation.

In its Financial Stability Review on Thursday, the Reserve Bank said that for some funds, “in particular those with many young members working in industries heavily affected by the pandemic, this will represent a relatively large share of funds under management and therefore a large liquidity drain”. “Superannuation funds have similarly required additional liquidity to cover higher member requests to switch from high- to low-risk investment options, in addition to needing to pay variation margin on the derivatives they use to hedge foreign currency assets,” the RBA said.

“Superannuation funds hold liquidity buffers that have enabled them to manage these liquidity demands and have been redeeming term deposits to increase their liquidity. Some trustees have also lowered the value of their unlisted assets to ensure that investors reducing their exposures now are not overcompensated at the expense of remaining members.”

Qantas Super, which also carries about $500m in liabilities for generous defined benefit schemes, has about $850m in cash on its books, according to its latest financial reports lodged with the Australian Securities & Investments Commission.

According to the Australian Prudential Regulation Authority’s superannuation “heatmap” which ranks funds performance according to a number of criteria, Qantas Super was, before the coronavirus crisis, already suffering a negative 1.3 per cent cash flow each year over the last three years, while it was losing 0.5 per cent of its members annually over the same period. The fees charged by the fund were also among the worst in the industry, according to APRA.

Qantas Super declined, despite several requests, to respond to a number of questions from The Weekend Australian which related to the $8.5bn fund’s preparedness for drawdowns, how many members it expected to access savings, and whether it had been having any discussions with the prudential regulator — which is discussing liquidity concerns with a number of trustees in the $3 trillion sector.

“While superannuation’s primary purpose is to help save for retirement, the federal government has recognised that for those who are significantly financially affected by the coronavirus crisis, accessing some of their superannuation today may outweigh the benefits of maintaining those savings until retirement,” a Qantas spokesman said.

“We would encourage those who access their superannuation early to consider topping up their account once they’re back at work. Even replacing a modest sum can have a big impact on a member’s final superannuation balance over time.”

According to Qantas Super disclosure statements, the trustee retains the right to “suspend” applications from members who wish to switch savings into safer options, such as cash, during “times of investment market volatility or illiquidity, such as a major market event (eg a significant banking failure or an economic depression)”.

Michael Clancy, the chief executive of Qantas Super, recently shared on his LinkedIn profile an article arguing that the Reserve Bank should provide extra liquidity to super funds to lessen the impact a large number of early access applications would have on the fund.

Some parts of the funds management sector have lobbied the government to allow the Reserve Bank to supply extra liquidity to the sector as super funds strain under the pressure of investment markets crumbling, their cohorts switching out of diversified investment strategies and into safer cash investments, and longer-term investments in unlisted assets such as infrastructure returning less.

Australian Institution of Superannuation Trustees head of advocacy Melissa Birks said the ATO application figures were “in line with industry expectations” of a total drawdown that would double the government’s expectation.

“We hope that as the JobKeeper Payments kick in, that these early release measures are increasingly viewed in the context of them being a last resort measure,” Ms Birks told The Weekend Australian.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout