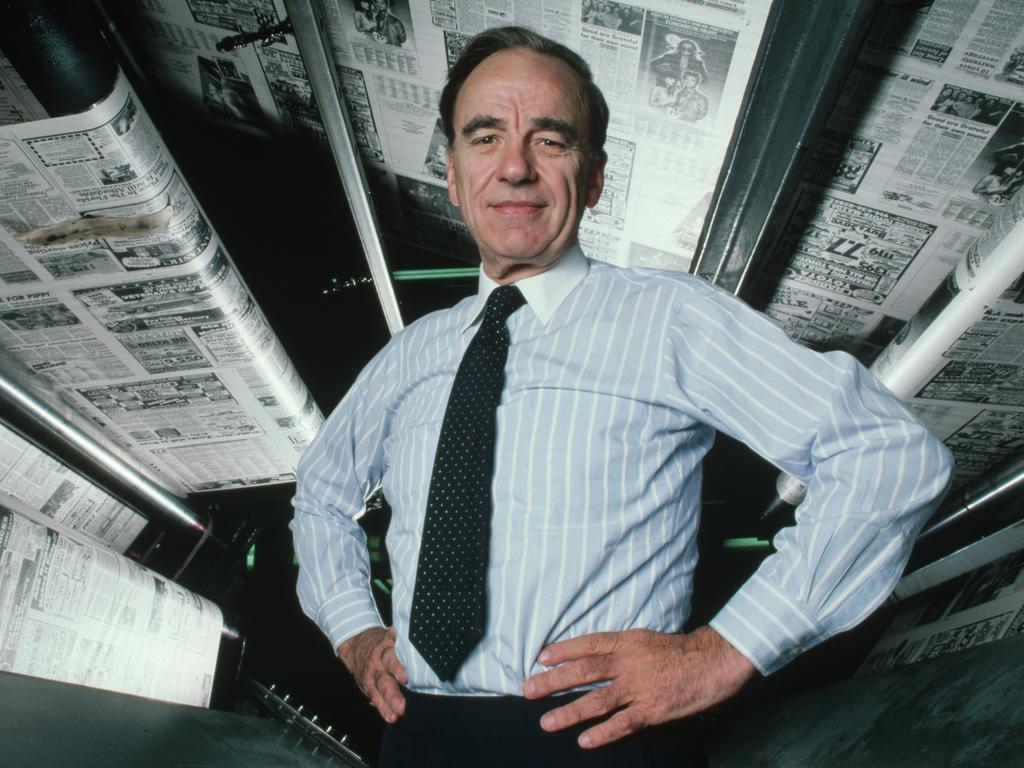

Rupert Murdoch: Three ingredients to success in 70 years of audacious deals

Rupert Murdoch’s billionaire peers discuss his biggest triumphs and share what they think make him ‘Australia’s greatest businessman’.

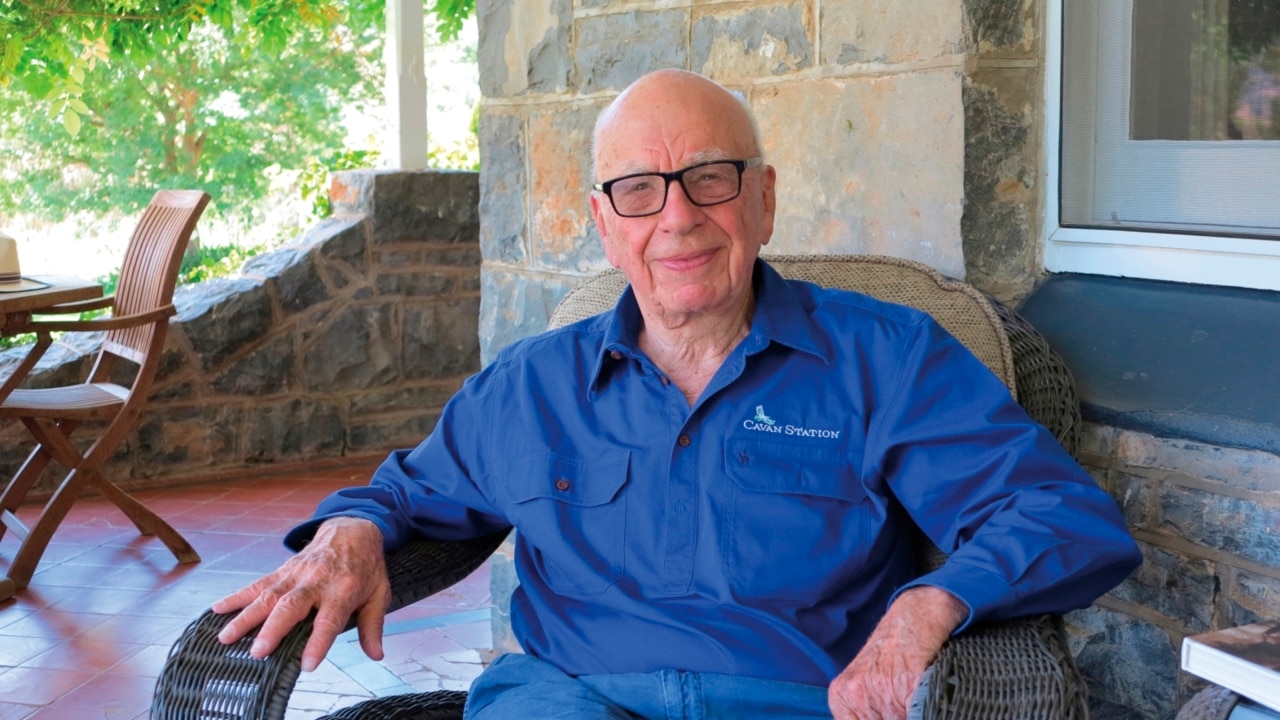

Rupert Murdoch has been hailed as “Australia’s greatest businessman” by his billionaire peers, following the announcement that the 92-year-old will step down as chairman of News Corp and Fox Corporation after building a $US25bn ($39bn) global empire over seven decades.

Some of the country’s most successful business identities cited Mr Murdoch’s entrepreneurial acumen, good business judgment and a deep understanding of the global media sector as traits that have driven his commercial success.

They also said he had shown an excellent ability to break into new markets and build assets from the ground up, such as the establishment of Fox as the US’s fourth television network and the later launching of Fox News, buying undervalued assets such as The Sun newspaper in the UK and turning it into the nation’s most popular tabloid, and undertaking transformative deals such as the $US5bn ($7.8bn) acquisition of Wall Street Journal parent Dow Jones in 2007 that now underpins the growth of News Corp.

Mr Murdoch also led the television sport revolution, with landmark deals such as Fox gaining NFL rights in the US for the first time in 1993, and soccer’s English Premier League moving to BSkyB (later Sky) and turbocharging its growth from 1992, as well as Foxtel and Fox Sports later gaining rights to all AFL and NRL matches in Australia, spearheading huge growth in the popularity of the competitions domestically and internationally.

More recently, there was the $US71bn ($110bn) sale of all the entertainment assets within Fox, including 21st Century Fox, to Disney in 2019, which crystallised the biggest amount of wealth in the Murdoch family at a time when Mr Murdoch was 88.

Mr Murdoch will become chairman emeritus of News Corp and his eldest son, 52-year-old Lachlan, will take over as sole chair of News Corp and continue as executive chairman and chief executive of Fox.

The move comes 71 years after Sir Keith Murdoch died and passed control of his Adelaide newspaper to his son Rupert.

Starting with that Adelaide paper, The News, Mr Murdoch has gone on to build a conglomerate spanning publishing across Australia, Asia, the UK and the US, where his companies have also had significant network and cable television, film, book and other media holdings.

Anthony Pratt, the billionaire executive chairman of cardboard box manufacturing and recycling giants Visy and Pratt Industries said of Mr Murdoch: “He’s the greatest Australian businessman in the world. He’s also a great family man and he has a great enthusiasm for life.”

Billionaire Hungry Jack’s founder Jack Cowin, who moved from Canada to Australia five decades ago to build his fast-food empire, said Mr Murdoch was “head and shoulders above anyone else as the No.1 professional and entrepreneurial manager in Australian business history. “Adelaide to the world is a great story.”

Media mogul Kerry Stokes, the executive chairman of Seven West Media and a long-time owner of newspapers and televisions stations, said Mr Murdoch “is one of Australia’s great business success stories, having built up News Corporation and Fox Corporation over the last seven decades both in Australia and overseas”.

“In his new role as chairman emeritus, I expect Rupert will continue to play an important role in both groups,” he said. “Lachlan Murdoch will handle the position of chairman with aplomb and I wish them both every success in the future.”

Billionaire mining magnate Gina Rinehart, Australia’s wealthiest person, said: “Rupert has long been a supporter of our free market system without which we would not have our current high and improving standards of living.

“I remember well an important speech he gave 10 years ago when he reminded us of the too-often-forgotten point that free markets are not only economically superior, but also morally superior.”

Sir Rod Eddington, who has spent 23 years on boards including News Corp observing Mr Murdoch, said the media titan’s entrepreneurial skills, sound business judgment and media industry knowledge stood him in good stead when “he took decisions that others thought risky, he was able to bring those three things to the decision-making process and that combination made him successful over a long period of time. It didn’t mean every decision paid off but those attributes more often than not delivered strong outcomes.”

REA chairman Hamish McLennan, a former vice-president in Mr Murdoch’s New York office, said his former boss was “a visionary … always helping, thinking about the future and offering his views. He’s easily our most successful businessman ever.”

Despite his successes, Mr Murdoch has had to navigate plenty of controversies and setbacks during his seven-decade career.

There was a debt crisis in 1990 when a refinancing of $US7.6bn ($11.8bn) in debt rescued News Corp from the financial brink, the News of the World phone hacking scandal in the UK that saw the newspaper shut down and a $US787.5m ($1.22bn) settlement this year over a lawsuit that alleged Fox News defamed a voting machine company in its coverage of the 2020 US election.

There was also the ill-fated acquisition of social media network MySpace and the costly Super League war that split rugby league in Australia.

Sports broadcast rights expert Colin Smith said Mr Murdoch’s transformation of sports across three continents from big rights deals changed the very nature of the competitions.

“He saw that the consumer would demand the ability to see all the matches in a competition, not just a handful that used to be telecast. In a way, that was brilliant as he was ahead of others. And the players have been big beneficiaries as well, in terms of salaries, given 65-75 per cent of sports revenue is now from broadcasting rights.”

Mr Eddington said Mr Murdoch, while he “had ink in his veins”, was able to navigate the digital transformation of the media assets as content went online and with it the necessity for paywalls that would ensure customers paid for quality content rather than have it given away for free online.

“Rupert has never stood still. He is always looking forward. I can remember seeing the iPad for the first time with him and some thinking it would kill newspapers.

“Instead, he said ‘this was a great way to get great content to my customers’.

“His absolute passion for the industry he is in, that is a hallmark of the great business leaders. You think of Warren Buffett as an investor, Jamie Dimon in banking, Bill Gates at Microsoft and Steve Jobs at Apple.

“These are individuals who are different personalities but have one thing in common: an absolute passion for their industry.”