Withdrawal of stimulus ‘a headwind for global growth’, says Randal Jenneke of T. Rowe Price

After a great year for shares, the head of Australian equities at US investment giant T. Rowe Price says we are entering a new phase of the market cycle.

Randal Jenneke is less keen on cyclical stocks that outperformed in 2021.

Overall, he sees the market environment in 2022 as being suited to quality defensive companies.

The head of Australian equities at US investment giant T. Rowe Price says the withdrawal by governments and central banks of their huge post-pandemic stimulus will be a headwind next year.

It has been a great year for shares as the unprecedented policy stimulus at the start of the Covid-19 pandemic was mostly sustained. The market surged despite a slump in iron ore prices from record highs on China’s curbs on steel production and property developer woes, coronavirus restrictions hitting economic growth in the second half, and the dialling back of fiscal and monetary stimulus.

The S&P/ASX 200 index had been up 12 per cent for the year to date, or 16 per cent in total return terms, not far off a record 23.4 per cent jump achieved in 2019.

But after a record high of 7632.8 points in August, the market stalled. The S&P/ASX 200 fell 6 per cent from the high, failing to keep up with the tech-heavy US market despite a huge amount of dividend payments, share buybacks and takeover activity.

“We believe we are entering a new phase of the market cycle – the ‘deceleration phase’ characterised by slowing economic and earnings growth,” Mr Jenneke said.

T. Rowe Price is one of the world’s biggest managers of actively managed assets.

It had $US1.63 trillion ($2.3 trillion) of assets under management globally as of November 30.

The T. Rowe Price Australian Equity fund made 17.6 per cent net of fees for the year to November 30, almost 3 per cent above its benchmark S&P/ASX 200 total return index.

“Inevitably, the withdrawal by governments and central banks of massive post-pandemic stimulus is set to become a significant headwind for global growth in 2022,” Mr Jenneke said.

“This clearly matters a lot for a trade-dependent, open economy like Australia.”

His fund is underweight the big banks and iron ore miners, while being overweight some of the big healthcare and consumer staples companies such as CSL and Coles for their quality and defensive characteristics, as well as some consumer discretionary stocks like Domino’s Pizza.

He says the enormous fiscal injection since 2020 – proxied by the change in the cyclically adjusted primary fiscal balance as a percentage of global GDP – is fast fading and may already be negative.

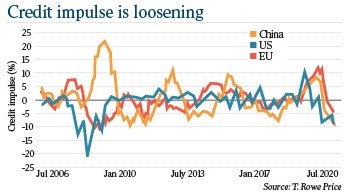

The same is true for global monetary policy stimulus – proxied by the credit impulse for the major economies, which has turned negative for the US, Europe and China. “Inevitably, the flip side of massive fiscal stimulus in 2020 and 2021 is fiscal drag in 2022, a headwind for company earnings as well as for economic growth,” Mr Jenneke said.

He now sees a “major inflection point” with monetary policy normalisation already under way.

Quantitative easing is rapidly ending and a growing number of central banks are raising interest rates.

That could spell a rise in volatility for financial markets.

“An earlier tightening of liquidity conditions by central banks in 2022 is important for equity investors, as low global interest rates resulting from unprecedented quantitative easing provided major support for equities since the pandemic,” Mr Jenneke said.

He therefore sees a potentially very different environment for markets in which volatility is no longer held back by global QE and uncertainty over corporate earnings forecasts continues to grow.

“We believe the global economy no longer needs exceptional policy support, since it is back on a firm growth trend,” he said. “However, markets may still protest loudly when support is withdrawn next year. Equally, there are many who believe that some governments, notably the US, have overstimulated their economies in response to the pandemic, resulting in rising inflation pressures.”

Somewhat contradictory fears of policy withdrawal and higher inflation suggests a difficult first half. Increased uncertainty and volatility should favour active fund managers, according to Mr Jenneke.

China remains of great importance and, while the Australian market got through 2021 unscathed, investors underestimated the amount of pain Beijing is willing to incur in order to tackle some of its structural problems, including its overreliance on residential property investment.

“Property has been the biggest single driver of China’s economic growth over the past two decades. This contributed to some undesirable side effects such as a widening wealth gap, a rising cost of living, and the rapid growth in financial leverage,” Mr Jenneke said.

“We believe the government of President Xi Jinping is determined to address these structural issues and the round of financial deleveraging that started five to six years ago still continues today.”

With China’s property and related sectors accounting for almost one third of its GDP, a slowdown in the overall economy looks inevitable, and China has probably passed a peak in residential property investment, which will crimp demand for iron ore and other commodities.

Domestic economic trends are broadly favourable, with a moderate recovery in growth expected, with significantly less inflation pressure than in other developed markets economies.

Most parts of the domestic economy are expected to do well as the economy reopens, provided there are no major setbacks caused by the new Omicron strain of the coronavirus.

A high household savings rate gives potential for a rebound in consumer demand.

New home loans may have peaked and APRA has started macroprudential controls, but Mr Jenneke sees the housing market staying strong for at least two quarters, barring sharp rate rises.

Overall the big challenge for markets in 2022 will be slowing, albeit still reasonable growth, and inflation remaining higher for longer at a time when liquidity is being withdrawn by central banks as market valuations appear uncomfortably high.

“Total market returns can be expected to be lower than in the recent past and with uncertainty likely to remain high, a highly selective approach favouring quality companies is prudent in our view,” Mr Jenneke said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout