What US outcome could be the best for asset prices?

Could a Biden White House and gridlocked Congress be the best of both worlds for asset prices?

Global sharemarkets rose and volatility eased as investors embraced the prospect of a Biden White House and gridlocked Congress as the best of both worlds for asset prices.

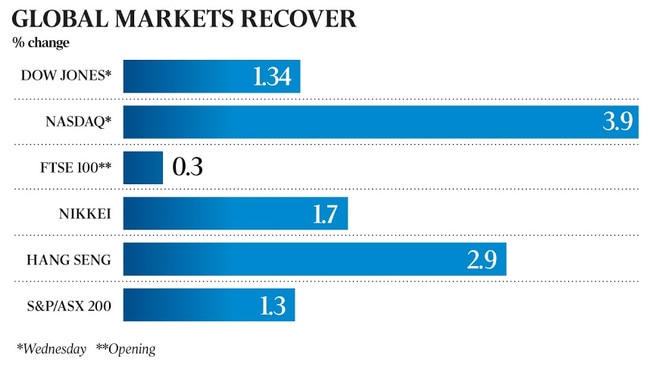

Australia’s S&P/ASX 200 share index rose 1.3 per cent to an eight-day high of 6139.6 points as futures pointed to another strong night on Wall Street, after betting odds swung sharply in favour of Joe Biden and SportsBet decided to pay out early to punters who backed the Democratic candidate. Yet a clean sweep of Congress that was widely predicted by opinion polls remained well out of reach.

“The US election outcome might be uncertain but investors already know what matters,” Credit Suisse Australia macro strategist Damien Boey said.

“Although we still do not know who has won the presidential vote, we do already know that the Democrats have control of the House, albeit with a slimmer majority than they had previously.

“Also, the Senate race, while tight, appears to be going in favour of the Republicans.

Therefore, the likelihood is that we will see a gridlocked government, between House and Senate.”

The US 10-year bond yield dropped by a massive 14 basis points yields – improving sharemarket valuations for growth stocks in particular — as it became clear that Democrats will lack the numbers in Congress to allow rampant public spending, and that the tax hikes and greater regulation of tech giants that was feared in a “blue wave” scenario won’t happen either. That triggered a surge in the Nasdaq 100 index of 3.9 per cent on Wednesday, while the S&P 500 index rose 2.2 per cent and the VIX index of volatility on S&P 500 futures plunged to a two-week low of 28 per cent from 41 per cent a week ago.

High-flying mega-cap growth stocks were set to underpin Wall Street again on Friday night, with Nasdaq futures up 2.1 per cent, but value stocks — dominated by the financial, materials and energy sectors — were set to lag, with Dow Jones index futures up 0.9 per cent.

The global shift back to the growth stocks – mostly “COVID-19 winners” in the Nasdaq index, which fell 5.2 per cent in September and 2.3 per cent in October — was also encouraged by news of a record 104,000 new cases of COVID-19 in the preceding 24 hours.

That hit crude oil prices, with WTI crude futures falling as much as 2 per cent in Asia Pacific trading.

Growth stocks also dominated in the Australian market on Thursday.

CSL rose 3.5 per cent, ResMed rose 3.6 per cent and Afterpay gained 2.5 per cent, but BHP slipped 0.1 per cent, Rio Tinto fell 0.8 per cent and Woodside Petroleum fell 0.7 per cent.

Elsewhere in the region, Japan’s Nikkei 225 index rose 1.7 per cent, China’s Shanghai Composite gained 1.3 per cent, South Korea’s KOSPI jumped 2.4 per cent and Taiwan’s TAIEX rose 0.4 per cent.

However in Australia there was an overlay of positivity about domestically-focused value stocks that will benefit from economic reopening.

That followed news that the NSW-Victoria border will reopen later this month, and the nation again recorded zero new locally-acquired COVID-19 cases in the past 24 hours.

The federal government also secured two more coronavirus vaccine supply deals for Australia.

Flight Centre surged 6.9 per cent, SkyCity Entertainment rose 3.4 per cent, Stockland gained 3.3 per cent and NAB jumped 3.3 per cent, helped by improving revenue trends in its full-year results.

Surprisingly, confirmation in China’s state media that the nation will apply a sweeping halt on exports from Australia worth more than $6bn a year, from Friday, had negligible impact on either the sharemarket or the Australian dollar. The exchange rate was steady around US71.80c.

Credit Suisse’s Mr Boey noted that many analysts had thought a gridlocked US Congress would be bad for shares since it would make the passage of legislation – including fiscal stimulus – much more difficult, and that conversely, a Democrat sweep would be very supportive of larger fiscal deficit spending, higher bond yields and curve steepening and a move back to value stocks.

But others had feared corporate tax hikes, financial re-regulation and more frequent and widespread rounds of coronavirus lockdowns from a Democrat clean sweep.

“On the flip side, while bears believe that a contested or gridlocked election outcome will make it harder for large-scale fiscal stimulus to be passed, there are those who think that it could be the best possible compromise,” Mr Boey said.

“After all, under a Biden government with Republican Senate, we are likely to see some fiscal stimulus at some point, but with strings attached.”

In his view, Republican lawmakers might agree to a spending package of up to $US2 trillion ($2.8 trillion) on the proviso that corporate tax hikes and financial re-regulation don’t happen.

But in the event that large-scale fiscal stimulus doesn’t occur, the Fed might increase the pace of its asset purchases, supporting lower-for-longer rates, lower-for-longer volatility, and expanded equity valuation multiples. The Fed was due to meet overnight, with a statement due at 6.00am AEDT.

“Less stimulus, with more strings attached, and a potentially more active Fed means that bonds should be well supported, and that the yield curve should flatten,” Mr Boey said.

“This takes the wind out of the sails of the value, reflation trade.

“On the flip side, lower bond yields support longer-duration growth and quality exposures.”

But he cautioned that the VIX volatility index was below his fair value estimate of 35 per cent.

“At some point, when post-election euphoria fades, we could well return to a regime where investors worry about the cyclical state of economic growth, COVID-19, fiscal uncertainties, and the diminishing returns from monetary stimulus, causing the market narrative to change again,” he said.

“In this environment, it is certainly not smooth sailing for equities as an asset class.”

Citi’s chief US equity strategist, Tobias Levkovich, agreed that the Senate count indicated US corporate taxes hikes were now unlikely, giving more conviction in 2021 earnings estimates for companies with US operations.

The risk to as much as 5-5.3 per cent of Citi’s S&P500 earnings forecast for next year from a corporate tax hike has “dissipated”, while fear of more severe treatment on capital gains was another hurdle that “looks to have faded as a result, giving investors some positive feelings”, he said.

If Joe Biden ends up winning, some other areas of concern for market participants are no longer as worrisome as they had been before the election, given the probable Senate composition.

While the healthcare sector is less threatened by major changes to its current structure, Citi’s Mr Levkovich saw continued populist pressures around drug prices.

“While pharmaceuticals represent only 10 per cent of US medical costs, there is significant political capital to be won by beating up on the industry,” he noted.

“Nevertheless, the lower possibility of rising regulatory zeal and unwelcome legislation, plus pre-election positioning, leaves managed care and hospital stocks in better shape.”

And while the electoral outcome may result in less fiscal stimulus than might have been the case, a number of areas, like airlines, will still need help. Mr Levkovich expects financial support for those still suffering from the consequences of COVID-19.

But he still favours the “value trade” in equities over growth stocks, with vaccine developments potentially coming soon, valuation differentials “intriguing” and financials, cyclicals and companies hurt by the virus over the past nine months facing easy comparisons by the end of the March quarter.

And Mr Levkovich suspects deficit financing could push up Treasury yields, especially if the US dollar weakens, with negative implications for the sustainability of super high valuations for growth stocks.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout