Valuations on a high as FY2020 results loom during coronavirus outbreak

Profit reporting season will get under way in the US and Australia amid elevated uncertainty.

Profit reporting season gets under way in the US and Australia this month amid elevated uncertainty, after the steepest economic downturn in decades and a second wave of coronavirus.

Despite a lack of clarity over earnings, dividends and the outlook for a wide range of companies, share valuations are unusually high as record-low interest rates and unprecedented asset buying by central banks has left investors with few alternatives, and large amounts of fiscal policy stimulus have temporarily propped up the short-term economic outlook.

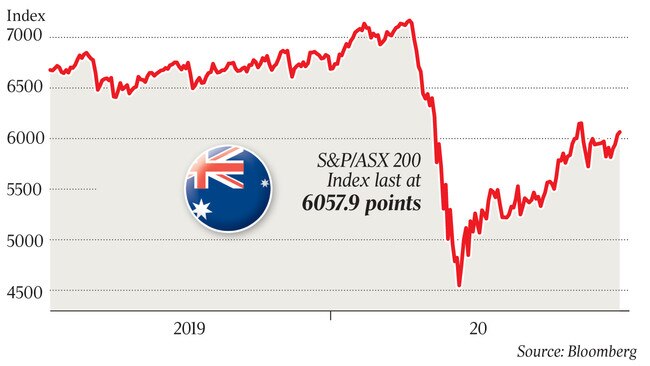

After hitting a three-week high of 6101.4 points on Friday, Australia’s S&P/ASX 200 share index was trading on a 12-month forward price-to-earnings ratio near 20 times — about 4 per cent above its pre-pandemic high — and only about 3 per cent off a record high near 20.7 times early this month.

The 12-month forward dividend yield of the S&P/ASX 200 hit a record low near 3 per cent.

“With bond yields low and central banks likely to keep them low, the TINA (there is no alternative) trade has returned with a vengeance in recent months,” said Macquarie Australian equity strategist Matthew Brooks. “This is reflected in high valuations.

“You could argue this is due to investors’ looking past the impact of COVID-19, but the second year price-to-earnings ratio is also close to pre-pandemic levels.”

While the S&P/ASX 200 fell 10.9 per cent last financial year — the first fall since 2015-16 and biggest since 2011-12 as the pandemic and associated lockdowns hit economic growth, a 16.2 per cent rise last quarter was its best since 2009 thanks to faster-than-expected reopening of the economy.

“From their lows in April, many global and Australian economic data releases have seen a ‘deep-V’ rebound and this has helped support sharemarkets, including Australian shares,” AMP Capital chief economist and head of investment strategy Shane Oliver said.

“However, except in China, shares remain below their June highs and are still vulnerable to a further correction or consolidation, particularly if the renewed rise in coronavirus cases in the US and Australia leads to a renewed generalised lockdown and as the recovery in economic indicators falters or slows, which it may be starting to do.”

Dr Oliver cautioned that weekly economic activity trackers for the US and Australia — based on high-frequency data for things like restaurant bookings, confidence, retail foot traffic, box office takings, hotel bookings, credit card data, mobility indexes and jobs data — faltered over the last week as reopenings stalled and consumers worried anew about the outlook.

“Our Australian activity tracker fell over the last week in response to weaker readings for consumer confidence, hotel bookings and retail foot traffic and highlights the vulnerability of the economy to the latest rise in coronavirus cases,” he said.

It comes as Victoria reported 108 new cases of coronavirus cases on Saturday, the most since March.

Dr Oliver said the approaching US presidential election could add to volatility in shares, but support should ultimately come from record amounts of cash on the sidelines, cautious investor sentiment, further policy stimulus and ultra-easy monetary policy.

“So our base case remains that as long as a new generalised lockdown is avoided shares will remain in a correction for the next month or so before a resumption of the rising trend,” he added.

Macquarie’s Mr Brooks said the market’s risk appetite appeared to peak around June 10, but he viewed the subsequent pullback as a “correction” caused by the second wave of COVID-19 cases in the US and a shrinking of the US Federal Reserve’s balance sheet, albeit for technical reasons.

“We think market volatility reduces the likelihood of fiscal stimulus being withdrawn too quickly (but) in addition to this fiscal cliff, (the prospect of) Trump losing the US Election is the other key concern for investors in the second half of calendar 2020,” he said. “On the plus side, it looks like earnings per share expectations bottomed in early June.”

As the bulk of corporate Australia has ruled off its corporate accounts for a year that saw the steepest economic downturn in decades, many corporates are expected to re-base their investment plans for the new financial year.

Morgan Stanley Australia head of research Chris Nicol warned that COVID-19 impacts had created a “high degree of stale estimates” within consensus for corporate earnings.

“Post the onset of COVID-19, increased prevalence of companies withdrawing guidance, combined with continued volatility in trading conditions as reopening phases have waxed and waned with the virus evolution, have seen point estimates embedded within consensus averages continue to age and in many cases become outright stale,” he said.

Traditional valuation techniques using near-term earnings have therefore been “compromised” and snapshot trading updates have taken over from more traditional guidance communication.

“This window of accepted compromise is closing now that June 30 preliminary results are in the bag,” he said. “Companies currently have a degree in forbearance relating to continuous disclosure requirements relating to their results but while forbearance from litigation risks has been provided we do not expect this to significantly reduce market updates. So, while companies have less risk of being sued thanks to disclosure forbearance, this does not reduce the requirement to update the market in the spirit of broader disclosure principles.”

Top 200 stocks where estimates are quite stale included Treasury Wine Estates, A2 Milk, Dexus, TPG Telecom, WiseTech Global and Newell Brands.

“The focus of this screening is not to imply positive or negative bias but rather help identify potential candidates for early disclosure of fiscal 2020 results,” Mr Nicol said.

“A higher mix of stale estimates could also lead to higher volatility as refreshed bottom-up earnings and opinion signals are digested, while consensus earnings dispersion remains elevated.

Also companies when updating, versus a consensus lens, will need to consider what estimates should be considered live, how broker data lags are impacting averages and the level of detail regarding outlook to address out year forecasts.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout