US-China trade war: Beijing looks to Australia for LNG sales

China is prepared to open up more markets for Australian LNG sales as a result of its trade war with the US.

China is prepared to open up more markets for Australian LNG sales as a result of its trade war with the US, a senior trade official in Beijing said yesterday.

“The US is a major supplier of LNG to China, but because of its trade restriction measures, China is compelled to adopt counter-measures,” China’s vice-minister of commerce and deputy international trade representative, Wang Shouwen, said at a briefing on Beijing’s latest position paper on its trade war with the US.

“Australia is an important source of China’s LNG. The trading between China and Australia in LNG is pretty sizeable and there is huge potential.

“China is a huge market. It is ready to expand the market.”

Mr Wang said there would be “even more opportunities” for LNG producers from countries that were not involved in the trade war with China.

He also indicated that agricultural exporters such as Australia and Brazil could expect to see more demand from China as the trade war with the US bites.

China has imposed tariffs of 10 per cent on US LNG in response to President Trump’s escalating trade war against China, but this could increase to 25 per cent if Washington steps up tariffs on Chinese goods being imported into the US.

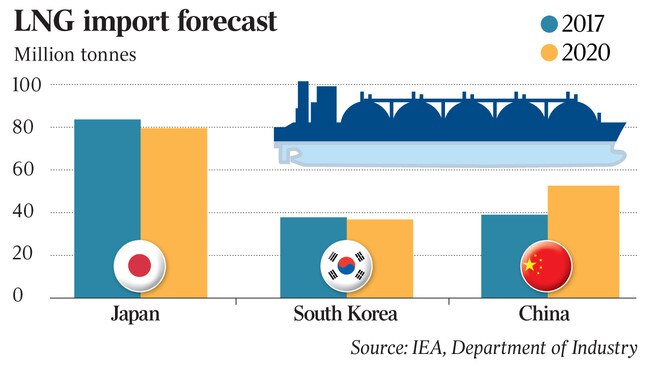

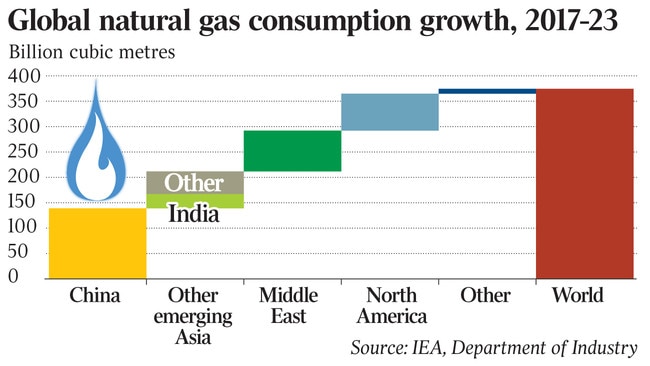

Australia has become a major exporter of LNG to China, which is pushing to expand its use of gas as a way of cutting pollution.

China has long-term contracts to buy LNG from Woodside’s North West Shelf project, Chevron’s Gorgon project and export terminals at Gladstone in Queensland.

Increased demand from China could strengthen the case for more local LNG projects, such as Woodside’s $US26bn plans to develop the Scarborough and Browse projects in Western Australia and $US13bn in planned projects in Papua New Guinea which involve investments by Santos and Oil Search.

The new mood in China will make life difficult for more than a dozen US companies that have been pushing to build new LNG export terminals with China being a primary market.

The higher tariffs on LNG from the US will give Australian suppliers a price edge in the world’s fastest growing market for LNG.

Mr Wang said the trade war with the US had already “damaged the global value chain”.

He said America’s trade war had not delivered any gains to the US and was allowing foreign suppliers to increase their sales to the Chinese market.

Mr Wang was one of a group of senior officials arguing China’s case in its increasingly bitter trade war with the US.

In a 90-minute presentation, they sought to argue China’s case that it had open markets and that both the US and China had benefited from their increasing trade ties.

In its white paper released on Monday, China accused President Trump of using “bullying” tactics on trade and warned that his actions in launching a trade war pose a “grave threat to the multilateral trading system”.

The paper was released as US tariffs of 10 per cent on another $US200bn of China’s exports went into place.

The paper attacked the Trump administration’s “America First” policy and its trade war tactics as using “extreme pressure” and “intimidation” by attempting impose its own interests on China.

The paper reflects the worsening ties between China and the US as President Trump has continued to escalate the trade war by imposing higher tariffs on a total of $US250bn of Chinese imports in the past few months.

President Trump has also threatened to impose tariffs on another $US267bn worth of Chinese exports to the US, covering the almost the entire span of Chinese exports.

While China has retaliated with higher tariffs against a total of $US110bn in US imports, its scope to hit back is limited as it only imports around $US130bn in goods from the US while the US imports more than $US500bn worth of goods from China.

It cancelled plans for a senior economic envoy, vice premier Liu He, to visit Washington this week for further talks to try to resolve the situation after Trump’s moves last week to escalate the situation.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout