US Senate vote lifts shares, bond yields, as stimulus spending looms

Investors snapped up resources and banks, adding $34bn of value to the Australian sharemarket on Thursday.

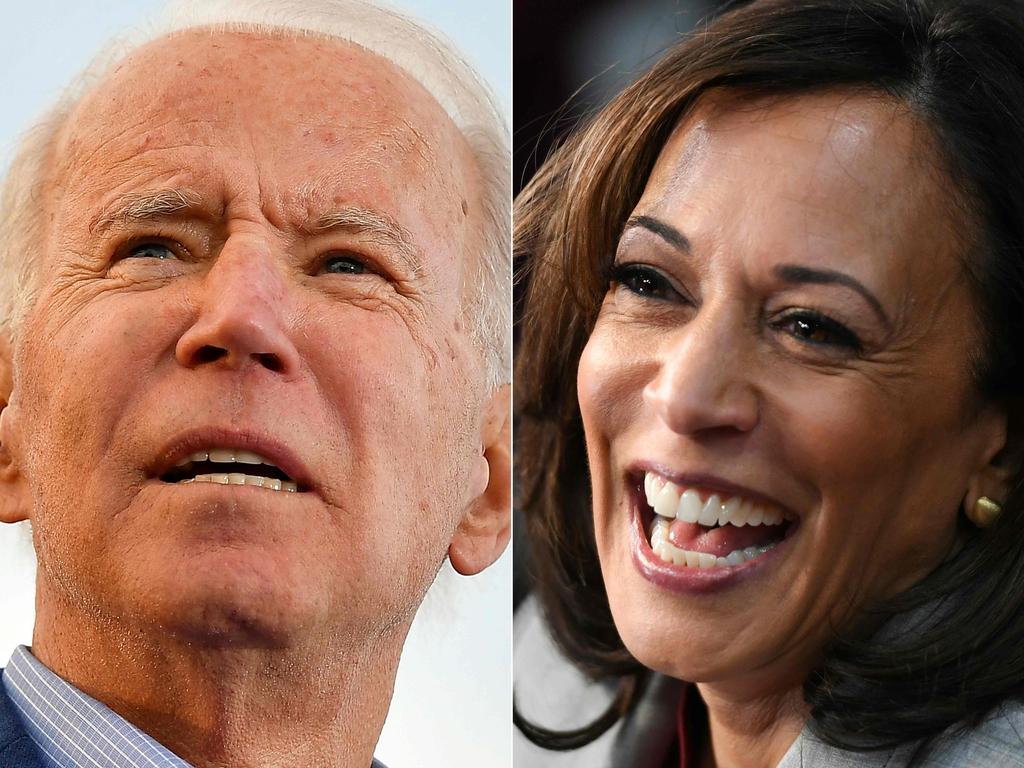

Investors snapped up resources and banks, adding $34bn of value to the Australian sharemarket on Thursday as the Democratic Party looked set to secure an effective majority in the US Senate, improving the chances of major fiscal stimulus under president-elect Joe Biden’s administration.

After a strong night on Wall Street, Australia’s benchmark S&P/ASX 200 share index rose as much as 1.9 per cent to a three-week high of 6733.4 points after two run-off elections for the US Senate were called for Democratic Party candidates and the US Capitol Building was secured after a brief siege by supporters of US President Trump.

The S&P/ASX 200 index ended up 105 points or 1.6 per cent at 6712, its best daily closing level in three weeks and its third-highest close in the past 11 months.

Rio Tinto was the strongest stock in the ASX200, surging 8.6 per cent to a record high close of $125.66, while BHP jumped 6.1 per cent and also set a record high of $46.90.

The outcome of Tuesday’s Georgia run-off elections for the US Senate looks set to increase the chance of major infrastructure spending in the US, and Citi raised its earnings forecasts for the resources sector on the basis of sustained strength in commodity prices.

“Today’s outcome from the Georgia Senate race means more fiscal stimulus to support households and infrastructure spending, while limiting the most progressive parts of president-elect Joe Biden’s policy platform,” JPMorgan Asset Management global market strategist Kerry Craig said.

“This is positive for the equity rotation and reflation for cyclical parts of the market, negative for government bonds as inflation and growth expectations lift yields, and should add to the depreciation in the US dollar.”

The financial sector was also particularly strong, with ANZ up 3.8 per cent and Challenger up 7.2 per cent as Australia’s 10-year bond yield hit a seven-month high of 1.1 per cent and equivalent US Treasury bonds hit 1 per cent for the first time since March 2020.

But there was a significant rotation out of defensive and growth stocks to fund the move into value plays in the materials, energy and financials sectors. Technology stocks fell the most, with Afterpay down 4.2 per cent and Xero down 5.1 per cent as the Nasdaq fell amid a sell-off in the “Fab Five” stocks (Apple, Facebook, Amazon, Microsoft and Google) on regulatory worries.

The outcome of the Georgia Senate race gave the Democrats a positive margin of one vote in the Senate, with vice president-elect Kamala Harris holding the casting vote.

“This means that markets will reprice for large stimulus measures under the new administration, which should favour cyclical sectors of the equity market and stoke growth and inflation expectations, leading to a rise in bond yields,” Mr Craig said.

“However, the narrow lead by the Democrats means that the most progressive parts of president-elect Biden’s policy platform are unlikely to come to fruition.

“Significant tax reform for companies or individuals are much more challenging to pass with such a narrow lead and the impact on corporate earnings may be less severe than feared.”

Still, it will take some time to assess the real chance of higher taxes and the impact on corporate America. Mr Craig noted that the budget reconciliation process could still allow some changes to taxes and spending if it doesn’t alter the projected deficit over the 10-year horizon, according to the Byrd Rule, and also meets certain other conditions.

The healthcare, real estate and communications sectors also lost ground, with CSL down 1.2 per cent, Goodman down 2.3 per cent and REA Group down 2.4 per cent.

Meanwhile, the Australian dollar dipped to US77.76c after hitting a 33-month high of US78.20c overnight. NAB head of FX strategy Ray Attrill said the key focus for global markets now was the extent to which the incoming Biden administration could enact its “Build Back Better” pre-election policy agenda and what this implied for economic growth, inflation and US interest rates, although the ability of the US to control the spread of COVID-19 via mass vaccinations would be a precondition for the domestic economy returning to some semblance of normality.

“Clearly, the strictures of the Byrd Rule would rule out passage of the Build Back Better agenda in its entirety, which envisages fiscal spending of up to $US5 trillion ($6.5 trillion) over 10 years with barely half of the total financed by tax increases,” Mr Attrill said.

“But proposals which increase spending, but which are fully financed by tax increases, could be approved by a simple majority, as could deficit-financed infrastructure spending which by its nature is non-recurring, so wouldn’t fall foul of the 10-year deficit rule.

“In any event, with an eye to 2022 re-election prospects, it is quite conceivable some Republican Senators will be supportive of new infrastructure spending.”

JPMorgan Asset Management’s Mr Craig cautioned that a larger fiscal stimulus package was more likely to be funded by increased borrowing and that would need to be soaked up by greater bond buying from the Federal Reserve if borrowing costs were to be kept in check.

“The flip-side is that more stimulus increases the probability of an earlier return to pre-COVID-19 levels of economic activity and lead to rising expectations that the Fed’s very accommodative policy stance will draw to a close sooner,” he warned. “The risk is that too much inflation is expected and yields move aggressively higher at a time when high valuations across bonds and equities have heightened market sensitivity,” Mr Craig said.

“The market outlook really relies on corporate activity and rising demand driving the earnings outlook and taking the economic reins from the Fed, something that is achievable given the improving economic outlook with a wider distribution of COVID-19 vaccines.”

For Asian markets, he said the continued decline in the US dollar should funnel funds into emerging market equities and debt, with the surge in COVID-19 cases in the US and Europe of late doing little to dent the manufacturing cycle, based on the recently released purchase managers’ indices for manufacturing, pointing to a continued lift in global trade to the benefit of many Asian markets.

Valuations challenge overall market returns, given the rerating that helped to drive equity returns in 2020, and the emphasis now is on identifying regions, sectors and companies that can survive the near-term weakness and seeking alternative forms of diversification beyond government bonds.

“Increasing equity and credit risk is appropriate at the beginning of a new cycle, but hedging the risks when valuations on safe havens are high is more difficult,” Mr Craig said.

Citi cut its recommended US sharemarket allocation to “neutral” on Wednesday, while upgrading emerging markets equities to “overweight” and remaining upbeat on the Australian sharemarket.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout