US presidential election could fuel more uncertainty and volatility

A delayed result brought on by postal voting is not the only way the US presidential election is threatening to crank up uncertainty and volatility.

A surge in postal voting in the US election could delay the result for weeks, triggering volatility in markets through to the end of the year and possibly beyond, according to the chief investment strategist of the $US1.1 trillion ($1.6 trillion) global asset manager Nuveen.

What’s more, a Joe Biden win could force a stalemate scenario and a period of “accidental austerity” unless the Democrats also take the Senate, Nuveen’s Brian Nick told The Australian in an exclusive interview.

Despite the risks ahead, he does not expect the market to retest its March lows any time soon and says investors should stay fully invested rather than retreat to cash.

“There is a risk that after the election the result is not known for some time because people are not voting in person. And not every state is well equipped to count votes that come in through the mail, because it’s quite new.

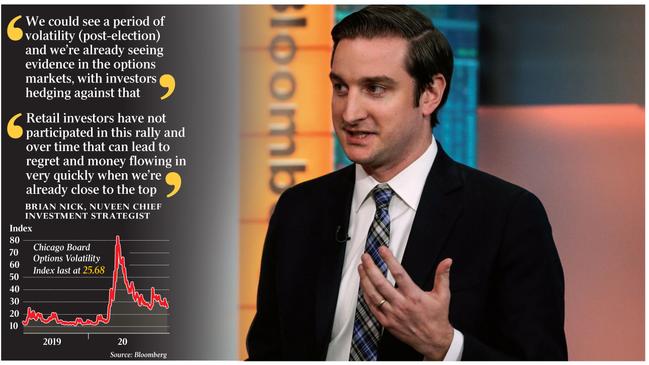

“If the election is close, we could end up in a Bush versus Gore 2000 scenario, with similar lingering uncertainty but in a much higher stakes economic situation than we were at back in 2000. I think we could see a period of volatility (post-election) and we’re already seeing evidence in the options markets, with investors hedging against that,” he said.

Election officials are bracing for a flood of postal ballots for the November election, as voters avoid lengthy queues amid the coronavirus pandemic.

If the race can’t be called on election night and mail-in ballots have to be counted to determine the result, it could take weeks to get a definitive answer, he warned.

“Then you have the potential legal challenges, and it will get to be really messy,” he said.

The presumptive Democratic presidential nominee is the current favourite to win the election, but if the Democrats did not control Congress then a period of accidental or forced austerity was likely, Mr Nick said.

“There’s two scenarios facing Biden (if he wins): one is he brings the Senate along with him, which means that fiscal policy stays quite loose. He could pass a lot of stuff if his coat-tails helped a couple of Democrats win Senate seats. You’re talking about probably the elusive scenario for fiscal policy, where you have unified democratic control.”

The other scenario will see a divided government, with a Republican-controlled Senate posing a challenge for the Democrat.

“As we’ve seen historically, it’s hard to get things pushed through when you have a Congress that is more sceptical about spending and a White House that wants to spend more. This was something that really dogged President Obama, not for all eight years, but probably for six out of his eight years. So that’s another scenario for Biden: that he has a hard time getting things through because he’s facing an oppositional Congress,” he said.

Betting markets are currently pricing in a six in 10 chance of the Democrats taking the Senate, up from about a 25 per cent chance at the start of this year.

In a normal election year, unified Democrat control might be a challenge for markets because of what it could imply for taxation and regulation, but the economic crisis brought about by the coronavirus pandemic meant it was unlikely Mr Biden would be itching to raise taxes dramatically, Mr Nick said.

Despite the volatility risk from a messy US election, he still expects equity markets to be higher at the end of the year and believes the money flowing out of ETFs and mutual funds is a sign that US equities have further to run. Retail investors are currently holding much less risk in their portfolios, with a lower allocation to equities than they were a couple of months ago, he said.

“Retail investors have not participated in this rally and over time that can lead to regret and money flowing in very quickly when we’re already close to the top,” he said.

“One of the things that gives me a reasonable degree of confidence, or maybe even hope, about the rally continuing at some pace is we haven’t seen the retail investor re-engage yet en masse, at least not in the fund world.”

While expecting multiples to move further up, Nuveen is not anticipating a similar trajectory to the market recovery of recent weeks.

“We’d be happy with single-digit returns for the S&P 500 over the next year,” Mr Nick said.

The S&P 500 is currently trading just 5 per cent off its February highs, after sinking 34 per cent in March.

Healthcare and technology are the asset manager’s two preferred sectors in the current environment, while banks are the “safest, highest-quality debt within cyclical value”.

“Technology is in sort of a sweet spot right now. There’s not that many companies that investors feel comfortable with that are earning money through this, and there’s not too many companies that seem like they can make their way through this very difficult operating environment and still come out OK on the other side,” Mr Nick said.

“So if you compare the valuation on Google or Amazon to what you would get from owning cash, or … a 10-year Treasury, it still looks pretty compelling. In fact, the market overall … still looks pretty compelling.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout