US IPO comeback bodes well for Australia: Bank of America

The IPO market in the US is staging a comeback, and Bank of America’s new local head says Australia could follow relatively soon.

The IPO market in the US is staging a comeback, and fresh from New York, Bank of America’s new local head of equity capital markets Yuta Kambe says Australia could follow relatively soon.

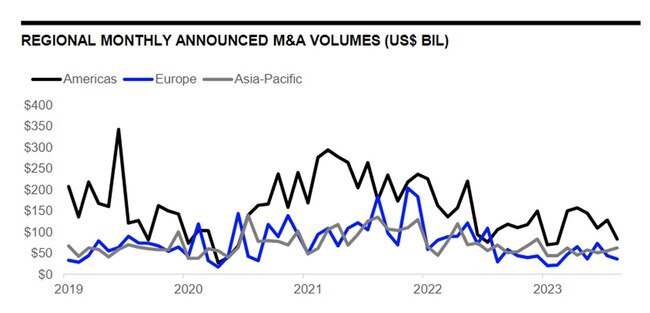

Both the US and the local market have been closed for large public listings since early 2022 when central banks across the globe began hiking interest rates to control the highest inflation in decades, causing asset values to plummet.

“So far this year there’s only been 21 IPOs priced in Australia,” Mr Kambe, who took on his new role earlier this month, told The Australian in an interview at his Sydney office.

That is almost 70 per cent lower than the number of deals in the same period last year, and compares to a 10-year average of about 80 deals per year in the Australian market. “This is a global slowdown,” he said. “But the key focus for us is when does this IPO market reopen? And the US tends to give a big cue.”

Mr Kambe’s team at Bank of America crunched the numbers for its corporate and private equity clients and shared them with The Australian. It examined how the local market tracks the US to figure out whether any reopening of the Australian IPO sector is on the horizon. “When the US market really reopens, that reverberates around the world. It opens up an opportunity for the others to go.” he said.

BofA’s research shows the Australian IPO market tends to track a full US reopening by one to two quarters.

The US had the first sign of a comeback on September 14 when the SoftBank-backed chip design company Arm Holdings debuted on the Nasdaq at a valuation of almost $US60bn.

The company raised $US5.2bn and its shares rallied 25 per cent on their debut session. That provided the perfect fodder for four other IPOs that saw big gains on their first day of trading.

However, all five companies, which include pharmaceuticals company RayzeBio, biopharma Neumora, grocery delivery company Instacart and marketing platform Klaviyo, have wiped out their initial gains and are now trading below their debut prices.

“There was a lot of movement in the market last week so it’s not all green lights, but it’s good that all of these deals priced at the high end or above their range,” Mr Kambe said.

He said to get deals across the line sellers were having to adjust their private and IPO valuations to come in line with public valuation expectations. “As investors look at their ability to invest in public stocks versus a new IPO, that relative valuation needs to be an attractive investment proposal.” he said.

In Australia, based on the bank’s pipeline, Mr Kambe expected a “small handful of IPOs” to come to market this year. Those would need to be well received and perform well after debut in order for a real reopening to happen as soon as the first quarter next year.

Steel manufacturer Molycop, payments company Cuscal, freight operator Mondiale VGL and wealth manager Mason Stevens are some names still in the pipeline for a potential IPO later this year.

One of the largest candidates, Virgin Australia, delayed its $3bn-odd listing earlier this year, while the large potential listing of data centre operator AirTrunk is seen by market sources as a 2024 starter.

The good news is that BofA’s analysis of the last two major IPO closures – during the dotcom crisis of the early noughties and the global financial crisis of 2008 – shows these shutdowns last about 21 months.

Coincidentally, that is the exact duration of the current shutdown, given the IPO market in Australia has been subdued since the first quarter of 2022.

“(That’s) not to say that because the Australian IPO market closures were 21 months the last two times and we are at 21 months closed today, that it is going to reopen soon, but it is a positive reference point that we are likely closer to the end than the beginning,” Mr Kambe said

There are of course other more important conditions that are crucial to see a recovery. That includes the stockmarket rebound this year with volatility that is trending below the 10-year average, increasing expectations for a soft landing of the economy, and pent-up investor demand.

“There was volatility last week so we’ll keep a close eye on that,“ Mr Kambe said.

And just because the market is starting to reopen, it doesn’t mean that anyone would be welcome. “There is still a lot of investor focus on the fundamentals of the business and on value. So not every company can go public right now,” he said.

“I don’t think the US market has seen a full reopening. What we want to see are multiple transactions coming at a fairly consistent pace, pricing well and trading well.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout