UK markets soar as Tories win mandate for Brexit

Investors were betting on a smoother path to Brexit and a rebound in the UK economy.

Investors were betting on a smoother path to Brexit and a potential rebound in the UK economy as the Conservatives headed for a landslide election victory, sending the British pound soaring.

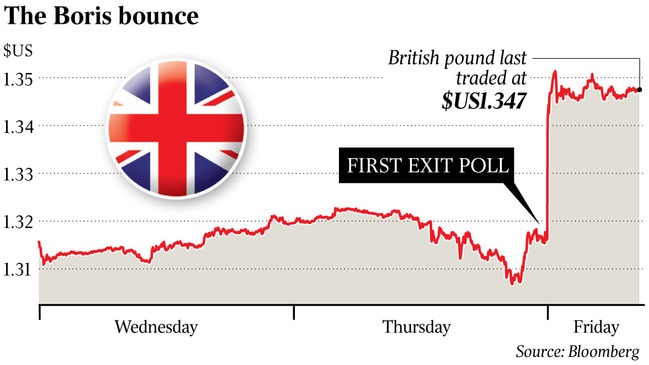

With exit polls showing an insurmountable lead for the Tories, investors piled into the pound, sending it 2.7 per cent higher to a 19-month high of $US1.3514 in the space of 45 minutes.

The Australian dollar, already rising after US President Donald Trump said he was “very close” to signing a trade deal with China, jumped to a four-month high of US69.39c as the US dollar was sold off.

But the Aussie couldn’t keep up with the pound, at one stage falling 2.4 per cent to 51.24 pence, the lowest since the Brexit vote caused the pound to plunge in 2016.

Similarly, the euro dived 2.1 per cent to 82.77 pence, the lowest since just after the referendum.

Shares in London opened higher last night with the benchmark FTSE 100 jumping 1.6 per cent. But the broader FTSE 250 index — made up of domestic-focused industries — jumped as much as 5.4 per cent, hitting a record high. Banks, utilities, home builders and retailers led gains for stocks, with Royal Bank of Scotland and Lloyds surging as much as 10 per cent.

The Royal Mail and telecoms operator BT Group, which faced nationalisation under Labour, surged as much as 8 per cent.

Equity strategists at Citi said the UK election result was “probably as good as it gets”.

While a convincing win for the Tories was expected, there were some late jitters about a potential hung parliament as opinion polls suggested their lead had narrowed.

Results late Friday showed the Conservatives secured at least 364 of 650 seats in the House of Commons, 38 more than needed for a majority. Labour had just 203 seats, 59 less than it previously held, prompting Labour leader Jeremy Corbyn to resign.

The BBC was predicting a 74 seat majority for the Conservatives giving Prime Minister Boris Johnson a strong mandate to leave the EU with his withdrawal agreement by the end of January. Labor was set for its worst defeat since 1935.

Mr Johnson declared, in an informal victory speech to Tory supporters, that “no one can now refute” that he had a “stonking mandate” to deliver Brexit.

Royal Bank of Canada currency strategist Adam Cole saw “risks to the upside” for sterling.

“Had the Conservatives won with a small majority, the leadership would have likely been held to its commitment not to extend the transition period beyond December 2020 by the hard exit wing of the party, but with that group effectively marginalised, there is significantly more scope for flexibility and compromise. Hence, the risk of exiting without a trade deal has fallen.”

Scotland was a “developing risk to watch in the longer-term”.

“What appears to be an SNP landslide — combined with the certainty that Brexit will be done — will no doubt raise the pressure for another independence referendum,” he said.

Investors should also pay attention to what the result may portend for the US dollar, amid a “global pivot to prioritising fiscal policy and contrarian signals on the inflationary outlook”, said Paras Anand, head of asset management for the Asia Pacific at Fidelity International.

“First, as the rally in the pound suggests, this could be another signal that the long period of US dollar outperformance is coming to an end.

“Uncertainly over Brexit has led to a long period of sterling weakness — but the US dollar has also been supported by America’s tighter stance towards monetary policy and stronger underlying economy relative to the rest of the world.

“Weaker economic data over recent months and an uncertain political outlook has led to the Fed coming under pressure to keep monetary policy loose, which serves to support the economy. The US dollar also looks stretched to us from a valuation perspective.”

AMP Capital chief economist Shane Oliver said: “The avoidance of far left policies under a Labour government is probably also a short-term positive for UK assets including shares and the British pound, although as always there is a risk of a near term ‘sell on the fact’ pull back as markets had generally anticipated a Conservative victory.”