Turmoil as Trump restarts trade war

The Australian dollar and shares dropped as the US threatened to impose higher tariffs on China.

The Australian dollar and shares dropped along with key offshore markets after the US dramatically raised the stakes ahead of renewed trade negotiations with China this week by threatening to impose higher tariffs on its biggest trading partner as soon as this Friday.

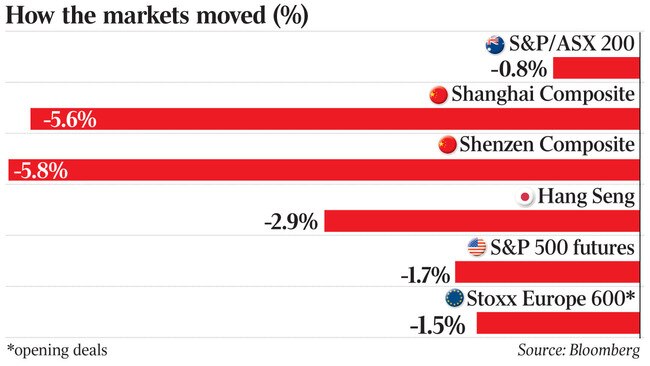

Before a possible interest rate cut by the Reserve Bank at its board meeting today, the dollar fell more than half a US cent to a four-month low of US69.63c and the S&P/ASX 200 share index fell as much as 1.4 per cent before ending down 0.8 per cent at 6273.7 points.

The market-implied chance of the RBA cutting its official cash rate to a new record low of 1.25 per cent increased to 49 per cent from 39 per cent because a re-escalation of the US-China trade war could worsen the global economic growth outlook after a recent slowdown.

An interest rate cut by the RBA is fully priced in for July and further cut to a 1 per cent cash rate is almost fully priced in for December.

China bore the brunt of the sell-off in global markets, with the Shanghai Composite falling as much as 6.6 per cent after US President Donald Trump tweeted that an existing 10 per cent tariff on $200 billion ($287bn) of Chinese imports would rise to 25 per cent on Friday and $325bn of additional Chinese imports currently untaxed would “shortly” be hit with a 25 per cent tariff.

China’s exchange rate dived with the offshore yuan falling 1.3 per cent to a four-month low of 6.8218 to the US dollar.

Elsewhere in Asia, the Hang Seng Index lost 3 per cent and Taiwan’s TAIEX fell 1.8 per cent. Japan and South Korea were closed for holidays.

S&P 500 futures fell as much as 2.1 per cent, pointing to a potentially rough night on Wall Street.

China Monday night said it was still planning to send a negotiating team to Washington this week to continue trade talks.

But a spokesman for China’s Ministry of Foreign Affairs, Geng Shuang, would not confirm last night if China’s chief negotiator, Vice Premier Liu He, would be leading the delegation.

The comments by China’s Ministry of Foreign Affairs headed off speculation that China might cancel the trip altogether following Trump’s aggressive threats to raise tariffs.

But there was confusion when the spokesman could not confirm whether Mr Liu, who was originally planning to lead a delegation of some 100 people to Washington this week, would make the trip to the US capital.

Quizzed over the nature of the delegation, Mr Geng would only say that “a Chinese team is preparing to travel to the United States for trade talks”.

The spokesman also conceded that “everyone in China and abroad is very concerned about the next round of trade talks”.

He said China hoped “to make progress in our trade talks” and “we hope the US side can work together with us and move in the same direction so we can achieve a deal that can benefit both sides”.

Brent crude oil futures fell 2.9 per cent to $US68.97 a barrel and London Metal Exchange copper futures fell as much as 2.8 per cent to $US2.74 a pound before both commodities recovered somewhat. Spot gold rose as much as 0.5 per cent to $US1285.86 per ounce.

Mr Trump’s tweets surprised many Chinese officials, a person briefed on the matter told The Wall Street Journal.

While there had been widespread expectations in recent days that an accord could be reached by Friday, Chinese officials were considering cancelling trade talks that were to resume in Washington on Wednesday.

“China shouldn’t negotiate with a gun pointed to its head,” the person said. Chinese officials have said Beijing wouldn’t bend to pressure tactics. By potentially scotching the trip, Beijing would be following up on its pledge to avoid negotiating under threat.

Government bond yields dived as investors rushed to safe havens, with Australian 10-year commonwealth government bond yields falling as much as 7 basis points to a fresh record low of 1.72 per cent. Australian three-year yields hit a record low of 1.23 per cent.

President Trump’s unexpected tweet is “bound to send shockwaves through global markets”, and a cancellation of a Washington DC trip led by China’s Liu He was a “real risk”, according to Li-Gang Liu, chief China economist at Citi.

“If the trip were to be cancelled, we would return to the scenario of a trade war escalation: turmoil in global markets would return; China’s economic stabilisation would be under renewed pressure; and global growth could be downgraded further,” he said.

Should trade tensions return, he expects a “speedy reaction” in terms of fiscal and monetary stimulus in China.

But Citi’s Mr Liu remained “cautiously optimistic” that a US-China trade deal will still be reached by mid-year.

“We believe the renewed tariff threat by President Trump is a negotiating tactic to secure more concessions from China and make a future agreement more enforceable,” he said. “With the Chinese economy stabilising, China may have appeared less willing to offer additional concessions to the US. Thus, the threat is consistent with the US increasing pressure on China to achieve these concessions.”

He also noted that while negative tweets on US-China trade were associated with an outperformance of US equity prices relative to Chinese equities, the US administration would also be attuned to the reaction of US equity markets, and a significantly negative reaction by equity markets to Trump’s tweet could see the US administration retreat from implementing the tariffs threat.

“We thus think both sides may need to back-step their negotiation strategy a little,” he said.

“Even with a deal, it is likely that Beijing might have to accept some tariffs remaining place, while Washington may not get its wish to keep a 25 per cent tariff on all $50bn of Chinese exports related to Made-In-China 2025, as some China hawks in the US would like.”

TD Securities emerging markets strategist Mitul Kotecha said Trump and the China hawks in his administration appeared frustrated with the time taken to achieve a deal, and Trump may be emboldened to take a tougher stance by the resilience of the US economy, strength of US equity markets and limited impact on the US economy from tariffs.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout