These days the biggest driver of markets is the money floods that are being generated by governments. If he becomes president Joe Biden is planning a much bigger money flood than President Trump so, on current market sentiments, that outweighs the higher taxes on high income earners and corporations.

But in Walter Reed hospital near Washington, two remarkable market-impacting events took place against a background of weaker-than-expected US September employment numbers.

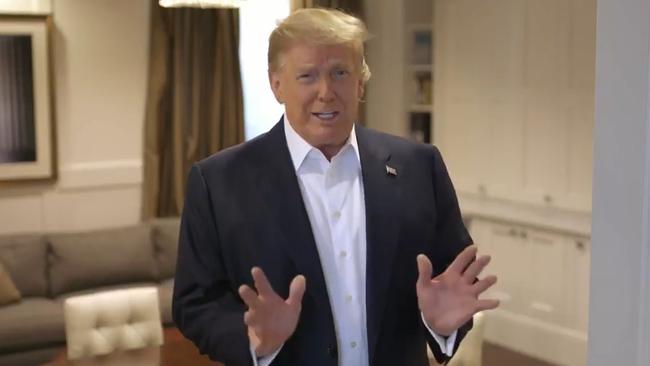

For weeks Republicans have been opposing the Democrats’ desire for much greater spending but, but from his hospital room, President Trump tweeted:

“OUR GREAT USA WANTS & NEEDS STIMULUS. WORK TOGETHER AND GET IT DONE. Thank you!”.

OUR GREAT USA WANTS & NEEDS STIMULUS. WORK TOGETHER AND GET IT DONE. Thank you!

— Donald J. Trump (@realDonaldTrump) October 3, 2020

That tweet changed the game. Suddenly House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin held an hour-long phone call and discussed “the justifications for various numbers” and “plan to exchange paper” in preparation for further discussions, according to the Pelosi camp.

She says Trump’s diagnosis was changing the dynamic of talks toward an agreement and called on the airline industry to delay furloughs, saying additional relief for the industry is “imminent”.

Not to be outdone, Trump sent off a series of tweets urging Americans to vote for him, citing the “biggest tax cut ever” and “stock market highs”.

So, in the middle of the US election campaign, there will be a further money flood and that drives markets. And, of course, in Australia Josh Frydenberg’s money flood was well documented before the budget and is also driving the Australian market.

But there is a second issue that will now suddenly enter the US presidential campaign and inevitably impact markets. Trump on Tuesday morning sent out an amazing tweet:

“I will be leaving the great Walter Reed Medical Center today at 6:30 P.M. Feeling really good! Don’t be afraid of Covid. Don’t let it dominate your life. We have developed, under the Trump Administration, some really great drugs & knowledge. I feel better than I did 20 years ago!”

I will be leaving the great Walter Reed Medical Center today at 6:30 P.M. Feeling really good! Don’t be afraid of Covid. Don’t let it dominate your life. We have developed, under the Trump Administration, some really great drugs & knowledge. I feel better than I did 20 years ago!

— Donald J. Trump (@realDonaldTrump) October 5, 2020

What Trump is telling the world is that the new drugs being developed mean that the COVID death rate is going to be slashed and that means even if you are 74 and overweight you can overcome the virus.

The treatment Trump is receiving, which include unproven drugs, is not widely available and we are yet to see if there are any side effects.

Nevertheless if Trump does not relapse then we are on the way to a safer COVID world with vaccines and treatments available next year that were not available for most of 2020.

It seems that a majority of the early vaccines being developed will not prevent most people being infected but rather will greatly reduce the impact of the infection.

So as things now stand the Trump infection looks set to not only stimulate the US economy but perhaps lower the COVID fear rate.

This is marvellous news for markets. Trump is way behind in the opinion polls but his new theme is clear and it starts a new chapter in the campaign. Of course, there us no certainty his health will hold out. In addition his staff have been ravaged by COVID-19.

But if the Democrats and Republicans can agree on a greater money flood markets will be delighted.

Sentiments can change rapidly but President Trump’s COVID-19 infection is starting to stir a sense of renewed optimism on Wall Street - a sharp contrast to the fear of looming chaos of last week.