There’s hope for the market under Trump

Investors are worried, but initial US election responses don’t predict future market performance.

Markets have a tendency toward hyperbole, and as Donald Trump headed toward a win they bet on the four horsemen of the Trumpocalypse hitting Mexico. The peso fell more than 10 per cent to its lowest ever against the dollar, as traders focused on the clearest Trump trade.

Mr Trump called for “Brexit times 10,” but aside from the peso he’s getting a market reaction to his likely presidency only somewhat worse than the British vote to leave the European Union in June. The flight to safety has seen the dollar itself fall 3 per cent against the Japanese yen, gold leap $US43 and US stock futures predict at one point a 5 per cent plunge in the S&P 500 when it opens.

There’s one exception: The flight to safety has been tempered in government bonds. Usually when investors panic they pile into Treasurys, and sure enough the 10-year yield is down 0.05 percentage point at 1.8 per cent. That’s a chunky move, but less than half the post-Brexit fall in yield (prices rise when yields fall).

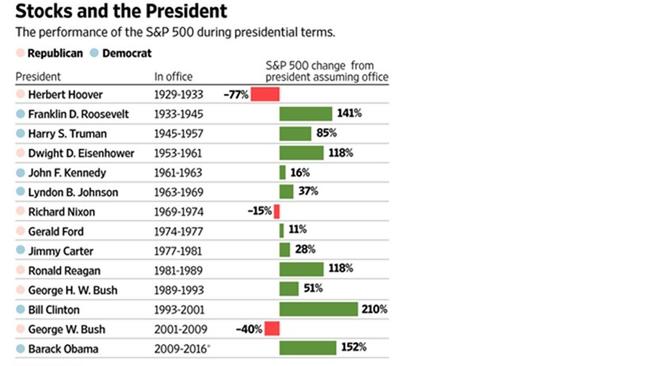

The market moves tell us that traders are worried, but don’t tell us much about how investors will fare under a President Trump. Market moves between Election Day and inauguration have had no obvious link to performance during presidential terms in the past, as data compiled by Birinyi Associates shows. Indeed, markets fell sharply after the elections of two of the presidents who oversaw the biggest bull markets once they were elected, Franklin Roosevelt and Barack Obama.

The records of the two presidents suggest there’s hope for the markets under Mr Trump.

One interpretation of the market’s performance under the two Democrats is that markets like massive government stimulus programs. The S&P 500 was up 141 per cent under Roosevelt in his three-plus terms, and 152 per cent under Mr Obama, up to last night’s close.

The market’s fear about a President Trump is that he will turn out to be just as he was on the campaign trail: Unpredictable, vindictive and antitrade. The chance of a really bad outcome is higher than it was, which justifies a switch to safer assets.

But it’s possible that the highest office in the land will make him act at least a little more presidential. In this case, his stated policy positions might matter, and they would be stimulative. Tax cuts for the rich benefit the economy less than tax cuts for the less well off, but are still supportive. Corporate tax cuts put money into the pockets of shareholders. And infrastructure spending should help the economy, as well as improving productivity.

The likelihood of more borrowing and the possibility of a better outcome for the economy is likely part of the reason Treasury yields haven’t fallen further, as inflation makes bonds less appealing. The unpredictable Mr Trump is another reason, as investors have worried that his criticism of the Federal Reserve would destabilise the bond market.

Another hope for markets is that presidents really don’t matter as much as we all make out. Markets move in cycles, and the presidents who oversaw the biggest bull runs had the good fortune to be elected in the middle of really bad recessions.

Roosevelt’s devaluation, bank fixes and stimulus surely helped fix the Great Depression, but it didn’t hurt to take office after stocks had already fallen 80 per cent from their 1929 peak. Similarly, Mr Obama took office in January 2009 just before the market hit the crisis low two months later.

The market performed worst (since 1928) under two Republicans,Herbert Hoover and George W. Bush. Both had the misfortune to take office when stocks were frothy, although Mr Hoover’s policies certainly didn’t help.

On this basis Mr Trump’s timing looks bad. He himself thinks share prices are in a bubble, and said this summer he’d gotten out of stocks. The market’s been rising for more than seven years with only the briefest of interruptions, and it is highly valued, with its price-to-forward-earnings ratio of 16.6 times close to the highest in a decade. When Mr Obama took office, shares were at just 11.8 times forward earnings.

For the next few hours none of this is likely to matter. But once longer-term investors wake up, if Mr Trump can act presidential he just might convince many of them to buy the dip sometime in the next few days.

For the longer run, high valuations and still-high profit margins mean stocks are likely to deliver pretty low returns, even in a good scenario.

Wall Street Journal