Tech leads ASX best performers as travel slammed

What prospered in the pandemic? Winners and losers of the ASX in 2020.

Clear winners and losers emerged from the wild stock market ride of 2020 as the Covid pandemic reshaped nearly every aspect of the Australian economy.

As tougher Covid border lockdowns returned on Thursday, the impact of the virus is still being felt among key sectors.

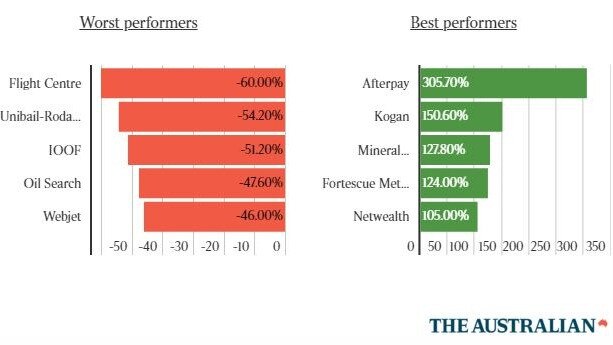

Travel stocks were hammered for one final time for the year, as holiday plans were put in disarray. Qantas on Thursday closed down 2.2 per cent to $4.85 taking its total losses down 32 per cent for the year, while Flight Centre was off 4 per cent on Thursday. This made it the worst performer of the S&P/ASX 200 Index with its shares down 60 per cent over the past 12 months.

During the depth of the crisis, Flight Centre was forced to raise $700m that drastically diluted shareholders but saved the company from potential detonation.

The second-biggest loser among the top 200 was Unibail-Rodamco-Westfield, owner of global shopping mall empire, which saw its shares savaged, falling 54 per cent.

At nadir the property giant was trading around $2.40, well below its close at $5.10 this time last year.

IOOF Holdings, despite cementing a deal to take over National Australia Bank’s wealth division MLC to form one of the largest market players in the country, has been given short shrift by the market. Shares in the company closed the year down 50.6 per cent, only after bottoming out at $2.50.

PNG-focused energy play Oil Search saw its shares smashed 47 per cent on the back of a rout in global oil prices. Webjet was off 46 per cent and Origin Energy was off 43 per cent, hit buy the collapse in both global gas prices and wholesale electricity prices as the economy slowed.

While some sectors are still reeling from the virus others are booming with some retail players still enduring despite the shock to their operations.

Buy now, pay later darling Afterpay experienced a rough ride in the beginning, tumbling from a pre-pandemic share price of nearly $40 to a low of $8.01, before recovering and enjoying a steady rise across 2020, to close the year just short of $120.

This has given it a market capitalisation of more than $33bn, putting it in the top 15 of ASX listed companies. Indeed, Afterpay is valued at more than property giant Goodman Group, energy play Woodside Petroleum and is more than twice the size of Queensland based financial services major Suncorp.

The rise in online retail gave a boost to the still new buy now, pay later sector which is making steady inroads into a payments market dominated by credit cards.

With Australians locked at home, spending patterns shifted, which helped drive Kogan.com’s shares up 153 per cent for the year to $19.00 each.

But the third-placed best performer for the market, Mineral Resources, slipped under the radar amid the tech fervour, boosted by the surge in iron ore, which briefly pushed past $US170 a tonne.

The junior iron ore play clambered up the ASX to close almost 127 per cent higher for the year. Also riding the commodities boom, Fortescue Metals Group added 124 per cent over the year seeing it overtake big four bank Westpac in terms of market capitalisation.

The iron ore bonanza has enriched Fortescue holders, delivering its founder and RM Williams owner, Andrew Forrest $1.11bn in dividends alone.

Across the top 200 companies, energy was the worst performing sector, down 29.5 per cent.

This was followed by utilities, which was also mauled by market movements on the back of the pandemic, collapsing 20.7 per cent.

However, the boom in technology stocks delivered a 57 per cent gain for the sector.

This was followed by the materials index, which delivered a more modest 14.75 per cent growth despite a surge in iron ore prices.