Super funds dip on inflation fears and slowing economy in China

Australian superannuation funds have suffered their first monthly fall in returns for more than a year.

Australian superannuation funds have suffered their first monthly fall in returns for more than a year as inflation jitters sparked a rise in market interest rates and China’s economic outlook slowed, suggesting the easy gains from a post-Covid rebound on the back of unprecedented stimulus may have waned.

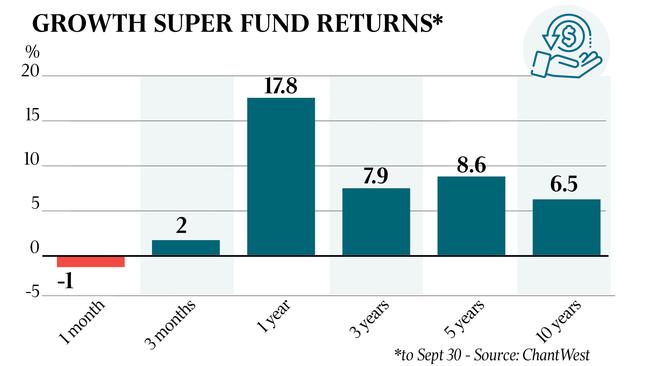

According to super fund researchers Chant West, the median growth super fund, which typically has 61 to 80 per cent of funds invested in growth assets like shares, lost 1 per cent in September as global sharemarkets retreated slightly after a record-breaking run.

The returns capped off a subdued September quarter.

Australia’s S&P/ASX 300 index fell 2.7 per cent in September, its first down month in a year, while the MSCI All Country World index lost 4.3 per cent, with the US S&P 500 down 4.8 per cent.

“Global sharemarkets retreated in September, mainly due to a spike in interest rates prompted by growing concern about emerging inflation,” Chant West senior investment research manager Mano Mohankumar said.

The US 10-year bond yield rose from 1.31 per cent to 1.49 per cent last month.

This month it reached a four-month high of 1.63 per cent as signs of inflation added to the case for the Federal Reserve to start tapering its bond purchases soon after its meeting early next month.

Despite this setback, growth funds had returned a stunning 28 per cent over the 18 months since the Covid-induced low point at end-March 2020, and were now sitting about 13 per cent above the pre-Covid crisis high that was reached at the end of January 2020, Mr Mohankumar added.

The Australian sharemarket still generated a total return of 1.8 per cent in the September quarter after rising more than 28 per cent in the past year thanks to unprecedented fiscal and monetary policy stimulus and a stronger-than-expected economic rebound helped by vaccine developments.

The Reserve Bank has pushed back against market speculation of official interest rate hikes in Australia, with minutes of its October board meeting repeating that the central bank doesn’t expect its precondition for a rise in interest rates to be met before 2024.

The minutes of its October board meeting, which was held a day before the prudential regulator increased the minimum interest rate buffer rate for home loans this month, said other measures to address “a build-up of risks associated with high and rising household indebtedness” included restrictions on lending at high debt-to-income ratios and/or high loan-to-valuation ratios.

“Given the environment of rising housing prices and low interest rates, members continued to emphasise the importance of maintaining lending standards and agreed that loan serviceability buffers were appropriate,” the RBA minutes said.

“Members also agreed that, while less accommodative monetary policy would, all else equal, see lower housing prices and credit growth, it would result in fewer jobs and lower wages growth, which would in turn create further distance from the goals of monetary policy – namely, full employment and inflation sustainably within the target range.”

The RBA’s view on the trade-off between keeping interest rates low to support the economy and not increasing financial stability given that the housing market is “red hot”, suggests macro-prudential policy will be the key tool to keep housing-related risks in check while interest rates remain so low.

Amid a surge in market interest rates which has seen markets bring forward their RBA rate hike pricing, with a full 25 basis point rate hike now priced by August 2022 and 50 basis points of hikes priced by the end of 202, the RBA also said Australia’s wage and inflation experience was quite different to other countries, lessening any need to lift interest rates.

Patterns in wages growth differed across advanced economies, and some economies that were experiencing a pick-up in wage growth – such as the US and the UK – were among those that had experienced relatively fast wage growth and higher inflation prior to the pandemic.

New Zealand wage growth had also picked up as spare capacity had largely been absorbed there, but modest wage growth in Canada and the eurozone was consistent with ongoing spare capacity.

Strong demand for goods, supply bottlenecks and rising energy prices saw producer prices rise at their fastest rate in many years, and the pass-through to underlying consumer price inflation varied.

Increases in consumer price inflation were most apparent in some large emerging market economies, and while consumer price inflation in advanced economies remained high, underlying measures of inflation had not risen to the same extent.

“Most central banks in advanced economies had continued to characterise pandemic-related price increases as either temporary or one-off price level changes that would have only a transitory effect on inflation,” the RBA said.

The RBA board also discussed slowing in economic activity in China in recent months, including the role of policies to reduce overall debt levels and emissions, and the effects of the pandemic.

“More generally, members noted that renewed focus in China on achieving ‘common prosperity’, combined with a range of regulatory actions, had created more uncertainty about the medium-term outlook for policy settings and the economy in China,” the RBA said.

“Some observers had interpreted these developments as an attempt to curtail the influence of the private sector, while others saw it more as the next stage of long-running strategies to reduce poverty and corruption and to promote social fairness.”

Elsewhere in east Asia, economic conditions were adversely affected by surges in Covid-19 cases and the reintroduction of containment measures through July and August, but rising vaccination rates and declining case numbers in recent weeks had allowed restrictions to be eased.

“Growth in goods exports continued to be very strong among the more export-oriented economies, with surveyed manufacturing conditions remaining strong in all the advanced Asian economies.”

Domestically, the rapid increase in vaccinations, particularly in states with outbreaks of the Delta variant of Covid-19, will see restrictions on activity eased sooner than previously expected, and the international border start to reopen earlier than had been assumed.

“In addition, the publication of roadmaps by some states had provided more clarity over the sequencing and pace of economic reopening,” the RBA said.

“Information from the Bank‘s liaison program indicated that many firms were preparing for the lifting of restrictions, and timely indicators of household spending and hiring intentions suggested the recovery in activity and employment would be well under way by the end of the year.

Surveys of business and consumer sentiment had been “fairly resilient during the recent lockdowns”.

The economy was expected to have returned to its pre-Delta path by the second half of 2022.

“Nonetheless, members acknowledged that the recovery was likely to be uneven across the economy and that uncertainty would be a feature of the outlook for some time yet,” the Reserve Bank said.