Stockmarket falls from record highs after a surprisingly sharp rise in the “dot plot” of interest rate projections from Fed board members were limited by chairman Jerome Powell’s comments that “the dots should be taken with a big grain of salt” and talk of raising rates would be “highly premature”.

But with Fed board members now predicting annual US inflation will be above the 2 per cent target through 2023, 11 of 18 now seeing two hikes in the Fed funds rate by 2023 and seven seeing a hike by 2022, the US 10-year bond yield bounced decisively back to the middle of its 1.43-1.77 per cent range of the past three months and the Australian dollar hit a two-month low of US75.98c.

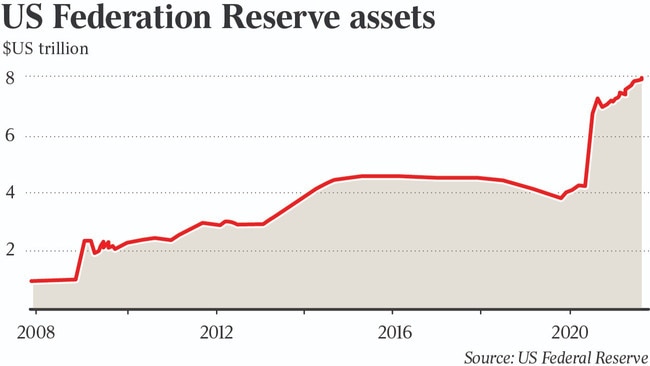

If the consensus view at the Fed shifts to hiking the funds rate next year, as 39 per cent of its board members now think will be appropriate, the world’s most powerful central bank could soon start tapering the pace of its $US120bn asset buying that’s been a mainstay of the sharemarket rally.

“You can think of this meeting as the talking-about-talking-about meeting, if you like,” Powell said in his press conference after the Fed meeting concluded early Thursday.

A plan to start tapering the Fed’s quantitative easing program may come as soon as next month’s meeting on July 29, although economists feel it’s more likely to come at the annual Economic Policy Symposium in Jackson Hole, Wyoming, on August 25-28.

Fed chair Powell has previously said that the Fed will taper “well before the time we consider raising interest rates”. Its most recent tapering started in December 2013 and rates didn’t rise for two years.

“As the reopening continues, shifts in demand can be large and rapid, and bottlenecks, hiring difficulties and other constraints could continue to limit how quickly supply can adjust – raising the possibility that inflation could turn out to be higher and more persistent than we expect.”

“I am confident that we are on a path to a very strong labour market,” Powell said, while downplaying the potential for labour shortages. “We learned during the course of the last very long expansion, the longest in our history, that labour supply during a long expansion can exceed expectations.”

Meanwhile the quarterly report of Australia’s Council of Financial Regulators said the Australian Prudential Regulation Authority had written to the major banks to “seek assurances that they are proactively managing risks within their housing loan portfolios, and will maintain a strong focus on lending standards and lenders’ risk appetites”.

“Council members are also paying close attention to the implications of trends in household debt,” the CFR said. “They discussed the risks that could build if growth in household borrowing substantially outpaced that in income, as well as potential policy options to address these risks.

But in his speech – “From Recovery to Expansion” – in Toowoomba, Queensland, RBA Governor Philip Lowe continued to expect very little in the way of inflation and wages growth, even as he remained upbeat on the outlook for economic growth and unemployment.

CBA’s Australian economics chief Gareth Aird, said that in light of a shift in rhetoric by the US Fed, the Reserve Bank of New Zealand, the Bank of England and Bank of Canada, the RBA appeared “incredibly dovish”, particularly given the relative strength of Australia’s economy.

“The RBA governor continues to point out a range of options on why wages growth will remain low, despite job vacancies being elevated and labour market supply being so constrained,” he said.

It is almost as if the RBA does not believe that it can achieve the objective it has set itself, of wages growth of at least 3 per cent per annum. If that is the case it may be time to review the inflation target, given the RBA has a higher inflation target than all of the other major central banks.

Perhaps Dr Lowe would have tweaked his speech if it was delivered after the May jobs data.

Despite the end of the federal government’s JobKeeper wages subsidy in March, the data showed a massive 115,200 rise in jobs, mostly in the important full-time employment category.

The exceptionally strong jobs growth caused the unemployment rate to plunge from 5.5 per cent to a 17-month low of 5.1 per cent, despite a near record labour force participation rate.

The underemployment rate – which includes employees who want more work – hit a more than seven-year low, and the underemployment rate, which adds the unemployment and underemployment rates, hit an eight-year low, increasing the prospect of faster wages growth.

A hawkish surprise from the Federal Reserve and booming Australian jobs growth gives the Reserve Bank more flexibility to decide on a plan to lessen its policy stimulus when it meets next month.