Stocks surge ushers in new bull market

The Australian sharemarket’s return to a bull market comes after one of its shortest bear markets in history.

Australia’s sharemarket is back in a bull market after one of its shortest bear markets in history.

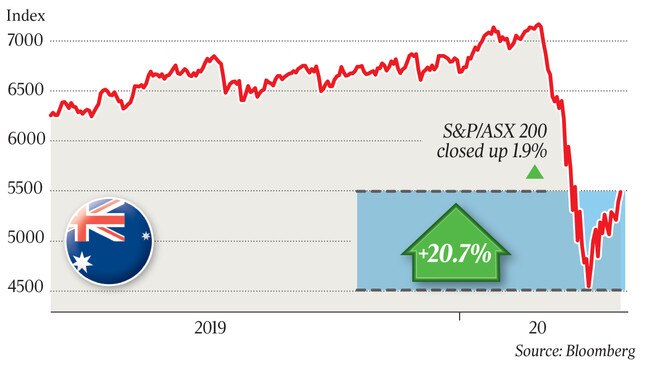

Buoyed by surging global equities amid unprecedented fiscal and monetary stimulus and expectations that slowing infection rates will allow some normalisation of economic activity after damaging coronavirus lockdowns, Australia’s S&P/ASX 200 jumped 100 points, or 1.9 per cent, to a five-week high of 5488.1 when trading resumed after the four-day Easter long weekend.

The decisive jump in the sharemarket took its rise from the daily closing low of 4546 three weeks ago to 20.7 per cent, exceeding a minimum 20 per cent rise needed to declare the end of the bear market and the start of a new bull market based on the standard definitions.

“The day was all about risk-on,” said Bell Potter’s head of institutional sales and trading, Richard Coppleson. “High PE (price to earnings) stocks, stocks that have been decimated, the biggest shorted stocks, small caps that have been out of favour and some big caps as well — all saw strong buying.”

Buy-now-pay-later operator Afterpay jumped 29 per cent after reassuring investors on its sales outlook, Newcrest Mining surged 12 per cent amid a strong rise in gold miners, and Westpac rose 1.9 per cent despite flagging a $1.4bn writedown in its upcoming first-half results as it braced for a record fine from the anti-money-laundering regulator Austrac.

QBE Insurance shares were halted for a $1.3bn capital raising while InvoCare was also halted pending a raising announcement, and InvoCare and Healius both deferred their dividends.

It came amid strong gains in global markets, with Japan’s Nikkei 225 up 3.1 per cent, China’s Shanghai Composite up 1.6 per cent, South Korea’s KOSPI up 1.7 per cent and Singapore’s Straits Times index up 2.3 per cent, while S&P 500 futures rose as much as 1.6 per cent.

Crude oil prices were volatile amid concern that a weekend agreement by OPEC and its allies to cut about a 10th of the world’s oil supply in response to slumping demand won’t stop a short-term glut due to a slump in demand amid the coronavirus lockdowns.

West Texas crude oil futures fell 2.6 per cent to $US21.82 a barrel in early European trading.

The Australian dollar hit a five-week high of US64.32c before easing to US63.90c.

Investors scrambled to regain exposure to shares after a surge in recent weeks as central banks and governments dialled up their support for economies buckling under the strain of lockdowns and as world leaders gave hope that lockdowns could be eased.

“Almost no one believes this rally and many have dismissed it from the day it started but it has defied consensus thinking that it would be a lot worse,” Mr Coppleson said.

After plunging as much as 39 per cent from its record high to a seven-year low of 4402.5 last month after the pandemic went global, the ASX 200 took just 14 days to exit the bear market, but was still 24 per cent below the 7197.2 it reached on February 20.

“The consensus is that this is a ‘bear market rally’ and looking back over the years that view is well supported by history,” Mr Coppleson said. “Right now everyone agrees when I say the market will probably retest its lows and all say that when it does that that’s when they will buy, but for now there are many hating this rally and waiting for the dire economic reality of the situation to hit.”

JPMorgan’s Australian head of research Jason Steed said the durability of the rally would be tested by deepening cuts to corporate earnings forecasts, as well as a “flood of awful macro-economic data over the coming weeks and months”.

The US March quarter earnings season kicks off this week with Johnson & Johnson, JPMorgan and Wells Fargo due to report their results on Wednesday.

Mr Steed noted that with earnings per share projections reversing sharply, a “remarkable” move higher in sharemarkets had led to a “marked expansion of PE multiples across the globe”, with the one-year forward PE multiple of Australia’s ASX 200 now well above its 10-year average.

But not even a massive fall in business confidence could dent shares on Tuesday. The NAB business confidence index dropped to -66 points in March — the lowest on record — from -2 points in February, while operating conditions dived to -20 points, consistent with the depths of the global financial crisis.

“Business has essentially told us that trading conditions, profitability and employment all went backwards in a big way in the month,” NAB chief economist Alan Oster said. “As time passes and containment measures are kept in place it is likely that conditions will fall further as more businesses are impacted”.

The government has committed to spending $215bn to cushion the blow from strict social isolation measures, including the forced closure of “non-essential” businesses such as casinos, while tourism and education — two of the country’s largest export sectors — have ground to a halt.

“It is important to note while the impact on the business sector has been dramatic, the policy response has been unprecedented in terms of speed and size,” Mr Oster added.

“This will serve to support the recovery in the economy as the impact of containment measures fades. Our view is that these measures are unlikely to fully offset the impact of the containment measures in the near term, but will provide a very important offset to the economic fallout in the recovery phase, preventing mass business closures and even higher unemployment.”

Treasury estimates the unemployment rate will hit 10 per cent in the June quarter.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout