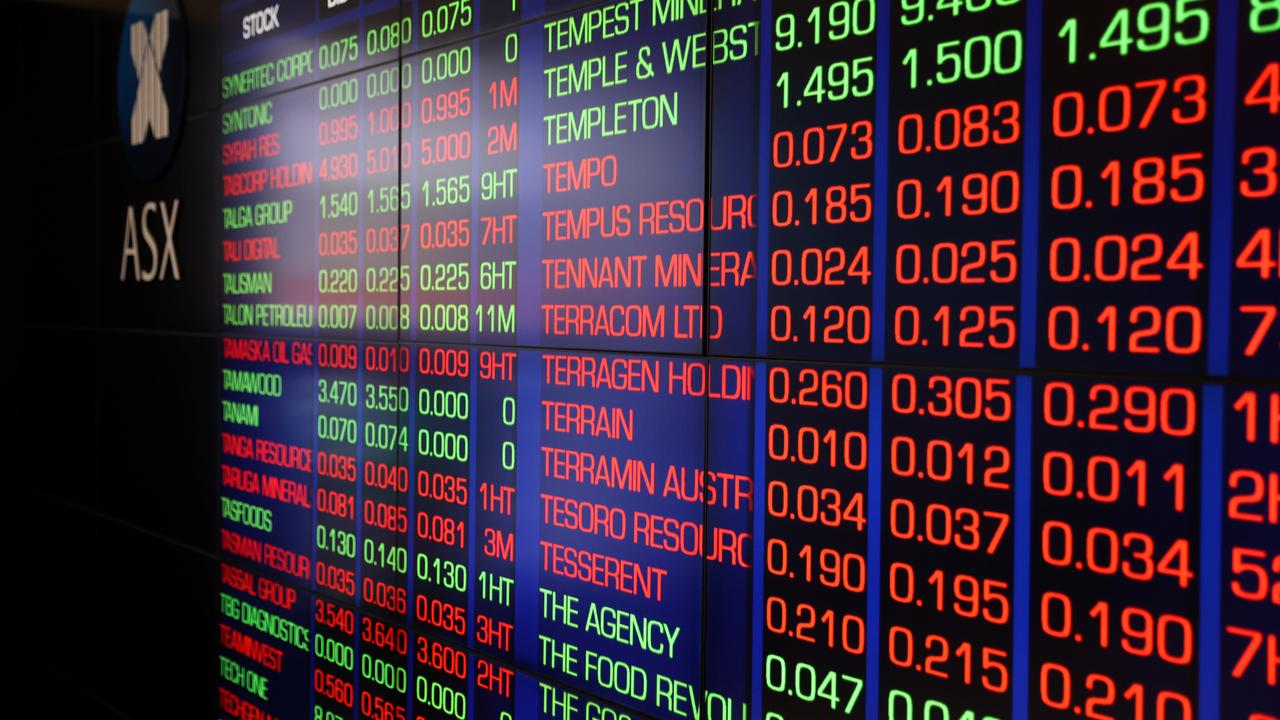

Stocks soar on RBA’s rate cut

The bourse has closed more than 2pc stronger, returning to its highest level in seven-and-a-half months.

The Australian sharemarket has soared following the Reserve Bank’s historic interest rate cut on Tuesday, with profit-reporting ANZ and currency-exposed CSL the standout performers.

The gains returned the bourse to its highest level in seven-and-a-half months and featured broad-based improvements across nearly every major sector.

At the 4.15pm (AEST) official market close, the benchmark S&P/ASX 200 index had advanced 110.8 points, or 2.11 per cent, higher to 55353.8, while the broader All Ordinaries index had jumped 103 points, or 1.94 per cent, to 5415.

After edging moderately higher across the morning, the benchmark leapt sharply on news of the RBA’s decision to cut the official cash rate by 25 basis points to a new historic low of 1.75 per cent.

The decision raised sentiment across the market, with banks, property trusts and exchange-rate exposed businesses the highest-flying sectors.

The lift returned the market to its highest close since August -- before the financial markets turmoil that rocked it and global peers early in the New Year, amid concerns about China’s growth prospects.

The benchmark has now clawed back almost 10 per cent from its lowest point this year, which was 4906 points on February 10.

ANZ and CSL were the standouts among the bluechips as the former shrugged off a 24 per cent slide in first-half cash profit to close 5.31 per cent higher at $24.99. Bio-tech giant CSL crossed the $50 billion market capitalisation line as it lifted 3.25 per cent to $109.45.

“What was interesting was the fact that this lift (after the rate announcement) was so broad-based,” Macquarie Equities senior wealth adviser Noel Yeates said.

“All sectors bar energy had some benefit. The market has taken the RBA’s decision on face value, that it was all about inflation.”

Mr Yeates said Amcor-spinoff Orora’s 3.44 per cent lift, Treasury Wine Estate’s 3.35 per cent lift and infrastructure duo Transurban and Sydney Airport’s plus-2 per cent rises illustrated the all-encompassing nature of the rally.

The Australian dollar immediately plummeted on the RBA announcement, slipping about half a cent to the US76.6c level.

Investors’ eyes will now turn to Treasurer Scott Morrison’s federal budget speech tonight and then the National Australia Bank’s half-year earnings report on Thursday.

“This rally may be short-lived,” Mr Yeates said.

NAB was 3.76 per cent higher to $27.63 today, while Commonwealth Bank lifed 3.7 per cent to $75.05 and Westpac 2.4 per cent to $30.65.

In other economic news, the RBA decision defied an Australian Bureau of Statistics upate on building approvals for March which found a lift in the measure for a second straight month against expectations of a decline. Residential building approvals lifted 3.7 per cent in March against expectations of a 2 per cent decline, seasonally adjusted.

Elsewhere in equities news, a sales miss at Woolworths was initially harshly dealt with by the market, but the retailer’s stock lifted on the RBA call to close up 2 per cent to $22.27.

Woolworths told investors ahead of the market open that comparable sales at its core food and liquor division had slid 0.9 per cent in the third quarter, below expectations of a 0.7 per cent drop.

Supermarket peer Wesfarmers also pared early losses to close 1.09 per cent higher to $43.43 after the conglomerate announced the departure of its long-serving resources chief, with a replacement head yet to be named for the struggling coal-based division.

In other trading, resource stocks slipped after oil prices eased ahead of the session and oil futures headed southward during Asian trade. Woodside Petroleum lost 0.38 per cent to $28.63 and Santos fell 2.54 per cent to $4.60. BHP Billiton and Rio Tinto eased 0.91 per cent and 1.24 per cent respectively after iron ore prices were unchanged ahead of Australian trade due to a Chinese holiday.

Elsewhere, Telstra built on Monday’s gains with a 2.36 per cent lift to $5.64 while Qantas also joined in the rally, rising 2.79 per cent to $3.32.

Looking ahead, the Turnbull Government’s first budget is delivered tonight while the Australian Industry Group has its measure of services sector activity tomorrow morning.