Stocks pullback risk grows as Nvidia underwhelms

The latest results and outlook from the US tech giant and leading AI chipmaker were hard to fault, but they left plenty yearning for more.

Investors counting on Nvidia to lift the US stockmarket out of its funk could be disappointed.

As usual, the latest quarterly results and outlook from the US tech giant and leading AI chip maker after the US close on Wednesday were hard to fault, yet in some ways they were underwhelming.

With the stock price up 525 per cent in the past two years, the key question for investors is whether they were good enough to end the current sell-off and provide a positive catalyst for Wall Street amid heightened concern about the almost daily barrage of tariff announcements.

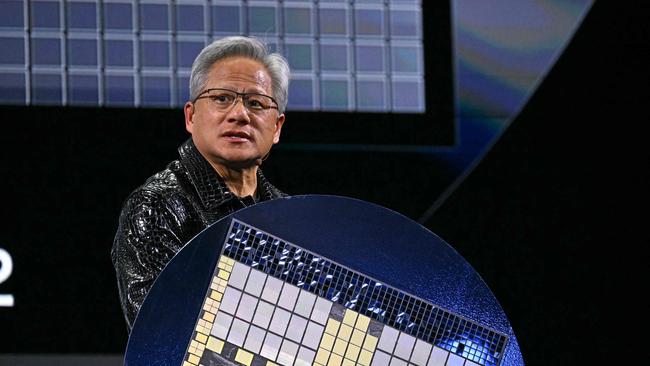

Nvidia’s revenue was forecast to hit $US43bn ($68.25bn) this quarter and its profit margin was expected to stay in the low-70 per cent range, even with the ramp up of Blackwell chips which saw $11bn in sales in the first quarter and “amazing” demand according to Nvidia CEO Jensen Huang.

Quarterly revenue rose 78 per cent on-year to $US39.3bn ($62.38bn), far above the 12 per cent average recorded for its Magnificent 7 peers (Amazon, Apple, Alphabet, Meta and Microsoft).

Nvidia’s gross profit margin of 71.5 per cent was also well above most of its peers. Its shares were relatively well behaved in after-hours trading, moving about 4 per cent in either direction, much less than 9 per cent swing implied by the options market.

However, in August 2024, Nvidia fell as much as 20 per cent in the week after its report.

The sell-off occurred simply because its results didn’t beat expectations by as much as usual.

According to Bloomberg, Nvidia’s quarterly revenue beat expectations by just 2.84 per cent in the fourth quarter. It was the smallest “earnings beat” since 2022.

“The company reported revenue and earnings per share which were better than Wall Street’s estimates, but the degree of that outperformance was less than it has been for a couple of years,” said Betashares investment strategist Hugh Lam.

Based on what happened to the stock price after its second-quarter report in August, and the fact the fourth-quarter beat was even smaller, a similar negative reaction could follow.

Of course, Nvidia was back hitting record highs within six weeks of its post-results sell-off in August.

It’s also much cheaper now. Nvidia’s price-to-earnings multiple for the next 12 months has fallen to about 29.5x versus 38.5x at the end of August as earnings forecasts have soared.

But, after such a skinny earnings beat in the latest report, consensus upgrades may not be as a strong as usual, particularly with worries about the competitive threat from DeepSeek set to linger.

And a lot has changed since the rapid recovery in Nvidia shares which followed the August sell-off.

By September, the Federal Reserve was aggressively cutting interest rates. By November, Donald Trump was set to retake the White House with an aggressively “America First” policy agenda.

However, the multiple interest rates cuts by the Fed, priced in by the market at the start of the year and which helped stock market valuations, at that time could be delayed by inflation risks.

The average valuation of the Magnificent 7 has fallen from 31x to 28x since August, and the tech companies have room for further correction. In recent years they found support at around 26x.

Nvidia shares are yet to fully recover from falling as much as 20 per cent four weeks ago after news of the stunning low-cost AI breakthrough by China’s DeepSeek.

During a conference call, Mr Huang argued DeepSeek should stoke interest in a new approach to AI which could actually increase demand for Nvidia products.

He said DeepSeek relies on “finetuning” that will need more computing sessions than the “one-shot” training of other software.

That approach might require millions of times more computing power than today, he claimed.

Future reasoning models “can consume much more computing” and DeepSeek’s AI model was “an excellent innovation”, according to Huang.

“Following an incredible run-up of 169 per cent in 2024 alone, and questions surrounding future accelerator chip demand following the release of DeepSeek –—the latest earnings call comments from Nvidia have largely put these concerns to rest, at least for now,” said Betashares’ Lam.

He said the results come at a shaky time for the AI industry after the release of DeepSeek’s AI model which used cheaper, less advanced Nvidia H800 chips, raising fears hyperscalers like Google, Microsoft and Amazon are spending too much on building data centre capacity.

But, these companies have actually raised their capital expenditure guidance with more than US$300bn expected this year.

“This backdrop provides a healthy source of demand for Nvidia’s GPU pipeline,” he said. “Allaying concerns around the concentration of Nvidia’s customer base in a handful of big tech companies, Nvidia’s Huang emphasised that over time the enterprise market will expand to be far larger than the hyperscale market.”

Still, in the short-term Nvidia’s results don’t seem good enough to prevent a wave of profit-taking on US stocks amid constant tariff headlines, increasingly negative US economic data surprises, rising volatility and deteriorating technical signals, with CNN’s Fear and Greed index now hitting “extreme fear”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout