Stocks dive with economy ‘near total shutdown’

The global COVID-19 crisis has wreaked further havoc before the first round of a major stimulus package today.

The global COVID-19 crisis has wreaked further havoc on Australian financial markets before the first round of a major stimulus package today as high-profile fund manager Hamish Douglass warned that the world economy faced a “near total shutdown” over the next two to six months.

In a global portfolio update to clients on Wednesday night, the co-founder of Magellan Asset Management said the crisis was “likely to lead to a near total collapse in demand” that could devastate small businesses and those with high financial leverage or high fixed costs.

“Only governments can prevent these businesses failing,” he said. The potential financial and social consequences are very concerning.”

The size of the fiscal response required to head off the crisis is “unprecedented and potentially could be up to 20 to 30 per cent of GDP”.

Mr Douglass said that while some countries might be unable to respond with sufficient force, major countries such as Australia, Canada, China, France, Germany, Japan, Britain and the US were in strong positions to respond to this crisis. “We hope that politicians and central banks will act in time and with sufficient force to prevent a devastating economic collapse,” he said.

In an abrupt shift from two weeks ago when Mr Douglass indicated to The Australian that it was too late to sell, he said the Magellan Global Fund has “taken steps to increase the defensiveness of the Global Equity portfolio and have increased cash in the strategy from approximately 6 per cent to approximately 15 per cent. All cash is held in US dollars.”

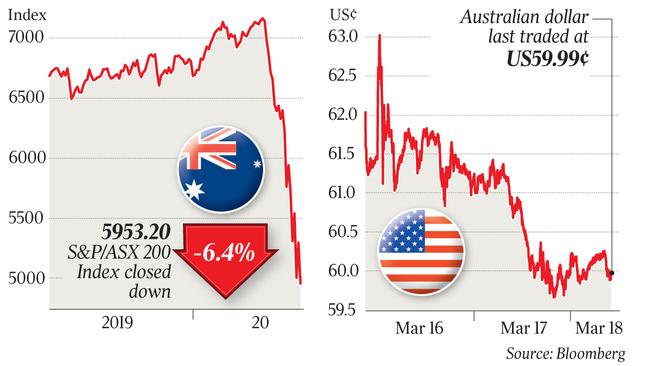

In another day of high drama the S&P/ASX 200 share index tumbled 6.4 per cent 4953.2, the Australian dollar hit a 17-year low of US59.59c and the 10-year Australian commonwealth government bond yield jumped 18 basis points to a two-month high of 1.22 per cent.

Among heavyweight stocks, CSL dived 8.6 per cent, ANZ and Wesfarmers lost almost 10 per cent and Macquarie plunged 13 per cent.

The renewed sell-off came amid renewed risk-aversion in global markets with S&P 500 futures falling by their daily limit of 3.7 per cent in Asian trading after the US benchmark surged 6 per cent and Australia’s S&P/ASX 200 rose 5.8 per cent in its best day in 23 years.

After a brief respite on Tuesday as the Trump administration floated an additional $US1.2 trillion ($2 trillion) spending package including direct payments of $US1000 or more to Americans within weeks, the sell-off in shares resumed, with Australia suffering more than most.

Japan’s Nikkei 225 fell 1.7 per cent, China’s Shanghai Composite lost 1.85 per cent, the Hang Seng index fell 4.1 per cent, South Korea’s KOSPI dived 4.9 per cent and the TAIEX in Taiwan lost 2.4 per cent. European and British stock index futures fell at least 4 per cent.

The brutal sell-off, which has wiped 32 per cent or $725bn off Australian shares, and the related sharp tightening of financial conditions in the past four weeks has added massively to the pressure for decisive monetary and fiscal policy stimulus to offset a likely sharp recession caused by aggressive “social distancing” to combat the virus.

Reserve Bank governor Philip Lowe on Thursday is widely expected to slash its official interest rate — possibly to zero — and start unconventional monetary policy stimulus via quantitative easing with yield curve control in a “monetary policy announcement” at 2.30pm.

And Prime Minister Scott Morrison will announce a series of far-reaching announcements designed to cushion the impact of the virus, including a second huge fiscal stimulus, in moves that will mirror the “wartime” initiatives unveiled by Boris Johnson in Britain.

The simultaneous slump in Australian shares and bonds came despite a further ramp-up of liquidity injections by the RBA.

The central bank added almost $10bn to the Australian financial system via reverse repurchase agreements.

It came as Westpac chief economist Bill Evans predicted that the nation’s unemployment rate would spike to 7 per cent in October, up from his previous forecast of 5.8 per cent to 6 per cent due to the abrupt slowdown in the economy.

And global credit rating agency S&P Ratings forecast a global recession, with “risks remaining firmly on the downside”.

US investment bank BofA said a contrarian “buy signal” had emerged from its Global Fund Manager Survey after a historic collapse in sentiment to GFC lows in terms of cash and corporate leverage amid the biggest drop in global growth expectations since at least 1994.

BofA chief investment strategist Michael Hartnett said sentiment was “bearish enough for positive asset price response”.

But he cautioned that “contrarian sentiment signals can be too early” when “exogenous two standard deviation events” are at play.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout