Shares surge 1.8pc after shock Coalition victory

Investors delivered a $33 billion ‘ScoMo surge’ to the Australian sharemarket after the weekend’s unexpected Coalition victory.

Investors delivered a $33 billion “ScoMo surge” to the Australian sharemarket after the weekend’s unexpected Coalition victory, with banks marking out some of their best one-day gains since the global financial crisis.

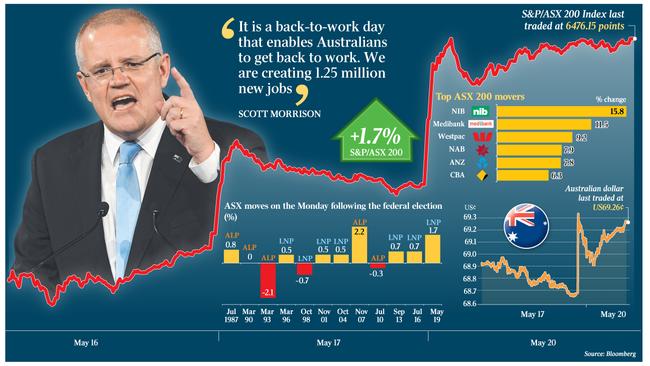

Posting its biggest one-day rise this year, the benchmark S&P/ASX 200 share index surged 110.8 points or 1.7 per cent to 6476.1 points.

This was the highest sharemarket close in almost 12 years as investors jumped back into banks, health insurers, consumer and housing stocks as the Coalition win removed the risk of a Labor government clamping down on tax breaks for share and housing market investors and fund managers predicted consumer and business confidence would get a much-needed boost from the election outcome.

The market staged its biggest one-day post-election rise since the Rudd government took power in November 2007, and its third-biggest rise since Malcolm Fraser was re-elected in October 1980.

It was the biggest post-election rise in the Australian sharemarket for a Coalition government in almost half a century.

Contact Asset Management portfolio manager Tom Millner said the election outcome was good for confidence and the strongly positive sharemarket reaction showed that retail investors “had a serious issue with Labor stealing their franking credits”.

“We really do think the Labor attack on franking credits and other taxes on hard-working individuals and families who were seen to be ‘rich’ impacted the result of this election,” he told The Australian.

“This result made it very clear that Australians just want to be rewarded for working hard, and the result in Queensland in particular was a clear indication that the mining community is still very strong.

“The good news is the market can push forward and businesses can have confidence that there’s stability so they can invest for growth. Consumer confidence should return, which will also have a positive effect on the retail and housing sectors.”

High-priced defensive industrial, healthcare and utilities stocks lost ground as investors switched their attention to the sharemarket sectors that may benefit from a lessening of policy risk and potentially a stabilisation of the property market and the broader economy.

Bell Potter director of institutional sales and trading Richard Coppleson said: “Banks were the biggest winners in so many ways — Labor was expected to put even more regulation on them — so that’s not happening,”

Mr Coppleson predicted the property market would now “stabilise here for a while” reducing the home loan risk for banks.

A 7.5 per cent rise in the S&P/ASX 200 Banks index was its biggest in records going back to 2000, with Westpac up 9.2 per cent to $27.75.

Morgan Stanley’s Richard Wiles upgraded his rating on National Australia Bank to Overweight from Equalweight and lifted his 12-month target prices by the major banks by an average of 2.5 per cent following the federal election outcome. NAB rose 7.9 per cent to $25.81.

“We believe the federal election result reduces tail risks in relation to credit quality, the mortgage market and the regulatory environment,” he said. “However, it does not change the fundamental outlook for the Australian banks, which face challenging operating conditions and an uncertain regulatory environment. We expect some support for major bank share prices in the near term but believe that trading multiples across the group are not cheap enough to compensate for low growth and falling returns on equity.”

Brokerage Morgan Stanley also predicted a “meaningful tactical rotation” benefiting “blue-chip yield, banks and consumer-linked sectors, since many of the risks around Labor’s significant and wide-reaching tax and policy reform agenda have been removed”.

With the Coalition now able to form a majority government, it looks to have a strong mandate to pass the revised tax pledges from the 2019 budget. And while the bulk of this package is slated for 2023, it could be brought forward in response to the slowing economy, which would “mark significant upside to our current base case expectations”.

But while a return of policy status quo is likely to calm anxiety about Labor’s proposed reforms, the reality of a slowing economy and lagged stimulus response to date keeps the door open to both further macro-economic disappointment and corporate earnings risk.

“Greater confidence and intentions are required to turn the cycle and encourage demand to pull activity forward,” Morgan Stanley said.

“If these spirits stay hibernated, downside risk will remain elevated.”

Goldman Sachs equity strategist Matthew Ross said the most meaningful boost to sentiment would be directed to the housing sector.

Among housing-exposed stocks, Boral rose 4.7 per cent, Stockland gained 4.8 per cent and Adairs rose 5.7 per cent.

“It is likely Labor’s policy to remove negative gearing on established housing was already contributing to the weakness in the housing market given how far ahead they were in the polls and that this was a key area of differentiation across the major parties,” Mr Ross added.

Private healthcare companies surged amid a perception that the sector was now “safe” from the threat of a cap on premium rises under a Labor government. NIB jumped 16 per cent, Medibank Private rose 12 per cent and Ramsay Health Care gained 7.3 per cent.

The Australian dollar surged 1 per cent to US69.38c and benchmark 10-year Australian Commonwealth Government bond yields crept up 4 basis points to 1.68 per cent as economists saw less risk of a sharp economic downturn as the Coalition was now projected to form a majority government, allowing it to pass legislation to implement tax cuts to prop up the economy.

A speech by Reserve Bank Governor Philip Lowe in Brisbane today is expected to set the scene for interest rate cuts.

UBS chief economist George Tharenou said the election had “materially reduced” downside risk for the Australian housing market.

“The main implication of the election is the absence of expected Labor changes, especially to negative gearing, capital gains tax and franking, rather than the Coalition’s mostly ‘status quo’,” he said.

“While this likely has limited impact on our credit tightening thesis, it may stabilise sentiment and materially reduces downside risk to our outlook for housing and the negative wealth effect on the consumer and economy.”

Mr Tharenou is planning to review his forecasts as the election results are finalised and any new government policies are released.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout