ASX shares prices solid as investors look past COVID-19 pandemic

Corporate Australia is proving resilient and investors are looking past the coronavirus pandemic.

Corporate Australia is proving resilient and investors are looking past the coronavirus pandemic, with the share prices of most companies outperforming on the day of their reports and the overall market rising in August.

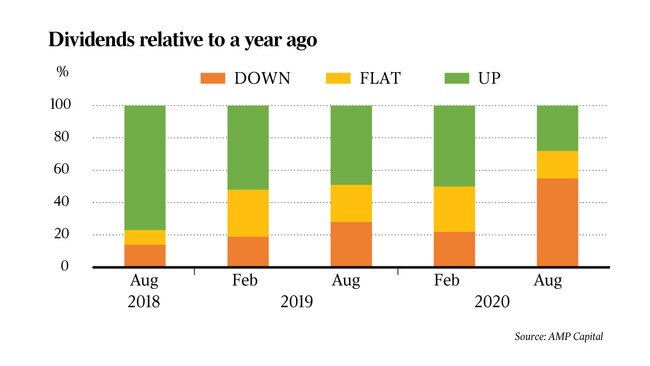

With the June half reporting season about 80 per cent complete by market capitalisation and about 70 per cent by the number of reporting companies, only 33 per cent of companies have reported higher earnings than the year earlier — compared to 66 per cent normally — and 55 per cent have cut their dividends while normally only about 16 per cent do so, according to AMP Capital.

So far the consensus estimate for 2019-20 earnings has fallen to minus 22.3 per cent from minus 21 per cent three weeks ago, making it the biggest fall in earnings since the early 1990s recession.

Financials have been hit the hardest with the consensus expecting a 29 per cent fall in earnings, followed by industrials and resources, with the consensus projecting a 14.4 per cent fall.

But the share prices of most reporting companies have outperformed on the day of their results, according to AMP Capital’s head of investment strategy and chief economist, Shane Oliver.

“While it’s clear that company earnings and dividends have been hit hard by the coronavirus shock, the hit has not been as bad as feared,” he said. “Most companies appear quite resilient.

“This in turn has enabled 59 per cent of companies’ share prices to outperform the market on the day they reported and for the market as a whole to rise so far through August.”

Only 28 per cent of results have exceeded estimates, compared to 44 per cent normally, but only 27 per cent of companies have missed expectations and around half have been as expected.

Today sees results from 10 S&P/ASX 200 companies including Fortescue Metals, while Seven Group, Scentre, Oil Search, Spark Infrastructure, Ansell, Alumina and Stockland are due tomorrow.

The ASX 200 hit a six-month high 6167.64 points last week and has risen about 1.5 per cent since the reporting season began in late July.

It has been a similar story to the recently concluded June quarter reporting season in the US, where the major indices rose as a majority of companies exceeded overly pessimistic expectations.

The average share price gain for Australian companies that have beaten expectations has been 6.6 per cent, while those that met expectations have risen 1.3 per cent on average and those missed have fallen 4.8 per cent on the day of their report, according to Bell Potter.

In each case the reactions have been better than the average since 2016.

“That tells us that the market is rewarding stocks that beat but also is not punishing stocks as hard that miss,” said Bell Potter’s head of institutional sales and trading, Richard Coppleson. “So in a way it shows that the market is looking through this reporting season and not being seduced by the horrendous earnings numbers and dividend cuts.”

Mr Coppleson warned that investors who have been holding “huge amounts of cash” since the market rout in March had “long thought that the results would be so bad that many stocks would get smashed and when they did they would be able to buy them cheaply.

“The problem is the market has already looked through the valley to where they will be in a year and thus they are not being hammered despite the awful numbers being reported.”

Citi Australia quantitative analyst Liz Dinh said that, on balance, earnings across the market have been in line with analyst expectations, with the exception of the banks.

Bank earnings have been hit by the economic impact of the pandemic causing worse-than-expected core profit due to low interest rates, higher capital requirements and accelerating cost pressures.

“Stronger markets revenue in some banks offset these challenges and loan deferrals have delayed the credit impact of COVID, leading to higher provisioning for bad debts and higher capital levels, as well as delivering very mixed dividend results,” she said.

While quite a number of companies had exceeded dividend estimates — most notably AMP, CBA, Newcrest and Woodside — analysts had cut their 2020-21 dividend estimates for banks, miners, healthcare and REITs, although their dividend estimates were upgraded on AMP, Newcrest and Woodside, Ms Dinh added.

Interestingly, companies have mostly refrained from providing earnings guidance.

“Outside of the miners providing production guidance and some REITs providing DPS guidance, very few companies are providing earnings outlook given the uncertainty around the pandemic,” Ms Dinh said. “Of the companies that have reported to date, we have seen downward revisions to 2020-21 earnings estimates in materials ex miners, healthcare and utilities.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout