Shares plunge as day of reckoning arrives

US stocks have roared back this morning as futures point to an Australian bounce after yesterday’s global rout.

Wall Street stocks finished with solid gains this morning after a rollercoaster session, winning back a good portion of the losses from the prior session’s rout.

At the closing bell, the Dow Jones Industrial Average stood at 24,915.45, up around 570 points, or 2.3 per cent, near its session peak.

The broad-based S&P 500 jumped 1.8 percent to finish at 2,695.29, while the tech-rich Nasdaq Composite Index jumped 2.1 percent to 7,110.92

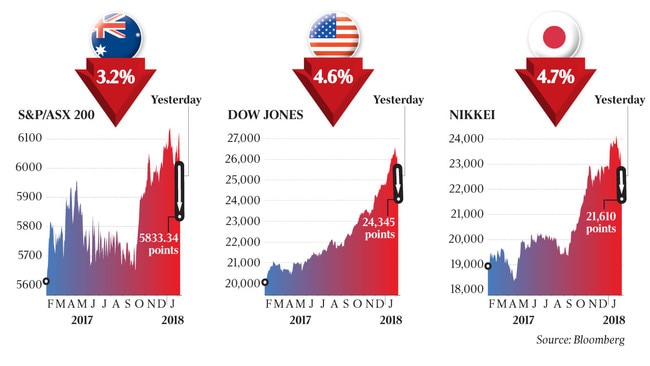

Amid the volatility, Australian stocks look set for a rebound after yesterday’s 3.2 per cent fall on the S & P/ASX 200 index. At 7.15am (AEDT) SPI futures were up 82 points.

The volatility follows the biggest global sharemarket rout in six years which stripped $84 billion from Australian share portfolios in the past two days.

Scott Morrison appealed for calm after the S&P/ASX 200 followed the lead of Wall Street, diving 3.2 per cent, saying the outlook for the Australian economy remained bright.

“It is wise to keep a cool head in these times and understand the difference between the sharemarket and the real economy,” the Treasurer said. “The fundamentals of the Australian economy remain sound.”

But former Reserve Bank board member Warwick McKibbin warned that Australian borrowers could face an increase in mortgage rates of more than half a percentage point this year due to higher funding costs for Australian banks.

“It can happen reasonably quickly,” Professor McKibbin told The Australian.

US markets have shed 8 per cent over the past week, giving up all gains this year following the release of labour market figures on Friday that showed the pace of wage growth had accelerated from 2.5 per cent to 2.9 per cent.

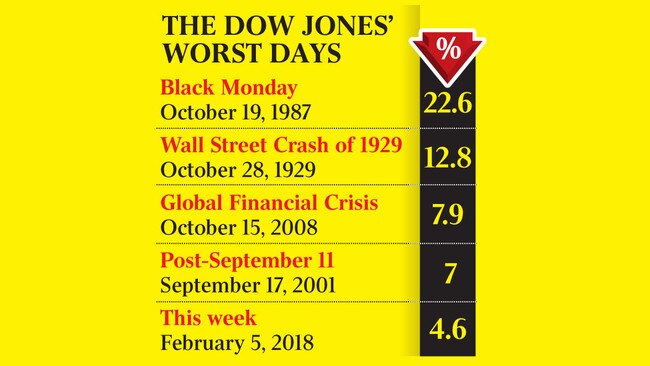

The US Dow Jones industrial average fell 4.6 per cent yesterday but at one point was almost 8 per cent lower as the market was hit with a wall of computer-based program selling. It was the biggest fall in the US market since 2011 when the market was rocked by renewed fears of a financial crisis and the US lost its AAA credit rating.

The US losses have ricocheted around the world. The S&P/ASX 200 dropped 192 points to 5833, its biggest one-day drop since September 2015. Tokyo suffered the biggest falls, with the Nikkei index losing 4.7 per cent yesterday. Futures prices anticipate further market falls today.

The Australian dollar touched a three-week low of US78.4c yesterday, with markets reacting to disappointing retail and international trade reports as much as to the share turmoil.

However, many analysts, as well as the Reserve Bank and Treasury, believe the market fall is simply a correction after US share values rose too high.

Reserve Bank governor Philip Lowe ignored the market turmoil in his statement following the first board meeting for the year, although it was certainly discussed.

Instead, Dr Lowe gave an up-beat account of the outlook, indicating he believed the economy would enjoy its best run of growth since before the financial crisis.

“The bank’s central forecast for the Australian economy is for GDP growth to pick up, to average a bit above 3 per cent over the next couple of years,” Dr Lowe said. “The data over the summer have been consistent with this outlook.”

The Reserve Bank believes jobs growth will remain strong and bring a further reduction in unemployment from the current level of 5.5 per cent. It left its core interest rate steady at 1.5 per cent for the 18th consecutive meeting.

Mr Morrison said that when he was in the US last week, many people had commented that American sharemarkets were overvalued. “The US is far more in that camp than Australia,” the Treasurer said.

“It is not unusual to see these corrections — we saw one a couple of years ago and it passed without trace.”

UBS chief equities strategist David Cassidy said US markets had run for more than 400 trading days without a correction greater than 5 per cent.

“It was well and truly overdue for some sort of pullback,” he said.

“There are pockets of froth in the Australian market but it is not looking particularly overstretched at an aggregate level and, post a 4 or 5 per cent correction, is looking like fair to slightly good value.

“If you get a genuine pick-up in inflation this year and bond yields continue to push higher, this could become somewhat more worrying, but at this stage it is more of an overdue correction.”

The National Australia Bank’s head of market research, Peter Jolly, said financial markets had become too complacent about the idea that the US Federal Reserve had everything under control.

“Markets have been very comfortable that the Fed is hiking but not a lot, that inflation is benign, wages are benign and all is under control,” Mr Jolly said.

“The spark is not surprising. The US employment report showed the first hint we may see some larger increases in inflation than people are comfortable with.”

The interest yield on US government bonds has been rising this year as markets anticipate Fed rate rises, but they spiked following the US labour market report, with the interest yield on 10-year bonds reaching a four-year high of 2.89 per cent.

Bond yields fell yesterday as investors switched funds from equities to bonds, but analysts say markets will remain vulnerable to any further sign of inflation.

ANZ senior rates strategist Martin Whetton said the market correction was not surprising, as there had been a massive flow of retail investment into the sharemarket while hedge funds were all betting on higher bond yields.

“When everyone is on the same side of the boat, you tend to see a reversal,” Mr Whetton said. “The bigger question is whether the rising yields so far do something to derail the global macro-economic picture. I don’t think so yet.”

Mr Whetton said the US economy was performing strongly.

Dr Lowe said a number of major advanced economies were growing faster than their long-term trend rates, while the Chinese economy was performing well, and rising international trade was boosting other Asian economies. Strong global growth is lifting commodity prices, supporting the Australian economy. However, the bank remains concerned about the household sector.

“One continuing source of uncertainty is the outlook for household consumption,” Dr Lowe said. “Household incomes are growing slowly and debt levels are high.”

Household spending before Christmas fell 0.5 per cent, new figures from the Australian Bureau of Statistics show.

However, this was distorted by the release of the latest iPhone in November and the introduction of “Black Friday” sales in that month.