Shares hit record high after fall in inflation rate boosts rate cut hopes

Australia’s rapidly falling inflation rate has bolstered bets of interest rate cuts and a soft landing for the domestic economy, driving the local sharemarket skywards.

The rapidly falling inflation rate has bolstered bets of interest rate cuts and a soft landing for the domestic economy, driving the local sharemarket up to record highs while weighing on the dollar and bond yields before a highly anticipated US monetary policy statement.

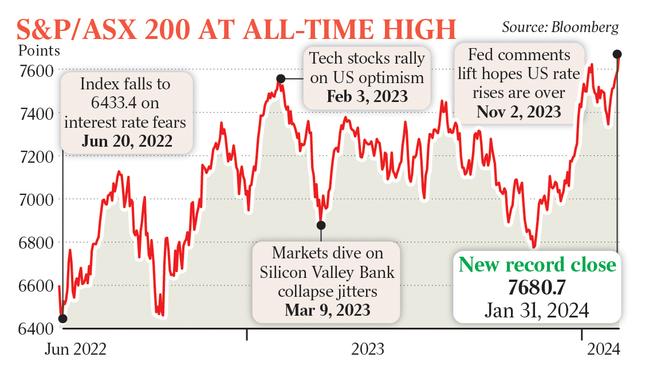

The S&P/ASX 200 index surged 1.1 per cent to a record high daily close of 7680.7 points on Wednesday after the CPI inflation rate for the December quarter dropped to 4.1 per cent, from 5.5 per cent in the September quarter, undershooting expectations of 4.3 per cent.

While still well above the Reserve Bank’s 2-3 per cent target band, inflation was below the central bank’s November forecast of 4.5 per cent, potentially allowing it to predict a faster return to the target than its previous projection of late 2025.

The monetary policy-sensitive three-year Australian Commonwealth Government bond yield dived 15 basis points to a four-week low of 3.57 per cent, while the benchmark 10-year bond yield fell 13 basis points to 4.01 per cent. The dollar fell 0.5 per cent to a one-week low of US65.59c.

When the ASX 200 last hit a record high in August 2021, the cash rate was 0.1 per cent and the economy was booming due to unprecedented stimulus and lockdowns during the pandemic.

Now the cash rate is 4.35 per cent and the full impact of the most aggressive rate rises in decades is yet to play out. However, economists are growing confident that inflation will fall fast enough to allow interest rate cuts, which would help valuations and support economic growth.

The ASX 200 has risen for eight days in a row, its longest winning streak in the past 10 months.

After the CPI data, economists at Citi and RBC scrapped their recent expectations of another rate rise next month. Market pricing of the cash rate outlook moved sharply to project faster rate cuts.

The implied chance of a 25-basis-point cut in the cash rate by May rose to 52 per cent.

A rate cut was fully expected by June and a second cut in the cash rate was expected by November.

Sixty basis points of rate cuts were expected by December, up from 44bps, after the CPI data.

Almost 100bps of cuts in the cash rate target were priced in by November next year.

The forecasts came as the US Federal Open Market Committee was due to give its latest interest rate decision at 6am AEDT on Thursday. Investors were expecting the Fed to adopt a neutral outlook on rates.

But despite the significant shift by Australian financial markets to price in faster interest rate cuts by the Reserve Bank, economists are mixed as to whether the RBA will also decide to scrap its long-standing tightening bias after its two-day meeting concludes on Tuesday afternoon.

NAB expects the RBA to keep its tightening bias because services inflation is too high and the bigger than expected fall in inflation was driven by goods prices and the government’s rental subsidy.

Goods inflation fell to 1.5 per cent on-year amid deflation in clothing, footwear, furniture and household appliances over the past year. In contrast, services inflation rose 5.4 per cent on-year.

Services inflation would have been even greater if not for the impact of the rental subsidy.

If not for the changes to rental assistance, services prices would have increased 2.2 per cent on-quarter. NAB expects core inflation to rise as the effect of the rental subsidy in inflation unwinds.

“The RBA will obviously be on hold in February, but will keep their soft tightening bias,” NAB head of market economics Tapas Strickland said. NAB does not expect the RBA to cut until November.

Westpac said the inflation data was “noticeably below” the RBA’s November forecast.

“Taken together with the run of soft data since the December board meeting, we expect the RBA to keep the cash rate on hold next week, and to stay at 4.35 per cent until it is confident that inflation will return to the 2-3 per cent target range by the end of 2025,” Westpac chief economist Luci Ellis.

“They are likely to reach this point later this year; we continue to expect September as the most likely date for the initial rate cut in this cycle.”

CBA expects the RBA to cut rates by 150 basis points between September and mid-2025.

“The CPI data will be viewed favourably by policymakers,” CBA head of Australian economics Gareth Aird said. “Our central bank will take comfort that the disinflation trend observed in other jurisdictions is at work in Australia.”

ANZ said the fact that services inflation was “still solid” should result in the RBA maintaining its tightening bias after Tuesday’s meeting.

“Our base case remains that the cash rate has peaked but cuts won’t begin until late this year,” ANZ senior economist Catherine Birch said. “That said, risks might be starting to skew towards an earlier commencement of rate cuts. We doubt the RBA will signal this at its coming meeting, however.”

However, Goldman Sachs predicted the RBA would remove its tightening bias at Tuesday’s meeting and potentially start cutting rates as soon as May.

“Although core services price pressures remain uncomfortably high, the RBA will likely tolerate this given the strength of the disinflationary pulse for core goods prices and ongoing gradual softening in the labour market,” Goldman Sachs Australia chief economist Andrew Boak said.

“The CPI report has increased the risk that the RBA starts an easing cycle as soon as May, particularly should weaker-than-expected price pressure spill into the March quarter CPI and the FOMC start cutting rates in March.”

Capital Economics said the CPI data would allow the RBA to cut interest rates sooner than most expect.

“If consumer spending and labour market data continue to surprise on the downside, as we think they will, concerns about over-tightening will probably come to the fore,” Capital Economics ANZ economist Abhijit Surya said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout