Shares finally set to surpass pre-GFC high

The Australian sharemarket may blow through its 2007 peak after Wall Street set new records on Friday.

The Australian sharemarket may blow through its 2007 peak after Wall Street set new records on Friday, notwithstanding concern about high valuations and potential volatility from the corporate profit reporting season and US-China trade talks this week.

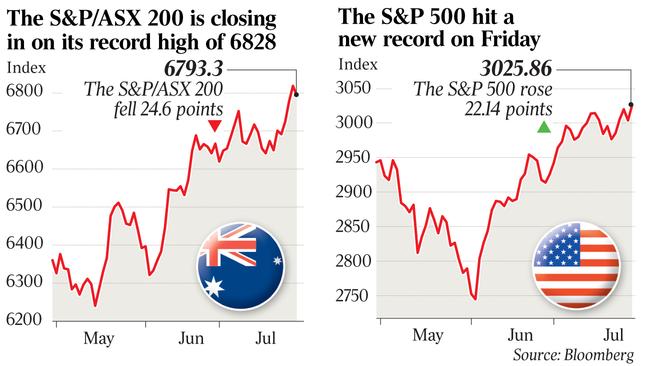

Futures suggest the benchmark S&P/ASX 200 index will open up 0.3 per cent at 6814 points, within touching distance of its record daily closing high of 6828.7.

The dollar is expected to fall due to a rising US dollar and increasingly negative Australian interest rate differentials.

Strategists say a new record high in the local sharemarket could trigger another wave of buying despite the risk of a correction.

“Going through past bull market highs after a long period below can attract investors into the market, so it could push on for a bit,” said Shane Oliver, head of investment strategy and chief economist at AMP Capital. The all-time intraday high is 6851.5.

On Friday, the S&P 500 jumped 0.7 per cent to a record close of 3025.9 on the combination of better-than-expected US earnings reports and economic data and expectations that the Federal Reserve will start cutting interest rates for the first time in a decade.

Google’s parent Alphabet and Starbucks soared after beating consensus estimates for second-quarter earnings, offsetting a weak result from Amazon.

The tech-heavy Nasdaq soared 1.1 per cent to 8330.2 points, also setting a record. The Dow Jones rose 0.2 per cent to 27192.5.

The US economy grew at an annualised rate of 2.1 per cent in the second quarter, versus 1.8 per cent expected by economists.

But the core personal consumption expenditure deflator — closely monitored for signs of inflation — rose a less-than-expected 1.8 per cent.

Reflecting the lack of inflation and expectations of monetary policy stimulus from central banks, including the Fed and the European Central Bank, the US 10-year Treasury bond yield fell 1 basis point to 2.07 per cent.

With Australia’s 10-year commonwealth government bond yield hitting a record low of 1.224 per cent on Friday after a particularly dovish speech from Reserve Bank governor Philip Lowe last week, the local bond yield was yielding 84 points less than its equivalent US bond — the most negative long-term interest rate differential for Australia since 1981.

A rising greenback and falling interest rates pushed the Australian dollar down 0.6 per cent to a five-week low of US69.11c on Friday.

After rising 3.6 per cent from a near decade low of US68.32c to a three-month high of US70.82 in the past few weeks, the local currency has lost 2.4 per cent in a six-day losing streak.

Adding to the political pressure on the Fed to cut rates, US President Donald Trump said in a tweet over the weekend that the GDP report was “not bad considering we have the very heavy weight of the Federal Reserve anchor wrapped around out neck”.

With “almost no inflation” the US was “set to Zoom”, Mr Trump added.

The Fed is widely expected to announce a 25 basis point cut in its funds rate after a two-day meeting concludes early Thursday.

But with economic data in Europe and Japan worse than expected and US data showing some bright spots despite sustained weakness in manufacturing, a rising US dollar could be an issue for investors and the Trump administration, according to JPMorgan.

“If we’re wrong on this assumption of synchronicity (of global economic growth), currency moves could become a greater focus for investors and the Trump administration,” said JPMorgan’s head of cross asset strategy, John Normand.

“The President has demonstrated an unusual interest in currency markets, and while it is almost unprecedented for a US president to comment publicly on the dollar, recall that Trump has disregarded almost every protocol regarding appropriate presidential purview.” The market now fully expects the ECB to cut rates and restart quantitative easing next month.

Another potential source of volatility is the profit reporting season which heats up this week, with Rio Tinto reporting on Thursday.

“After such a huge run — the market is now up 20 per cent year to date — it’s vulnerable to a short-term correction and the August earnings reporting season may result in some volatility,” said Dr Oliver.

“However, the combination of low bond yields — which means that the sharemarket is comparatively cheap — monetary easing by the RBA and other central banks and a likely pick-up in global growth by year end and Australian growth next year point to even higher share prices on a six to 12 month horizon.

“Basically, the Australian sharemarket is looking through short-term uncertainties around the economy and focusing on lower interest rates and bond yields making shares relatively cheap, the likelihood that policy stimulus will ultimately boost economic growth, high iron ore prices boosting mining companies and a positive global lead.”

The latest quarterly economic report from KPMG yesterday said Australia’s annual GDP growth was projected to rise to 1.9 per cent in the second half of 2019 after bottoming out at 1.4 per cent in the year ended June 2019.

“KPMG anticipates the Australian economy will continue to gradually improve — albeit with soft and uneven growth — through to 2022, where it reaches 2.6 per cent,” said KPMG Australia chief economist Brendan Rynne.

But the Australian dollar is likely to fall further to around US65c this year as the RBA moves to cut rates by more than the Fed, according to AMP’s Dr Oliver.

The spot price of iron ore rose 2.2 per cent to $US118.60 a tonne on Friday.

The price of Australia’s major export recently hit a five-year high of $US127.15 after supply disruptions this year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout