Sharemarkets look for signs of hope on coronavirus

Global sharemarkets were keen to latch onto any shred of good news to start the week.

Global sharemarkets were keen to latch onto any shred of good news to start the week, but it’s hard to believe that the devastating economic impact of coronavirus lockdowns will not spark another sell-off in risk assets even if lockdowns cause infection and deaths to peak in coming weeks.

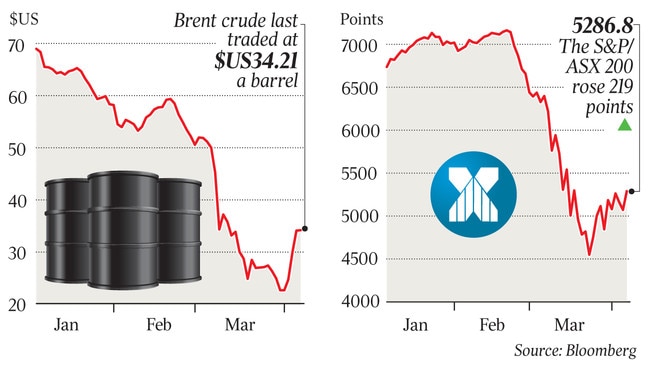

Monday was partly about oil prices again and the energy sector led a 4 per cent rise in the S&P/ASX 200 index as West Texas crude rose to $US28 a barrel — up 18 per cent from Friday’s local close — on hopes of production cuts at an emergency OPEC+ meeting on Thursday, with CNBC saying Riyadh and Moscow were “very close” to a deal.

As hard as it would be to cut production enough to cover even half loss of demand from lockdowns estimated at 25 million barrels a day (particularly since US antitrust law would make it impossible for it to join in), the threat of US tariffs on foreign crude has been fed into the equation.

Memories of 2016 will make investors wary of betting against production cuts, but oil oversupply is only a complicating factor rather than the main driver of the current crisis. If the emergency OPEC meeting does not deliver the goods, there will be a massive “sell the fact” reaction from the oil market, energy equities and the broader sharemarket.

Lessening fatalities from the virus in New York State, Italy, Spain and France also helped global markets on Monday. But Japan was reportedly close to declaring a state of emergency to apply stricter lockdowns in Tokyo after virus cases in the capital jumped at the weekend.

Indeed, it seems doubtful that nations can safely exit coronavirus lockdowns without so-called herd immunity, a vaccine or widespread testing — none of which are apparent now.

Meanwhile, Citi warns a likely 50 per cent fall in corporate earnings per share globally this year is “probably not yet reflected in equity markets”.

Citi has share index price targets that are a little above current levels — or a little below for the ASX 200 after Monday’s big rally — but expects them to fall further beforehand.

“[Citi’s forecasts] suggest that global equities end the year slightly higher than they are now, but we suspect that they might go lower beforehand, especially as the enormity of the likely collapse in global GDP and EPS becomes more apparent,” chief global equity strategist Robert Buckland said.

In his view, a stabilisation of infections, especially in the US, is needed before any sustainable rally.

Citi economists started the year expecting global GDP growth of 2.7 per cent. They now expect a 1.6 per cent contraction, implying a severe global recession.

“This would be consistent with MSCI World EPS falling by around 50 per cent,” Mr Buckland said. “Dividends could fall almost as much.”

As for whether it was “in the price”, Mr Buckland noted that markets typically fall the same as earnings per share in a recession, albeit with leads and lags.

“With global equities currently down around 30 per cent, we are not convinced they are pricing in the likely EPS collapse,” he said.

“On the positive side, aggressive central bank action may limit further downside.”

He said a peak in the infection data, especially in the US, was probably needed for markets to stabilise and the ability to identify immune workers “could set a viable route for a gradual return to work”.

The US remains Citi’s favoured developed market, as “EPS will plunge, but perhaps not as much as elsewhere”. UK equities have been cut to neutral due to a “potential collapse in dividends”.

Similar risk might apply to Australia. That is not Citi’s call, but it does rate Australia as “underweight”.

Citi strategists noted that consensus “bottom-up” forecasts anticipate no growth in EPS for this calendar year, which was “likely too high”. They expect it to be closer to a 20 per cent contraction.

They noted that “the duration of the COVID-19 pandemic will be crucial in determining the severity of earnings contraction”, but given the low interest rate setting and provided that credit conditions did not deteriorate further, a forward price-to-earnings multiple of 16 times “should be reasonable” in Australia by year-end.

Elsewhere, emerging markets, particularly in Asia, are now favoured on a valuation basis.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout