Analysts are warning that the economic impact of fresh coronavirus lockdowns in Melbourne could be more serious than officials are saying and that a second wave of the virus in other states would threaten an expected rebound in earnings and dividends, particularly for the major banks.

Credit Suisse macrostrategist Damien Boey said that rather than a six-week shutdown of Melbourne costing $6bn as indicated by officials, “policymakers are not planning for the worst in their forecasts” and the true cost may be closer to $26bn, or 1.3 per cent of GDP.

From another angle, UBS Financial analyst Jonathan Mott said the planned lockdown of Melbourne would be a “significant hit” to the national economy because, while Melbourne accounts for about 20 per cent of Australia’s population and economy, it drove 40 per cent of economic growth last year.

Mr Mott said he expected the banks to see a sharp reduction in credit impairment charges in their second half to September — given the bleak economic overlays they used in their first-half results — but warned that if the outbreak spreads to other states, especially NSW, requiring more of the country to go into lockdown, an expected recovery in earnings and dividends would be “at risk”.

The ACT said it would delay a further easing of restrictions after reporting three new cases of the coronavirus — its first in a month and linked to Victoria — which added to the sharemarket sell-off.

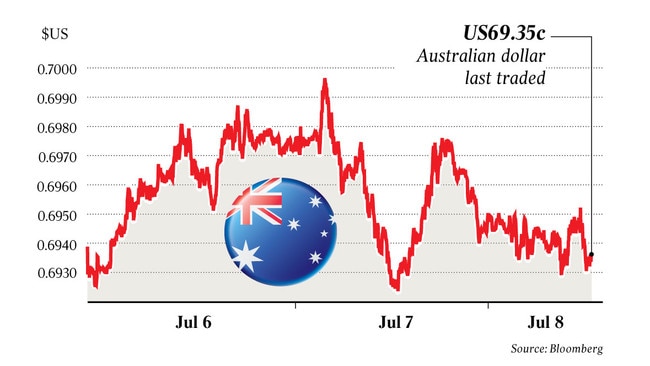

As Melbourne-exposed companies braced for a six-week shutdown of the nation’s second-most populous city after the number of new coronavirus cases in Victoria hit a record high of 191, the Australian dollar and shares continued to unwind recent gains, even as the federal government flagged an extension of income support beyond the planned end date of September.

After hitting a four-week high of US69.98c on Tuesday, the dollar fell to a two-day low of US69.22c overnight and was the worst-performing G10 currency in Asia on Wednesday.

The S&P/ASX 200 fell 1.5 per cent to a five-day low of 5920.3 points, its worst day in two weeks.

From a three-week high of 6101.4 last Friday, the S&P/ASX 200 has fallen 3.2 per cent so far this week.

The S&P 500 fell for the first time in six days and the VIX volatility index continued to rise.

Premier Investments dived 4.4 per cent to $14.93 after announcing a six-week closure of its Melbourne metro shops, Domain Holdings plunged 10 per cent to $3.14 amid housing market jitters, and the major banks dived 1.5 per cent on average, with ANZ down 2.1 per cent to $18.41.

Among shares of other Melbourne-exposed companies, REA Group fell 3.6 per cent to $103.08, Transurban fell 3.8 per cent to $13.67, Vicinity Centres lost 3.7 per cent to $1.32, GPT Group tumbled 4.1 per cent to $4.18 and Tabcorp fell 2.7 per cent to $3.24.

“Interestingly, when nationwide shutdowns were ordered in March, economists assumed the worst,” Mr Boey said. “As it turned out, these assumptions were far too pessimistic, and policymakers have since taken note. But now they seem to be erring in the opposite direction.”

Indirect impacts of shutdowns on consumer and business behaviour could magnify the damage.

“We worry a lot about permanent business closures, given evidence that many small businesses were already struggling with their “will to live” in such uncertain times, without much help from policymakers apart from JobKeeper subsidies,” Mr Boey said.

In this regard, this second round of shutdowns could be “the straw that breaks the camel’s back”.

Mr Boey is also worried that the housing market would suffer greatly from hard border closures.

“Whereas previously there was some hope that migration would be allowed to increase again — especially for students, who are heavy drivers of the Melbourne market — these hopes are being dashed,” he said.

“We could therefore see capitulation from housing investors holding out for better outcomes.”

If the housing market takes another sharp dive, “de-leveraging pressures will become pervasive, with negative flow-on effects for the banks, consumers and builders”. And while the crisis seems contained to Melbourne, he sees a hit to sentiment and activity for the rest of the country too, as flows in and out of Victoria are restricted, and the private sector worries about the spread of COVID-19 more generally.

Although Treasurer Josh Frydenberg flagged that an extension of income support for people impacted by the coronavirus crisis would be announced on July 23, Mr Boey said it would be too late.

“Adding to our suspicions that policymakers are not treating the Melbourne crisis as a national economic emergency, we note they are also not showing much urgency to offer help,” he said.

“These measures will take effect almost halfway through the stage three restrictions,” he noted.

“Details of what could be announced are scant, but many commentators believe the package will involve the extension of generous JobSeeker terms and the JobKeeper wage subsidy.

“To be sure, policymakers are treating the Melbourne crisis as a national health emergency by mandating interstate border closures, but we are concerned about the economic repercussions from delayed help. Indeed, the Reserve Bank in its early July meeting statement warned us about the elevated uncertainty and structural change that comes from an inadequate recovery.”

But Citi quantitative analyst Liz Dinh said consensus earnings forecasts “already reflect most of the negative impacts” from the pandemic, “earlier reopening of the Australian economy has resulted in a shallower downturn” and “policy support has also limited damaging feedback loops”.

“While we see overall earnings estimates as fair, we are more positive on banks and resources and cautious on industrials,” Ms Dinh said.

She added the current market valuation could be justified by the lower interest rate environment and the fact Australia’s equity risk premium had not risen like other developed markets.