Rush to safe havens as stocks slide in coronavirus rout

The local sharemarket dived for a fifth day, the Australian dollar dropped to its lowest value since the global financial crisis.

The local sharemarket dived for a fifth day, the Australian dollar dropped to its lowest value since the global financial crisis, and government bond yields hit record lows as the worsening spread of coronavirus continued to fuel risk aversion and safe-haven demand in global markets.

With the US reporting its first coronavirus case of unknown origin and the transmission of the virus accelerating in South Korea and Italy, investors sold shares, industrial commodities and risk-sensitive currencies, and bought government bonds, precious metals and Japanese yen and Swiss francs.

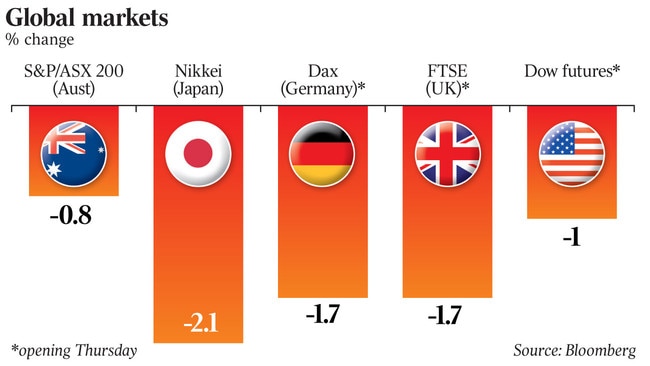

Australia’s S&P/ASX 200 share index hit a three-month low of 6630.5 points before closing down 50 points or 0.8 per cent at 6657.9 as US index futures pointed to a further slide on Wall Street.

“The US Centers for Disease Control and Prevention confirmed a possible instance of community spread of COVID-19 in California and if this virus spread intensifies Stateside, it will most definitely be the straw that breaks the market’s back,” said AxiTrader chief market strategist Stephen Innes.

“But ultimately, the tighter financial conditions triggered by the recent equity market declines will most certainly trigger the Fed’s circuit breaker.”

After hitting a record high of 7197.3 a week ago, the local market has now lost 7 per cent or $150bn of its value, marking its biggest five-day losing streak since August 2011.

In Asian markets, Japan’s Nikkei 225 fell 2.1 per cent, Korea’s KOSPI fell 1.1 per cent and Taiwan fell 1.2 per cent, while the Hang Seng gained 0.3 per cent.

As European markets opened the major stock averages there tumbled more than 2 per cent.

The Australian dollar continued to suffer from high volatility in global markets and its status as a “proxy” for the global growth outlook hitting an 11-year low of US65.43c.

Industrial commodities stayed weak, with Dalian iron ore futures down 3.9 per cent and Brent crude oil futures falling 1.7 per cent to a 14-month low of $US52.53 a barrel

Meanwhile, a multi-month rally in government bonds and precious metals gathered pace.

The global flagship US 10-year Treasury yield fell 5 basis points to a record low of 1.2905 per cent, driving the equivalent Australian commonwealth government yield down as much as 7 basis points to a record-low of 0.844 per cent, while the three-year yield fell 6 basis points to a record low of 0.557 per cent. AAA-rated NSW and Victorian state government bond yields also hit record lows.

The Japanese yen and the Swiss franc both rose about 0.3 per cent against the US dollar.

But precious metals remained among the best performing assets with spot gold surging 0.7 per cent to $US1652 per ounce and spot silver up 1.2 per cent to $US18.14 per ounce in Asian trading.

Goldman Sachs analyst Mikhail Sprogis predicted gold will surge to $US1800 per ounce over the next 12 months, citing risks to global growth surrounding the coronavirus outbreak, together with a continued savings glut, depressed real rates and increased focus on the US election.

With coronavirus increasingly threatening to curtail global economic activity, Mr Sprogis said gold was outperforming traditional haven currencies, “underscoring its status as the safest haven in a world where all currencies are susceptible to a virus-related shock”.

He also noted that gold was also outperforming 10-year bonds in all of the major G10 currencies, particularly German and Japanese bonds, amid limited room for looser monetary policy.

The increase in the probability of Bernie Sanders winning the Democratic presidential nomination could further boost investment demand for gold as his proposed tax hikes could pose risks to equities, and his planned boost in government spending could spark concern about inflation.

The proposed wealth tax could incentivise high net worth individuals to buy gold bars and store them in a vault, where it was more difficult for governments to reach them.

Credit Suisse analyst Damien Boey said despite elevated volatility in shares and record-low US bond yields, it may be too early to accumulate more cyclical risk in equities.

“Despite the sharp correction we have seen in the market from its highs, the equity risk premium is still slightly negative, and due for more normalisation,” Mr Boey said.

“We are not yet past the phase of multiple compression and even when we do get past this phase, we have to ask ourselves how COVID-19 and other risk factors have reshaped the earnings outlook.

“The VIX is now at dangerously high levels for risk parity funds, but the evidence so far is that these investors have not really de-risked or de-leveraged just yet. The fuse has been lit, but there has not been an explosive reaction just yet.”

He also warned that while interbank credit spreads were “behaving remarkably well all things considered… there are reports that debt market activity has slowed sharply of late.”

“Most concerning is the fact that credit markets froze,” said CMC chief strategist Michael McCarthy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout